A diagonal spread consists of two options with different expirations and strike prices.

The two options can be both put options or they can be both call options.

Contents

Here is an example of two call options on SPY that create the diagonal spread:

Date: Oct 10, 2025

Price: SPY @ $653

Sell one contract Oct 24 SPY $663 call @ $4.98

Buy one contract Oct 31 SPY $665 call @ $6.17

Net Debit: -$119.50

Because we sold a call option for $498 and bought another option for $617, the net debit paid for the spread is $119 and some change.

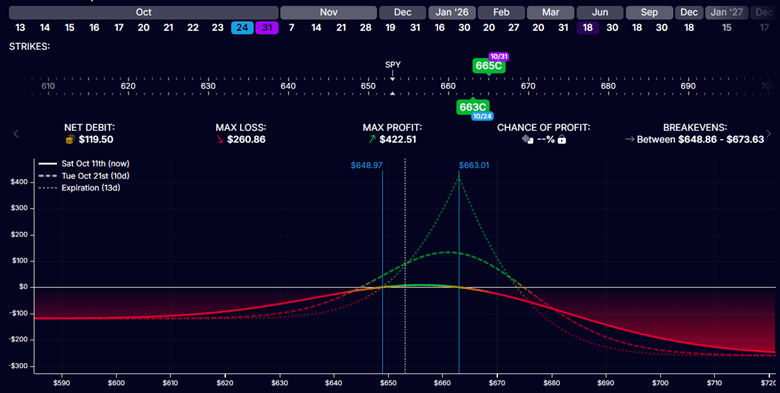

The risk graph of the diagonal is shown below.

The solid curve line is the profit graph today.

It is also known as the T+0 line (the current time plus zero days in advance).

The profit graph on October 24 is shown in the dotted line, which outlines the “tent” shape of the diagonal – October 24th is the earlier expiration of the two options expirations.

The option that was sold is always the one with the earlier expiration date.

In this case, the $663 call option expires in two weeks on October 24.

We call this the short option because we are selling the option.

The $665 call option is the long option that we are buying.

It has an expiration on October 31, which is one week after the short option’s expiration.

The shape of the diagonal expiration risk graph looks very much like the shape of a calendar risk graph, where the peak profit can be much larger than the maximum loss.

Except that the diagonal’s risk graph is not as symmetrical as the calendar.

It is skewed to one side.

In this case, there is more risk to the upside than the downside.

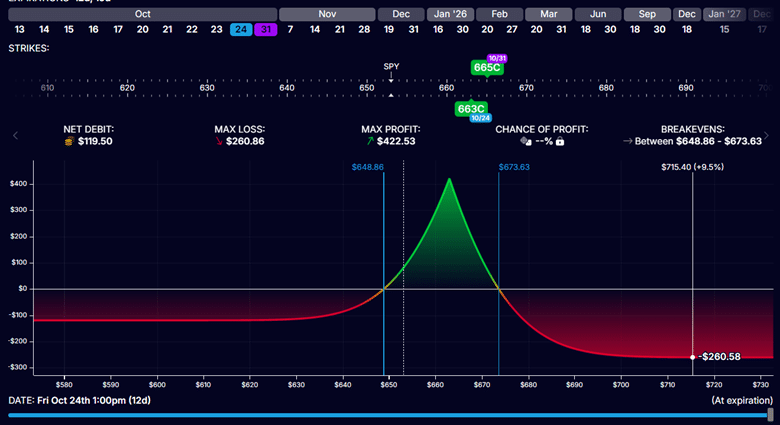

If SPY were to go to a very high price by the expiration of the short option, the loss could be around $260 based on reading the risk graph shown below, where I have slid the expiration slider all the way to the right to show the profit curve at expiration.

The exact amount of the loss is not deterministic ahead of time.

Because at the time of the expiration of the short option, it is not possible to know how much external time value is still left in the long option.

If SPY crashes and is at a very low price at expiration, then both call options will be out of the money and expire worthless.

In that case.

The maximum loss if the market crashes is the debit paid initially.

In this case, it is $119.50.

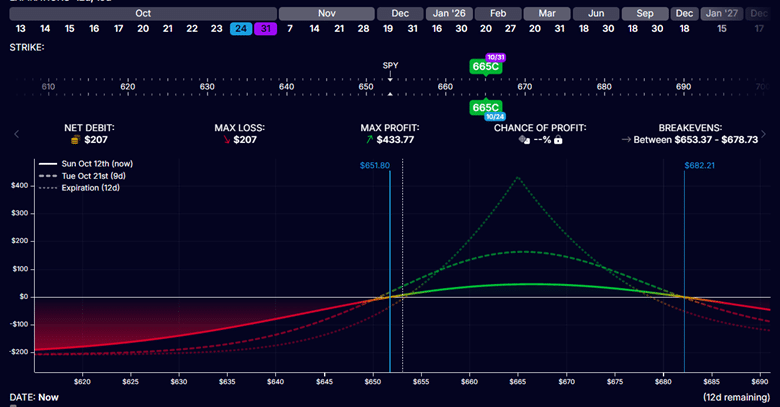

Consider another investor who initiated a calendar spread at the same time and expiration dates.

In the calendar spread, both the short and long options have the same strike price.

In this case, we use the $665 strike price for both.

Date: Oct 10, 2025

Price: SPY @ $653

Sell one contract Oct 24 SPY $665 call @ $4.10

Buy one contract Oct 31 SPY $665 call @ $6.17

Net Debit: -$207

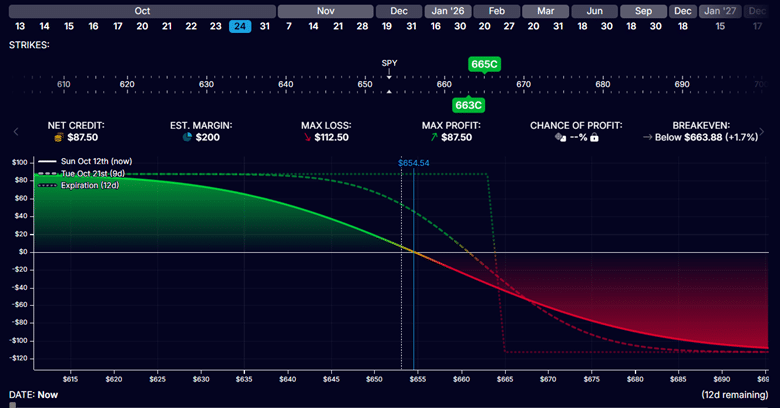

Immediately after filling the calendar spread, the investor initiates a bear call spread for the October 24th expiration…

Date: Oct 10, 2025

Price: SPY @ $653

Sell one contract Oct 24 SPY $663 call @ $4.98

Buy one contract Oct 24 SPY $665 call @ $4.10

Net Credit: $88

What is interesting is that these two trades, combined, are equivalent to a diagonal spread.

Because the bear call spread order involves buying back the Oct 24 SPY $665 call that was sold in the calendar order, both trades occur at the $4.10 price.

Hence, that option cancels out, leaving only these two options:

Buy one contract Oct 31 SPY $665 call @ $6.17

Sell one contract Oct 24 SPY $663 call @ $4.98

These are exactly the two options on the diagonal.

Obviously, if that was the intent, one should have placed a single order as a diagonal instead of two orders to save on transaction costs and slippage.

If you sum the -$207 debit for the calendar with the $88 credit for the bear call spread, the net debit is -$119, which is about the same as the debit for the diagonal.

The options Greeks from the calendar and bear call spreads add up to the same Greeks as the diagonal.

Just as a rough gauge of delta, the current-day profit curve shows the calendar is bullish and will benefit if the price of the underlying rises.

And the bear call spread is bearish.

If you combine the two, they hedge each other and result in a delta-neutral curve similar to that of the diagonal.

The diagonal is just a calendar with an embedded vertical spread.

In our particular example, the call diagonal is equivalent to a call calendar with a bear call spread.

We hope you enjoyed this article on the options diagonal spread.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Thực tế cho thấy, các vấn đề về giao dịch tại 888slot app rất hiếm khi xảy ra. Theo thống kê, tỷ lệ giao dịch có vấn đề chỉ chiếm chưa đầy 0.5%, thấp hơn đáng kể so với mức trung bình ngành là 2-3%.

Ứng dụng 888slot apk có một bộ sưu tập slot game 3D vô cùng đa dạng và hấp dẫn. Những trò chơi này được thiết kế với đồ họa 3D sống động, âm thanh chân thực và các chủ đề phong phú từ phiêu lưu, cổ tích đến các câu chuyện thần thoại.

Ứng dụng 888slot apk có một bộ sưu tập slot game 3D vô cùng đa dạng và hấp dẫn. Những trò chơi này được thiết kế với đồ họa 3D sống động, âm thanh chân thực và các chủ đề phong phú từ phiêu lưu, cổ tích đến các câu chuyện thần thoại.

V8 Poker, GPI và KingMaker – 3+ NPH game bài hot hit đang có mặt tại slot365 net. Bạn có thể lựa chọn chơi với nhiều chế độ: Đánh với máy, tự tạo bàn hoặc tham gia thách đấu với hội viên khác để tranh hạng Top 1, hốt ngay phần thưởng gấp 40 lần tiền cược ban đầu.