One of the key skills for any options income trader is knowing when and how to roll a cash-secured put.

Rolling allows you to manage risk, avoid unwanted assignments, and keep generating income, all while maintaining control of your trade.

In this post, I’ll walk you through exactly how I rolled my $IBIT cash-secured puts, step by step.

Contents

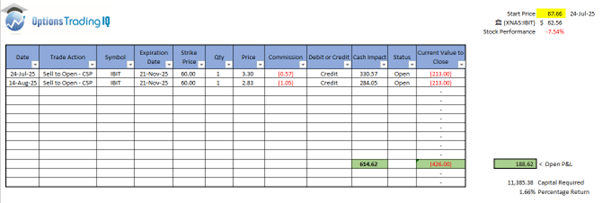

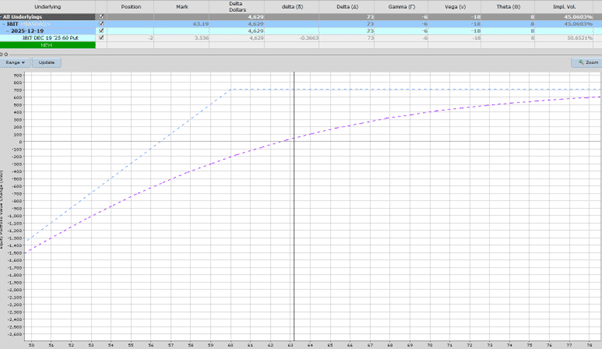

A few months back, I sold two cash-secured puts on IBIT (the Bitcoin ETF) at the $60 strike.

I opened the first tranche in July and added a second in August.

At that point, IBIT was trading comfortably above $60.

Fast-forward to now, and the stock has drifted lower, around $62.50, down about 7.5% from when I entered the trade.

Even though the ETF has pulled back, the position is still slightly profitable thanks to the time decay (Theta) I’ve collected.

When a short put starts to approach the strike price, you have two choices:

- Take assignment and transition into the wheel strategy (own the shares and start selling covered calls), or

- Roll the put to extend duration, collect additional premium, and potentially lower your strike.

In this case, I decided to roll because the stock was getting close to my strike and I wanted to delay assignment while continuing to earn income.

Rolling a cash-secured put is simple in concept but important to do correctly.

Here’s what I did:

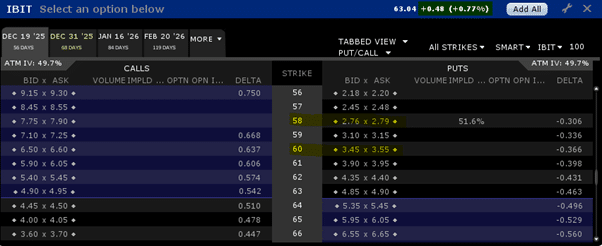

- Bought to close the existing November $60 puts for $2.13 per contract (that’s $213 per contract).

- Sold to open new December puts, either at the same $60 strike or slightly lower at $58.

The result?

- If I kept the strike at $60, I collected a net credit of about $274.

- If I rolled down to $58, I still received a small credit of $128, while also lowering my strike by $2.

The timing of the roll is crucial.

I like to start thinking about it when the stock is close to my strike price, not after it’s passed it.

Once the option’s time premium starts to shrink and the stock price approaches the strike, that’s your cue to take action.

Waiting too long can make it harder (and more expensive) to roll, especially if the option goes deep in the money.

I often set an alert at or slightly above the strike price, so I get notified early and can act before assignment becomes likely.

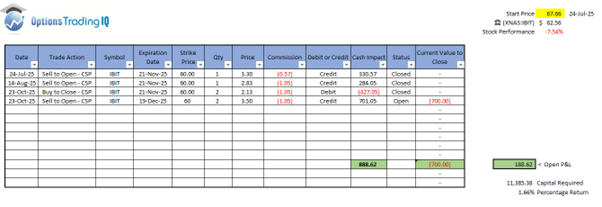

In my tracking spreadsheet, I simply:

- Add a new row showing the buy-to-close of the original put.

- Enter the debit amount (in this case, -$213 × 2 contracts).

- Add a new line for the sell-to-open of the December puts, including the new strike, expiration, and credit amount.

This keeps the trade history clean and makes it easy to track cumulative P/L.

If your short put is already in the money, rolling is still possible, but it’s a bit harder.

You’ll often need to roll further out in time to collect enough premium to make the roll worthwhile.

Sometimes, I’ll go out two or three months if necessary to get the strike back out of the money.

For example, if my short put was the $65 strike and the stock had dropped below that level, I might roll to December or even January and move the strike back down to $60.

Usually, this can be done for a small credit, but it’s generally better to roll before the stock breaks through the short put strike.

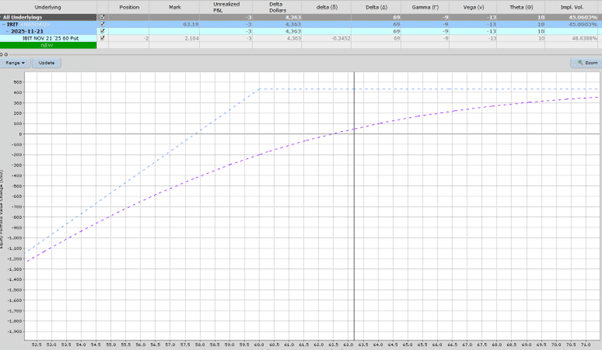

As long as there’s time value remaining in the option, early assignment is unlikely.

Assignment risk rises sharply once time value nears zero, usually in the final few days before expiration.

That’s another reason why I prefer to roll early rather than wait until the last minute.

Rolling is a cornerstone of managing income strategies like the Wheel or Cash-Secured Puts.

It keeps your capital working, smooths out your equity curve, and gives you flexibility when markets move against you.

As always, every decision in options trading is a trade-off between risk and return.

Rolling gives you the chance to extend the trade and collect more premium, but you’re also extending your exposure to the underlying.

Used correctly, though, it’s one of the best tools in your playbook for consistent income and risk management.

Before the roll:

After the roll:

Rolling cash-secured puts is more than just a tactical move; it’s a strategic lever for maintaining control, managing risk, and compounding income over time.

By acting early, tracking your trades clearly, and understanding the mechanics of duration and strike adjustments, you can stay ahead of assignment risk and keep your capital working efficiently.

Whether you’re navigating a pullback or simply optimizing your yield, rolling gives you the flexibility to adapt without abandoning your edge.

It’s one of the most powerful tools in the options income trader’s arsenal, and when used intelligently, it turns reactive trading into proactive portfolio management.

We hope you enjoyed this article on rolling IBIT cash-secured puts.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Các giấy phép này cũng yêu cầu asia slot365 login phải thực hiện các biện pháp bảo vệ người chơi, như bảo mật thông tin cá nhân, chống gian lận, và đảm bảo công bằng trong trò chơi. Điều này giúp người chơi yên tâm hơn khi tham gia cá cược tại nhà cái.