Gainify is a stock research platform that aims to provide institutional-grade data to retail investors through a visually intuitive interface.

Other attractive features include the use of AI analysis, graphical visualization of fundamental data, and screening of stocks based on a variety of company data.

Let’s take a look.

Contents

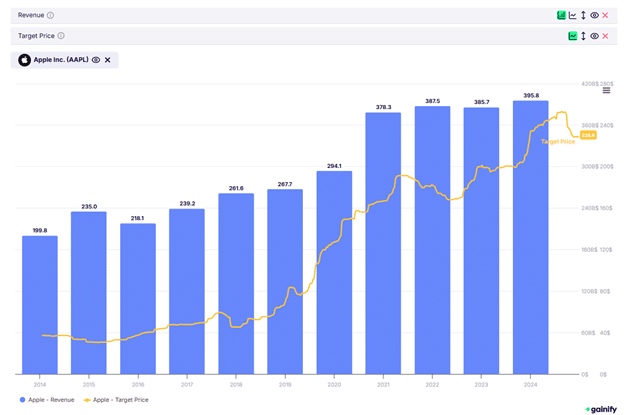

One of Gainify’s key strengths is its ability to visualize fundamental data.

Here is Apple’s (AAPL) revenue growth charted in relation to its target price…

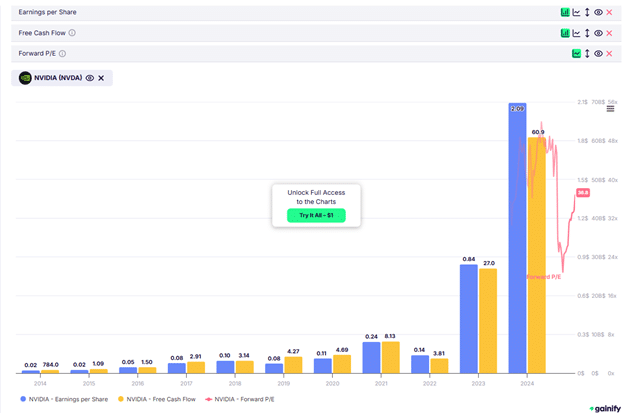

Here is NVDA with earnings per share, free cash flow, and forward PE:

You can explore all possible combinations of data you want.

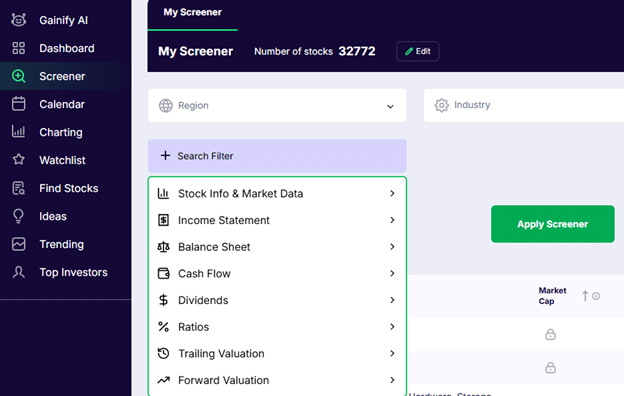

Gainify’s stock screener is one of the more detailed fundamental data screeners I’ve seen.

You can scan based on various fundamental data, including income statements, balance sheets, PE ratios, valuations, and more.

Besides the standard stock data, such as market cap, beta, float, and others, it allows you to screen for CapEx, EBITDA, CAGR, COGS, and many more.

It distinguishes Free Cash Flow from Unlevered Free Cash Flow, from Cash Flow Per Share, to Cash from Operations, and a whole lot more.

Of course, there are various price ratios, such as forward PE, PEG, EPS, dividend per share, book value per share, and cash flow per share, among others.

You can screen for more complex fundamental ratios such as:

(EBITDA – Capex) / Interest Expense

Just to name an example.

As for technical analysis screens, it does have a few, like:

- Price growth within certain timeframes

- Price percentage from a 52-week high or low

- Price percentage from a 50-day SMA or 200-day SMA

- Rebound from 52-week low

- RSI

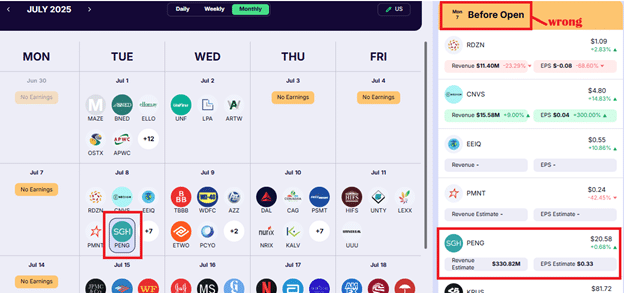

While the screener does let you screen by earnings date, I like the weekly and monthly calendar view of high-profile earnings:

That way, I see at a glance when there might be any “popular” earnings reports coming up.

By default, only the “popular” earnings are shown.

This way, it does not clutter my mind with unimportant company earnings that are of little consequence.

When it says July 8 has no earnings, it means that July 8 has no “popular earnings”.

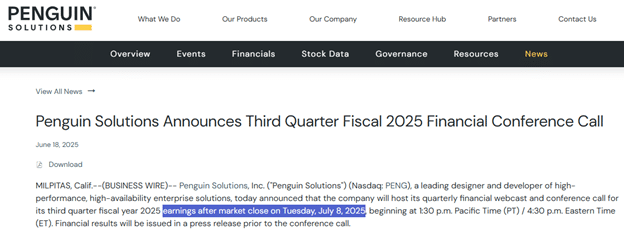

Penguin Solutions is scheduled to release its earnings announcement after the market closes on July 8.

But do I care about Penguin Solutions?

For me, maybe not.

However, if you do care about Penguin Solutions, you can adjust the filter to display all US stocks.

And Penguin Solutions (PENG) would correctly appear in the calendar for Tuesday, July 8…

Source: gainify

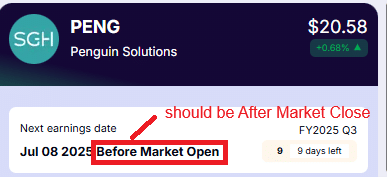

However, there appears to be a glitch in the software because, on the right sidebar, it is inconsistently labeled as ‘reporting’ before the open on Monday, the 7th, which is incorrect.

This is important information to get correct, as some investors may want to exit a stock or position before the earnings announcement.

I can understand that earnings information can vary if the earnings announcement has not been confirmed yet.

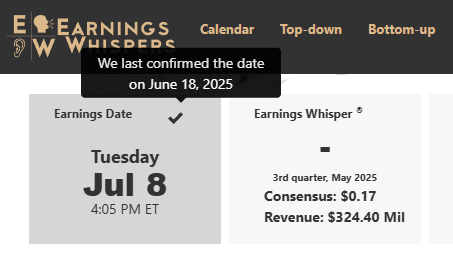

But this is a confirmed earnings report to be announced Tuesday, July 8, after the market closes, according to EarningsWhispers:

Source: EarningsWhispers.com.

It is further confirmed on the Penguin Solutions website.

If I were to click on PENG for details, Gainify now has the correct earning date, but the time is wrong…

It was officially founded in 2024 and is based in Vilnius, Lithuania. It’s a nice-looking place, as shown in the photo on their website.

The vision for the product came about in 2020.

Gainify uses financial data, analytics, and tools licensed from S&P Global Market Intelligence.

Therefore, we cannot determine whether the earnings data for Penguin Solutions is incorrect due to the Gainify software or S&P Global Market Intelligence data.

S&P Global Market Intelligence is a well-respected financial data provider used by many investment banks and other financial institutions.

The Gainify team appears to be highlighting their Gainify AI, as it is listed as the first item in the platform’s left menu.

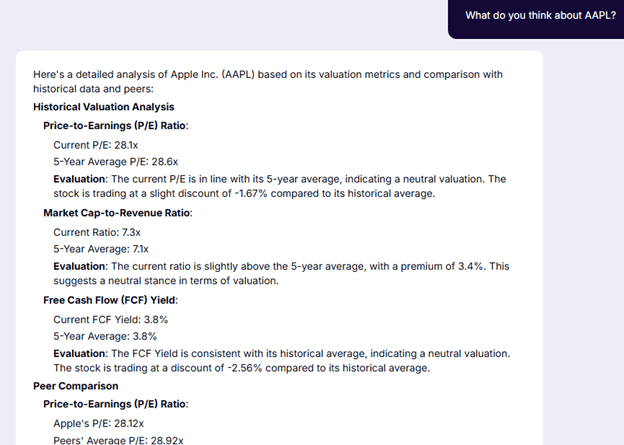

When I asked Gainify AI about Apple, it gave me decent fundamental data…

Gainify’s evaluation of stocks is based more on fundamental analysis than on technical analysis.

So I asked it.

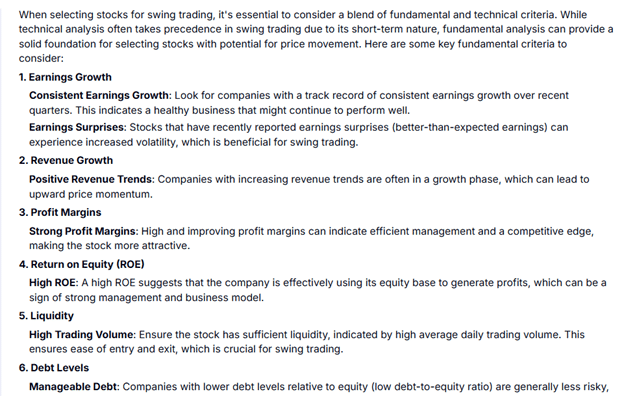

To find good stocks for swing trading, what fundamental criteria should I look for?

It gave this reply, which is reasonably good:

It continues to list items 7, 8, and 9 to be “Industry and Economic Factors”, “Valuation”, and “News and Catalysts”.

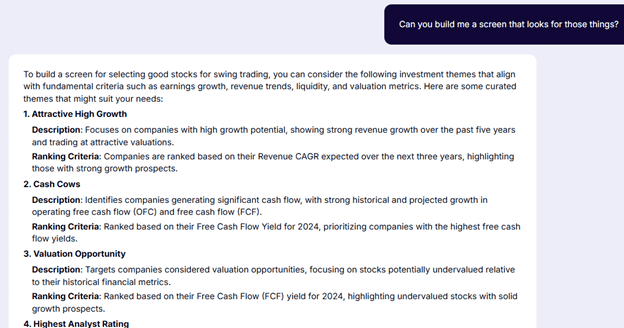

I had a follow-up question:

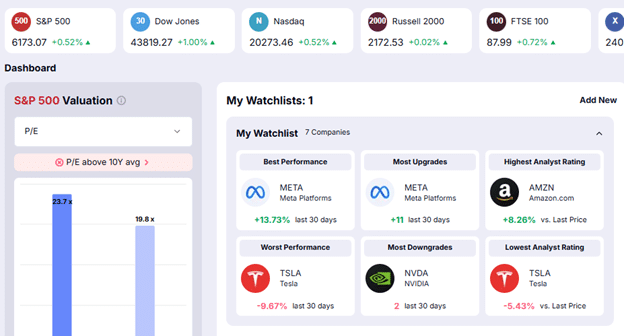

The dashboard shows you the performance of the major indices and that of your favorite stocks on your watchlist:

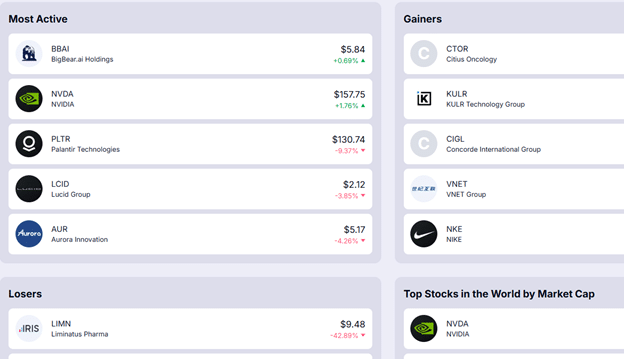

The Find Stocks section displays stock lists, including top gainers, top losers, and most active stocks, among others.

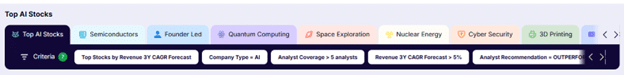

The Ideas section helps you find trade ideas for stocks in various categories using pre-built queries of fundamental data:

If you find some stocks that you like, you can add them to your watchlist.

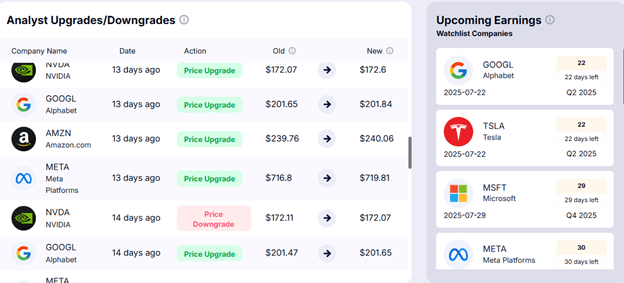

The Watchlist section will inform you if there are any analyst upgrades/downgrades on your watched stocks and tell you how many days till their next earnings announcement.

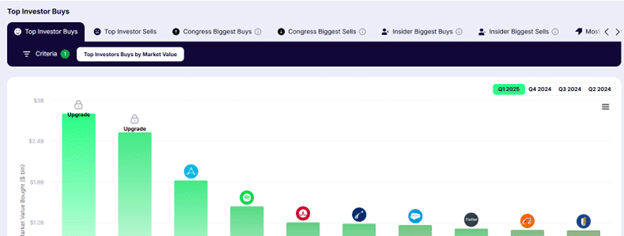

The Trending section tells you what top investors, congresspersons, and insiders are buying or selling,

There is a section in Gainify that tracks the portfolios of top investors.

They include well-known investors such as:

- Warren Buffett of Berkshire Hathaway

- Cathie Wood of Ark Investment Management

- James Simons of Renaissance Technologies

- Ray Dalio of Bridgewater Advisors

- Al Gore of Generation Investment Management

- Bill Gates of the Bill and Melinda Gates Foundation Trust

- George Soros of Soros Fund Management

- Paul Tudor Jones of Tudor Investment Corporation

- And many others

With all these features – most of which are available with the free pricing plan – an investor can generate some good trade ideas and use the screener to identify longer-term holdings based on a variety of fundamental data.

Many would also find the charting of fundamental data quite useful.

We hope you enjoyed this article on Gainify.io.

If you have any questions, send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Rapaziada, fiz umas apostas no slot win bet e confesso que me diverti demais! A adrenalina de ver os símbolos alinharem é demais! Da uma olhada lá: slot win bet