As its name implies, a bull put credit spread generates profits if the underlying stock price increases.

This is the directional component of the spread.

There is another component, which is the time component.

It generates income over time, even if everything else remains the same.

There is no guarantee that the underlying price will go up.

But there is a guarantee that time will pass.

These two components of a bull put credit spread are quantified by the option Greeks, delta and theta, respectively.

Contents

The option Greek delta quantifies the directional component.

If delta is positive, as in a bull put spread, the option spread’s profits increase when the underlying stock price rises.

The increase in profits will depend on the magnitude of delta.

The option Greek theta quantifies the time component.

If theta is positive, as in an out-of-the-money bull put spread, then the credit spread’s profits will increase over time.

The larger the value of theta, the greater the credit spread’s profit will be as time passes.

This assumption holds that all other factors remain constant.

A spread’s value will change based on many factors; the theta quantity is isolated to tell us only about the time factor.

When we say that a bull put spread has positive theta, this is only true of out-of-the-money put spreads. It is not true of in-the-money put spreads.

Hence, the theta of the spread will be different depending on how the put spread is configured.

Ultimately, we aim to determine the optimal configuration of the put spread to achieve the highest positive theta.

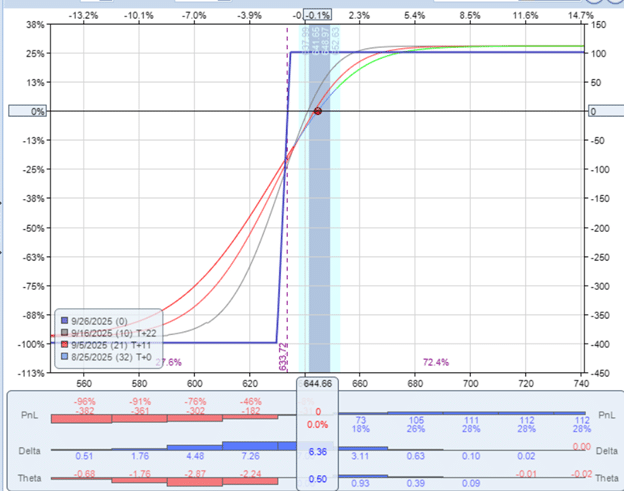

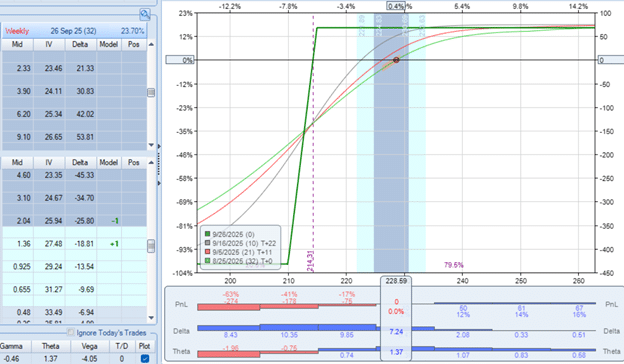

Here is an out-of-the-money bull put credit spread on SPY (the S&P 500 ETF) with 32 days till expiration.

Date: Aug 25, 2025

Price: SPY @ $644.66

Buy to open one contract Sep 26 SPY $630 put @ $4.33

Sell to open one contract Sep 26 SPY $635 put @ $5.44

Credit: $101

This is a credit spread because we collected a credit of $101 by selling the spread to open the trade.

We want the value of the spread to decrease so that we can buy it back at a lower price, thereby closing the spread for a profit.

It is an out-of-the-money credit spread because both put strikes ($630 and $635) are below the current price of the underlying ($644.66).

The histograms below the risk graph show that this spread has a delta of 6.36 and a theta of 0.50.

Both delta and theta are positive currently at the start of the trade.

That doesn’t mean that it will stay that way during the course of the trades, as many factors will cause these values to change.

However, for now, we have a spread that profits when SPY rises (bullish).

Even if the price of SPY doesn’t move, at least the spread will profit as time passes.

This is due to the positive theta (although it is not very pronounced now at 0.50).

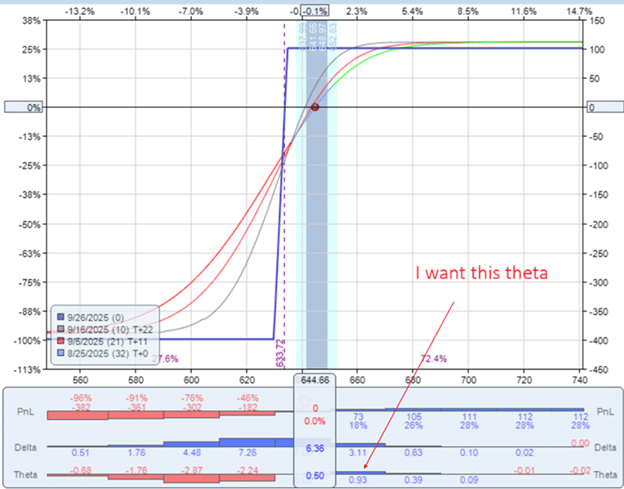

Is there a way to configure the bull put credit spread to have a more positive theta?

Yes, we can extend the expiration date by a few days.

And yes, we can increase the width of the strikes (for example, to a wider spread of strikes, such as $625 and $635 instead of $630 and $635).

Both of these will increase theta, but they will have other tradeoffs, such as increased option Greek gamma and/or increased downside risk.

Assuming that we want to keep the bull put credit spread at the same expiration and same width of the strikes, is there another way to increase theta?

I suspect there is, because I see another value of 0.93 of theta elsewhere in the theta histogram:

Let’s see if we can target achieving 0.93 theta by adjusting the location of the strikes while keeping the width of the strikes constant.

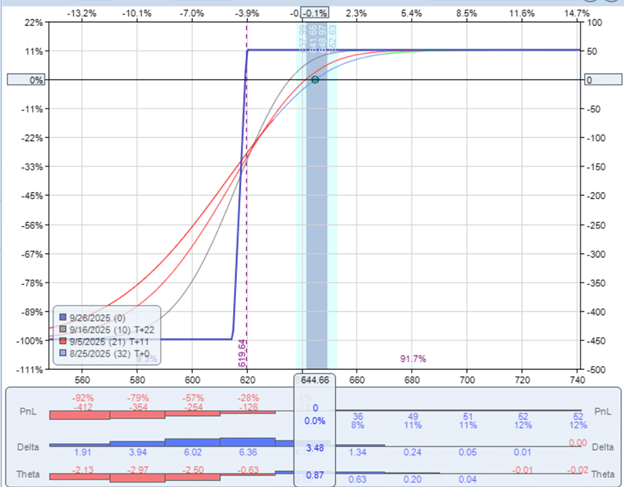

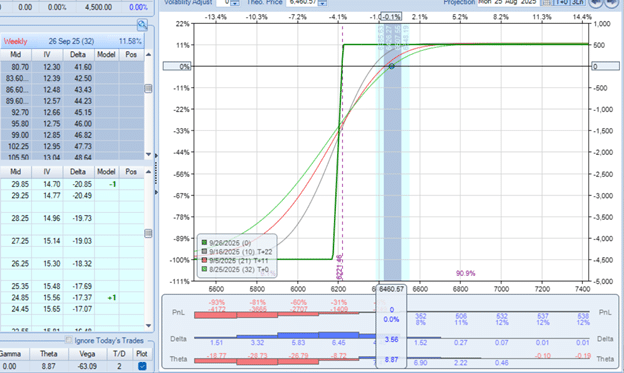

After some trials playing with different strikes in OptionNet Explorer, we found this spread, which gives a theta of 0.87:

Buy to open one contract Sep 26 SPY $615 put @ $2.50

Sell to open one contract Sep 26 SPY $620 put @ $3.01

Credit: $51

Although we receive less credit for this spread and a smaller directional delta (3.48 as opposed to 6.36).

This was the best theta that I could find.

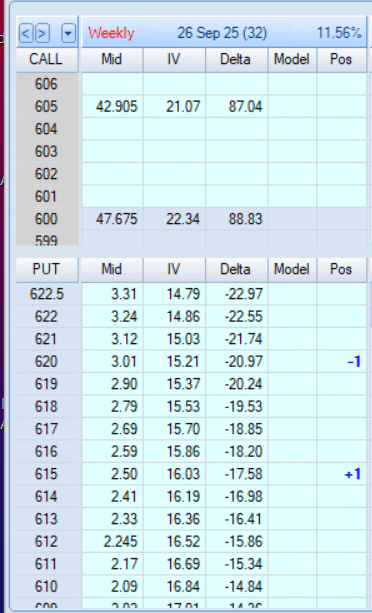

Looking at the option chain:

Selling the $620 put and buying the $615 put gave us a theta of 0.87.

In that same vicinity, selling the $622 and buying the $617 also gives us 0.87 theta.

Similarly, the $ 619/$614 bull put spread also performed well.

Moving up or down the option chain resulted in less theta.

So if someone asks:

Where is the sweet spot for capturing the best theta in a 5-wide bull put credit spread in SPY expiring in 32 days?

I can say it is to sell near the $622 to the $619 strikes.

Or I can generalize my answer to say “sell near the 20 to 25 delta on the option chain”.

I have turned on the Delta column in the above option chain.

You can see that the $620 strike has a delta of -20.97.

So I can simply say that the $620 strike is at the 20-delta.

Yes, this bear call credit spread on SPY with 32 days to expiration had the best theta when selling a call at the 21.54 delta.

Generally speaking, yes.

This APPL 5-wide 32-DTE put credit spread had best theta at the 25-delta…

Yes, here is a 50-point wide SPX bull put spread expiring in 32 days:

With a better theta selling at the 21-delta on the option chain.

If you want the best theta in an out-of-the-money credit spread, sell near the 20- to 25-delta point on the option chain.

If you want more of the directional component and less of the time component, move the spread closer to the money.

We hope you enjoyed this article on the best theta in an options credit spread.

If you have any questions, send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

**breathe**

breathe is a plant-powered tincture crafted to promote lung performance and enhance your breathing quality.