In the options market, there are options sellers and options buyers.

What is a win for the option seller is a loss for the option buyer, and vice versa.

Contents

The option sellers will reap the greatest reward if all the options they sell expire worthless.

In that scenario, the buyers’ options would become worthless, causing them to lose every cent they paid.

This scenario is an example of an extreme case.

The max pain theory suggests that market forces will tend to drive the underlying stock’s price towards this scenario.

The max pain price is the strike price at expiration, where options buyers would lose the most money based on the concentration of open calls and put options contracts.

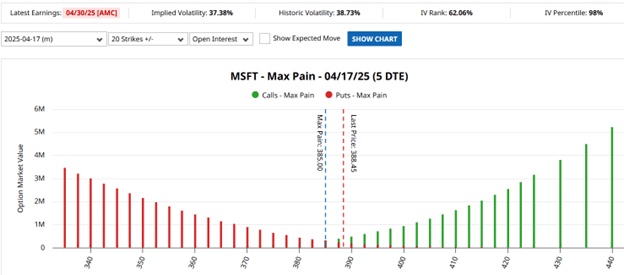

We can see barchart.com showing Max Pain calculation for Microsoft (MSFT) for the April 17, 2025 monthly expiration.

The option expiration is five days away, as denoted by “5 DTE” (days to expiration).

It shows that the current price of MSFT is $388.45, and the max pain price is the $385 strike price.

The red bars represent put options value; the green bars represent call options.

The Max Pain is the price where the option values are the lowest if MSFT were to expire at that price.

According to the Max Pain theory, the market forces will attempt to move the MSFT price down from $388.45 to $385 in the four days left until expiration.

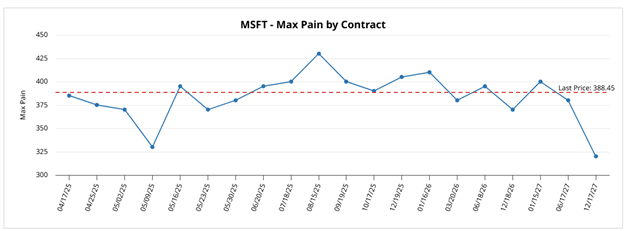

Remember that the Max Pain price changes daily as new options open and close.

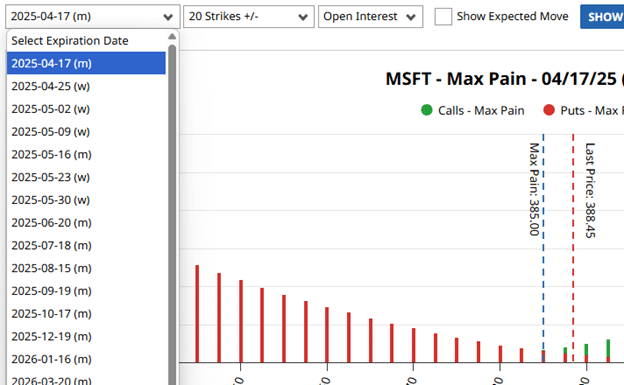

The Max Pain price will be different for different expiration cycles.

You can select from the dropdown menu which expiration cycle you want Barchart to compute the Max Pain for.

Instead of selecting each of the expirations to determine its Max Pain, we can scroll further down the page, and Barchart has plotted its calculated Max Pain price for the various expiration cycles:

The Max Pain concept helps us understand how the options market can influence the price of a stock near expiration.

Options market makers need to write (sell) contracts based on the demands of options buyers.

Not wanting to take these directional positions, the market makers hedge their options positions by buying or selling shares of the stock.

This hedging activity is believed to make a stock price gravitate to the Max Pain price.

Of course, this magnetic pull is not a guarantee of price movement.

Significant news events, a company earning announcements, a strong market sentiment trend on the stock, or other factors can easily override it.

Max Pain is less reliable for thinly traded stocks.

Apply them only to stocks with high option volume and open interest.

Max Pain is mainly a tool for the short-term thesis during expiration week and is less useful for longer-term trades.

Therefore, one should not solely trade based on Max Pain theory alone but may use it in conjunction with other technical analysis indicators such as price support and resistance levels and, trend lines, etc.

We hope you enjoyed this article on the max pain concept of options expiration.

If you have any questions, send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.