SPY is the ticker symbol for the S&P 500 ETF.

As such, its price movement reflects the broader market’s movement.

If an investor expects a significant market move (or a larger-than-expected move), the SPY long strangle trade is a strategy aligned with that outlook.

The options strategy known as the “long strangle” involves buying an out-of-the-money put option and buying an out-of-the-money call option.

In the case of the SPY strangle, we are doing the underlying SPY asset.

It is essential to qualify the strategy with the word “long” to avoid confusion with the “short strangle,” which involves selling options.

The expiry of the options is chosen to reflect the investor’s expectation of when the market move might occur.

Contents

Let’s look at an example initiated on September 15, 2025:

Date: September 15, 2025

Price: SPY @ $660

Buy one contract November 21 SPY $630 put @ $6.80

Sell one contract November 21 SPY $685 call @ $5.27

Net debit: -$1,207

Buying these two options costs the investor $1207.

This debit paid is the maximum potential loss in the trade.

This max loss is realized if the price of SPY is between $630 and $685 at the expiration of the options.

The max loss is only realized if the trade is held to expiration.

For this reason, most investors will avoid holding this trade to expiration.

In our example, we provided options with more than two months until expiry.

This gives us enough time to be right on the larger-than-expected market movement that is happening.

Having long-dated option expiry also decreases the rate of theta decay of our long options.

Any option we buy starts to lose value as time passes.

This is known as theta or time decay.

This decay accelerates as the option approaches its expiration date.

Therefore, we set this trade with 67 days to expiration (DTE), planning to exit well before reaching half of that duration.

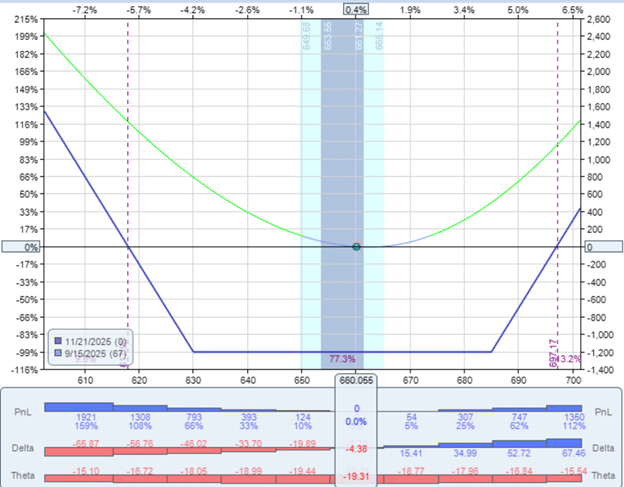

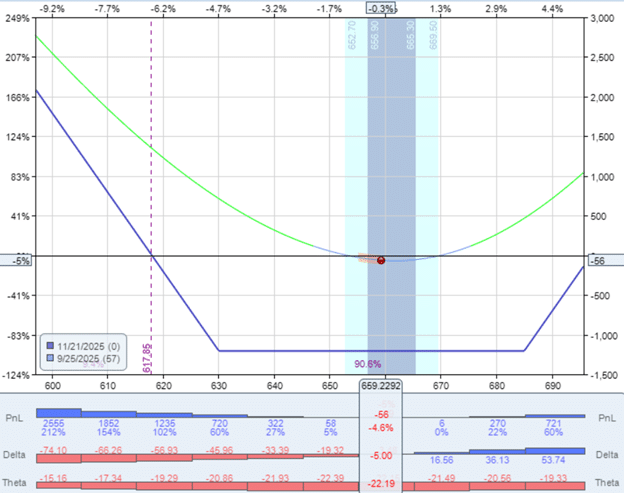

In a modelling software, we can see that we have a negative theta of -19.31, indicating that our trade loses money with the passage of time:

We also see that we can make money whether the market goes up or down.

We lose money if the market does not move.

At the start of the trade, it is delta-neutral, neither favoring one direction nor the other.

The delta of -4.38 is very close to zero as the price of SPY is at the flat bottom portion of today’s profit graph (the green line).

As the price of SPY moves around, the position delta of the trade will change:

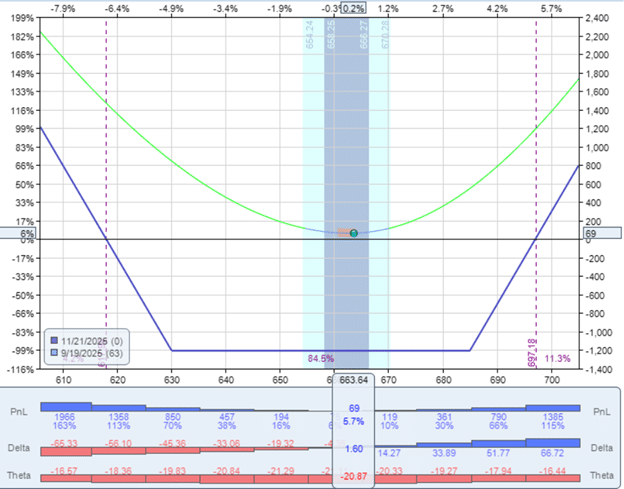

Four days later, on September 19, the trade has a positive delta of 1.60.

On September 22, the trade is up $158, which is a 13% return on capital:

$158 / $1206 = 13%

So the investor could close the trade and take early profits here.

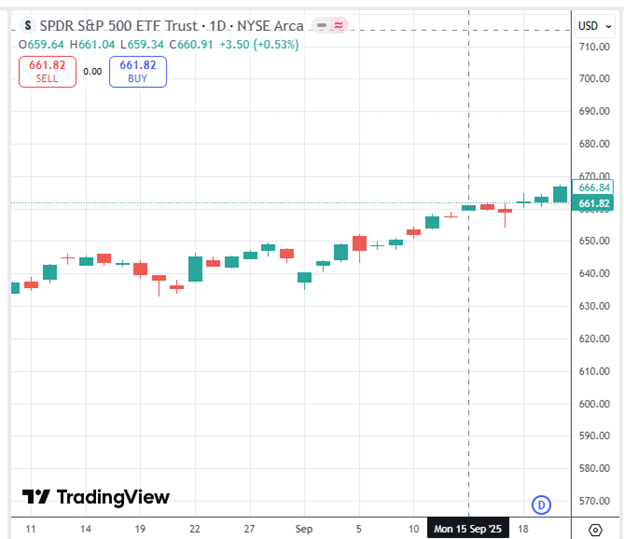

The trade worked because SPY made a significant move up:

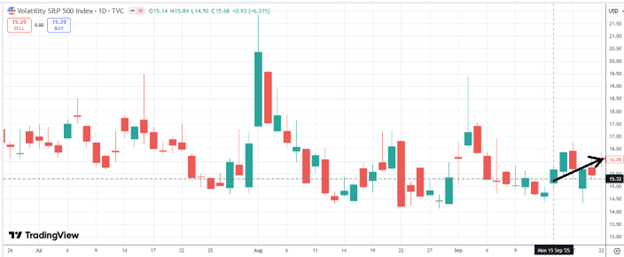

And volatility increased as measured by the VIX:

VIX is the symbol for the volatility of the S&P 500 index.

Long options typically benefit from an increase in implied volatility.

Since this trade has two long options, it benefited from the increase in VIX.

Vega is the option Greek that measures the increase in value of an option when volatility increases.

We say that this is a positive vega trade since its value increases with increasing volatility (with all other factors considered being equal).

Sometimes with these trades, you simply have to take the profits when they come.

Because the trade is affected by both delta and vega, the P&L of the trade can fluctuate quite a bit.

Since theta puts us under time pressure, we cannot hold the trade for long.

In fact, if the investor held the trade three more days later on September 25, when SPY came back down to $659, near where it started, all the profits disappeared and the long strangle would be down -$56, or close to -5%

The long strangle strategy can also serve as a hedge for theta-positive income strategies.

Range-bound income strategies typically involve selling options with the expectation that the market will remain relatively stable, whereas a long strangle involves buying options in anticipation of significant market movements.

Thus, the two strategies operate in opposition, and one can be a hedge for the other.

We hope you enjoyed this article on the SPY long strangle trade.

If you have any questions, send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

355bet5, eh? I’m always a bit skeptical of sites I haven’t heard of. Convince me! Bonuses? Good customer service? 355bet5