Everybody is talking about cash-secured puts.

Today, we are going to be talking about what no one else is talking about — cash-secured put calendars.

Contents

Cash-secured put calendars start similarly to selling cash-secured puts.

Except, we want to sell this put option at the money with the strike price close to the current asset price.

And then we add a long option in a calendar structure to cap the risk.

At-The-Money Put Calendar

Let’s use SPY, the S&P 500 ETF, as our first example.

On May 12, 2025, with SPY trading at $579.63, an investor sells the $580-strike put option expiring May 23, 2025 (about two weeks away).

Then the investor immediately buys the $580-strike put option expiring on May 30, 2025 (about one after the first expiration).

This could have been executed as a single order:

Trade Details:

Date: May 12, 2025

Price: SPY @ $579.63

Sell one May 23 SPY $580 put @ $6.60

Buy one May 30 SPY $580 put @ $7.97

Net debit: -$137.50

Buying the long put option makes things different.

Because it costs more to buy the long option than the credit that we received from the sale of the short put, the net trade requires a debit.

We are buying a calendar spread.

An options calendar spread is one where the strikes and type of options are the same, but at different expirations.

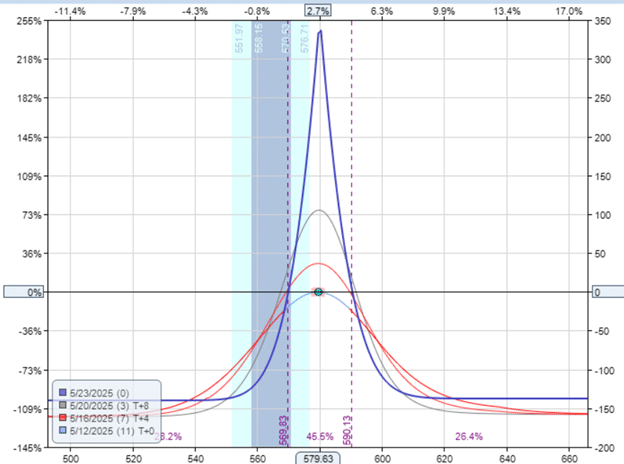

Its P&L graph looks like the following, where the most money is made if SPY stays at the same price:

What makes this calendar a cash-secured calendar is that the investor reserves enough cash on the side to buy 100 shares of SPY if necessary.

This amounts to about $58,000.

By being able to buy 100 shares of SPY, the investor can hold the trade past the expiration of the near-term short put option.

High Reward-To-Risk Near Expiration

This setup has a certain element of psychological advantage.

Because the investor knows that he has enough money to buy SPY and he may, in fact, be ready to buy and hold SPY shares, he is not worried about getting assigned and is able to hold the trade very close to expiration.

Being able to hold a calendar close to its expiration is what gives the calendar its high reward-to-risk ratio.

It is near expiration that the P&L graph peaks.

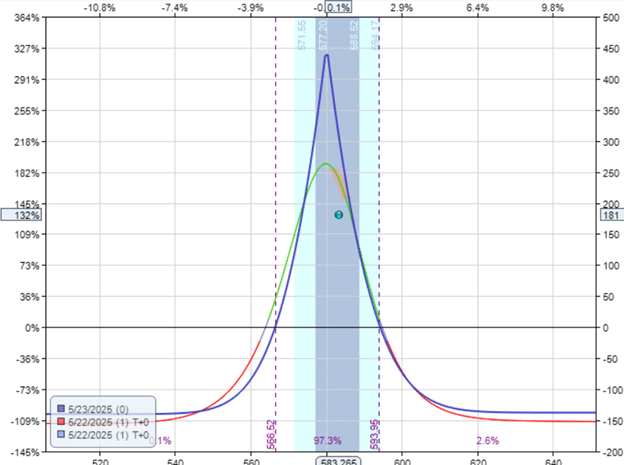

One day before expiration in this example, the trade’s P&L is up $181, or 132% return on the capital at risk.

Admittedly, this is a cherry-picked example where SPY stayed within a range.

At Expiration

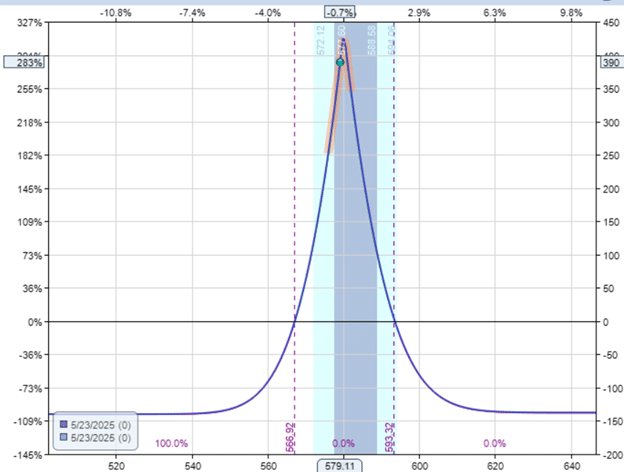

At the expiration end-of-session on Friday, May 23, SPY closed at $579.11.

Because $579.11 is below the put option strike price of $580, the investor is obligated to purchase 100 shares of SPY at $580.

The next trading day, which is Tuesday (because Monday was a holiday), the investor sees that he has the 100 shares of SPY and a long put option.

The short put option is no more.

This results in a position that profits if SPY goes up with limited risk on the downside.

Take Profit On Full Position

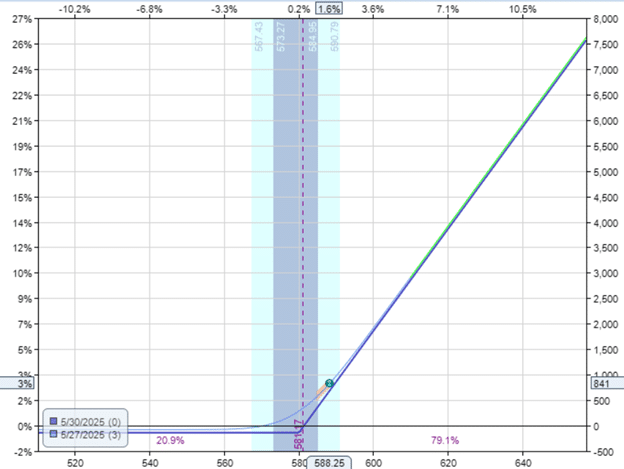

He could liquidate his position by selling the 100 shares of SPY and the long put option for a net profit of $841.

He was lucky because SPY had gapped up to a price of $588.25 on Tuesday morning.

Trade Summary:

Initial debit for calendar: -$137

Assigned 100 SPY at $580: -$58,000

Sell 100 SPY at $588.25: $58,825

Sell long put: $153

Net profit: $841

Hold Till Further Date Expiration

Or he can continue to hold the position to see if SPY goes up further.

Because he has a long put option that enables him to sell back his 100 shares of SPY at $580 (the same price that he bought), he is again comfortable holding the position — but only if he still has the long put option.

On Friday, May 30, on the day of expiration, but before actual expiration, the investor liquidates his position.

SPY had only gone up slightly more, reaching $588.75.

And the long put option has lost nearly all of its value.

Nevertheless, the net profit of $745 is a good one.

Final Trade Summary:

Initial debit for calendar: -$137

Assigned 100 SPY at $580: -$58,000

Sell 100 SPY at $588.75: $58,875

Sell long put: $7

Net profit: $745

Max Loss

Suppose the trade didn’t work out.

What if SPY continued downward right after the investor got assigned?

In that case, at expiration of the long put option, it would have been exercised, and the 100 SPY shares would have been sold at $580 per share.

Worst Case Scenario:

Initial debit for calendar: -$137

Assigned 100 SPY at $580: -$58,000

Sell 100 SPY at $580: $58,000

Sell long put: $0

Net loss: -$137

So the net loss would still be the debit of the calendar.

For a calendar, the maximum capital at risk is the debit paid for the calendar.

This is true all the way up to the expiration of the long, further-dated expiration.

This is true, even if assigned on the short option (provided that it is managed properly).

Calculating Percentage Return

You might say that a net profit of $745 is great considering that there was only $137 of risk in the trade.

That would be a return of 544% return on risk.

Percentage return on risk: $745 / $137 = 544%

However, an investor with only a $25,000 account could not have made this return because it required a purchase of 100 shares of SPY, or at least $58,000 of capital.

If we calculate the returns based on capital used, the percentage will look very different:

Percentage return on capital invested: $745 / $58,000 = 1.3%

For a cash-secured put calendar, the return on risk and the return on capital invested are different.

What If This Calendar Were Not Cash Secured?

What if the investor did not have enough cash to buy 100 shares of SPY?

In that case, when the short $580 put got assigned, the broker might exercise the long put option to close out your position.

The short option required a purchase at $580; the long put made the sale possible.

Net result, loss of -$137, the debit paid for the calendar.

Conclusion

In this example, we see the advantage of being able to cash secure a calendar.

The investor can hold the trade past the expiration of the short option either to hold the trade longer to get break-even or, in this example, to capture more profits.

If the investor was not able to cash secure the calendar and forgot to exit prior to the short option expiration, the in-the-money short put would likely have been auto-liquidated, resulting in a max loss of the calendar.

The purpose of a cash-secure put calendar is to be able to hold past the near-term expiration.

It is not necessary to take ownership of the underlying asset.

If that was the intent of the investor, it would be better to have sold a cash-secured put to collect a credit instead of paying a debit to buy a cash-secured put calendar.

Learn Options the Right Way — Step by Step

Cash-secured put calendars represent just one of many sophisticated options strategies that can enhance your trading arsenal.

If you’re interested in learning a systematic approach to options trading:

- Options Income Mastery: Learn proven option strategies with proper risk management techniques ($397). 1-month program.

- The Accelerator Program: 12-month program covering 9 major strategies with comprehensive portfolio management for serious options traders ($1,497).

Both programs include detailed modules on managing assignment scenarios, technical analysis, trading psychology, and proper position sizing techniques.

We hope you enjoyed this article on cash-secured put calendars.

If you have any questions, send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.