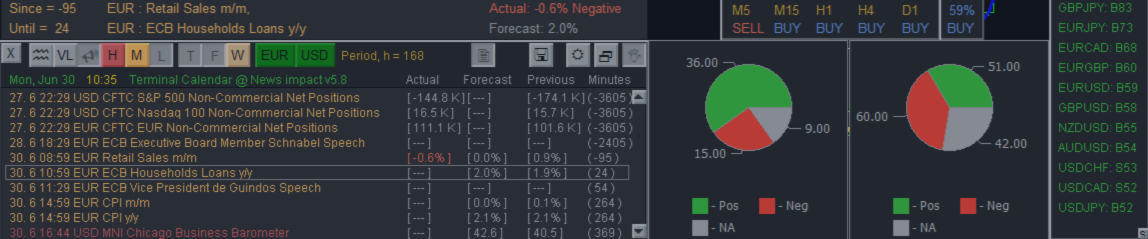

News and trends indicator News impact as a multi-currency trading tool – Trading Strategies – 30 June 2025

The News impact indicator: https://www.mql5.com/en/market/product/78957 Economic news The indicator has access to the terminal’s economic calendar or website. Investing.com (in the latter case, you will need the Get news5 utility) The chart table shows the news corresponding to the currency pair. Filters are provided: by importance by time period by currency (if you turn off … Read more