By Ivan Andriyenko, updated March 12, 2025

Speculation has been ongoing around Reliance Jio Coin cryptocurrency, a rumored digital token linked to India’s largest telecom company, Reliance Jio. However, in January 2025, Mukesh Ambani’s Reliance Jio made headlines again, this time venturing into the blockchain world with Jio Coin. For traders looking to invest beyond Jio Coin, exploring regulated trading platforms has become increasingly important. However, regulatory aspects remain a key consideration, especially in India. Many investors are interested in trading with Exness but first seek to clarify an important question: exness legal in india? Here, Traders Union provides all the details about Exness’ status in India.

This article explores what Reliance Jio Coin cryptocurrency could mean for investors, how it may compare to Bitcoin and CBDCs, Jio coin price, and whether it could become India’s first legally accepted digital currency. Let’s dive in.

What is Reliance Jio Coin Cryptocurrency?

Reliance Jio Coin cryptocurrency is an anticipated blockchain-based digital token developed by Reliance Jio, India’s largest telecom provider. While the announcement was made in January 2025, the official Jio coin launch date is not yet ascertained.

Jio Coin will not take the form of typical cryptocurrency like Bitcoin or Ethereum. Instead, it will operate as a closed-loop digital rewards system within the Jio ecosystem. Users can earn Jio Coin for engaging with Jio’s services, such as:

- Jio Cinema. Watching movies and exclusive content.

- Jio Mart. Shopping on Jio’s e-commerce platform.

- Jio Sphere. Interacting with Jio’s metaverse and digital experiences.

How much is the price of a Jio Coin?

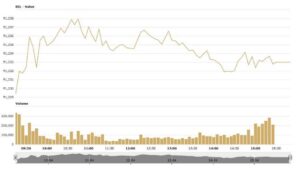

While Reliance Jio has not officially disclosed the valuation, reports suggest that each Jio Coin could be worth ₹0.0000000040 ($0.0000000479872). It has a market cap of ₹35 ($0.43) and a 24-hour trading volume of ₹1.7 ($02).

Mukesh Ambani and Crypto: Has he hinted at a blockchain revolution?

Mukesh Ambani, chairman of Reliance Industries, has consistently advocated for digital transformation in India. While he has not explicitly endorsed cryptocurrencies, his company’s growing interest in blockchain technology and digital assets suggests a strategic push toward a decentralized future.

Jio Financial Services and Blockchain Innovation

In August 2023, during Reliance’s annual general meeting, Ambani announced that Jio Financial Services (JFS) would explore blockchain platforms and central bank digital currencies (CBDCs). This initiative aligns with his vision of a robust, tech-driven financial ecosystem. JFS is set to develop a blockchain-powered payment infrastructure, ensuring secure transactions and seamless integration with digital currencies.

As blockchain-based financial solutions gain traction, stablecoins are becoming an essential bridge between traditional finance and the crypto economy. Many investors now prefer USDT deposit options for faster, low-cost transactions when trading digital assets. The growing reliance on USDT and other stablecoins highlights the increasing demand for reliable, fiat-pegged cryptocurrencies that could eventually complement Jio Financial Services’ blockchain ambitions.

Strategic Partnership with Polygon

Building on this momentum, in January 2025, Jio Platforms partnered with Polygon Labs to bring blockchain capabilities into Jio’s ecosystem. With over 450 million users, Jio’s integration with blockchain technology could revolutionize digital interactions across India. This partnership signals a larger ambition—leveraging blockchain for financial inclusion, data security, and decentralized applications.

JioCoin: A New Digital Asset?

Jio Platforms also introduced JioCoin, a reward-based digital token operating on the Polygon network. Embedded within Jio’s proprietary JioSphere browser, JioCoin allows users to earn tokens for online engagement. While it is currently non-transferable, speculation is growing that JioCoin could eventually be used within Reliance’s extensive ecosystem, including mobile recharges, e-commerce, and digital services.

Mukesh Ambani’s Blockchain Vision

Ambani has long emphasized the role of technology in India’s economic growth. His endorsement of blockchain-backed initiatives signals a shift toward a decentralized, secure, and scalable financial infrastructure. By integrating Web3 technology into Jio’s digital framework, Reliance Industries is positioning itself at the forefront of India’s next technological revolution.

Jio Sphere is expected to play a major role in Jio’s digital expansion, potentially integrating Jio Coin for in-platform transactions in the future.

Jio Sphere is Reliance Jio’s metaverse platform, designed to offer users an immersive digital experience powered by blockchain, AI, and 5G technology. It aims to blend virtual reality (VR), augmented reality (AR), and digital interactions into one seamless ecosystem.

Jio Sphere could serve as a hub for entertainment, gaming, virtual commerce, and digital events, allowing users to engage with content, interact with brands, and even earn Jio Coins.

How to earn a Jio token on Jio Sphere?

To earn a Jio token on Jio Sphere, you need to use Jio’s new blockchain-powered browser. It rewards users for browsing.

Steps to Earn Jio Coin on Jio Sphere

- Download Jio Sphere from the official site.

- Sign up using your phone number and verify with OTP.

- Browse the internet using Jio Sphere.

- Earn Jio Coin cryptocurrency as a reward.

This coin is built on the Polygon chain, making it a secure digital asset for future trading.

How Reliance Jio Coin could disrupt India’s digital payment ecosystem

Reliance Jio Coin cryptocurrency is rumored to have the potential to reshape India’s digital payments landscape. With 450+ million Jio users, Mukesh Ambani’s blockchain-powered token could introduce millions to crypto-backed transactions without facing regulatory roadblocks.

1. A controlled blockchain economy

Unlike Bitcoin or Ethereum, Jio Coin will operate within a closed-loop system. This allows Reliance Jio to control how it’s earned and spent. The model could set a precedent for corporate-backed digital currencies in India, making blockchain adoption more mainstream.

2. Digital Rupee integration

With India’s CBDC (Central Bank Digital Currency) gaining traction, Jio Coin could bridge the gap between private blockchain rewards and government-backed digital payments. If Reliance Jio integrates Jio Coin with the RBI’s digital rupee, it could create a hybrid digital economy.

3. Expansion beyond Jio services

Currently, Jio Coin is limited to Jio’s platforms, but future developments could extend its use to:

- Retail purchases via JioMart and Reliance Retail.

- Digital content payments on JioCinema and JioTV.

- Metaverse transactions through Jio Sphere.

Government regulations: Will Jio Coin be India’s first legal Crypto?

Reliance Jio’s JioCoin has sparked discussions about its regulatory status in India. As of February 2025, India enforces strict policies on cryptocurrencies, including a 30% tax on profits and a 1% TDS (Tax Deducted at Source) on transactions. The Union Budget 2025-26 did not introduce major changes but proposed new compliance rules for digital asset transactions, set to take effect from April 1, 2026.

JioCoin runs on the Polygon blockchain but is currently positioned as a reward token within Jio’s ecosystem. Users earn JioCoins through engagement on platforms like JioSphere. Since it functions more as a loyalty reward rather than a cryptocurrency, its regulatory treatment could differ. However, India’s financial authorities, including the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI), are expected to review its classification closely.

India’s broader stance on cryptocurrencies is also evolving. Economic Affairs Secretary Ajay Seth recently acknowledged that crypto regulations cannot be framed in isolation, given the global nature of digital assets. If India revises its approach, it could impact how JioCoin and similar projects are regulated.

For now, JioCoin is not recognized as India’s first legal cryptocurrency, and its future depends on upcoming regulatory decisions. Investors and users should stay updated on government policies and official statements from Reliance Jio regarding JioCoin’s status.

Reliance Jio Coin vs. Bitcoin & CBDCs: How does it compare?

Reliance Jio Coin cryptocurrency differs from Bitcoin and CBDCs in many ways. Unlike Bitcoin, Jio Coin won’t be decentralized. Instead, it will operate within Jio’s ecosystem, making it a controlled digital asset. The comparison test between Reliance Jio Coin, Bitcoin, and CBDCs is summarized in the table below.

| Feature | Jio Coin | Bitcoin (BTC) | CBDCs (Central Bank Digital Currencies) |

| Type | Digital reward token | Decentralized cryptocurrency | Government-backed digital currency |

| Blockchain | Private (Reliance Jio & Polygon Labs) | Public (Bitcoin blockchain) | Centralized (issued by central banks) |

| Use Case | Loyalty rewards within Jio services | Peer-to-peer payments, store of value | A digital alternative to cash |

| Transferability | Not transferable (closed-loop) | Fully transferable & tradable | Limited to regulated financial networks |

| Regulation | Controlled by Jio | Decentralized, face strict regulations in India | Fully regulated by governments |

| Value Stability | Fixed value (₹43 or $0.50 per token) | Highly volatile, market-driven | Stable, pegged to national currency |

| Trading & Speculation | Not allowed | Actively traded on global exchanges | Not tradable in open markets |

| Adoption Potential | Limited to Jio’s ecosystem | Global adoption as digital gold | Nationwide adoption (if implemented by the government) |

| Future Potential | Could evolve into a broader digital payment system | Continues as a major decentralized asset | Could replace physical cash in digital economies |

What this means for investors: Should you buy if the Jio Coin launches?

Investors are eager to know if Reliance Jio Coin cryptocurrency will be tradeable. Unlike Bitcoin, Jio Coin may function as a reward token rather than a market-driven asset.

- If the Jio Coin price remains fixed within Jio’s ecosystem, it won’t be a traditional investment opportunity. However, its adoption in Jio Mart, Jio Cinema, and Jio Financial Services could make it valuable.

Some claim Reliance share prices surged after Jio Coin’s announcement, reflecting investor confidence. However, Reliance has not officially confirmed Jio Coin’s launch, so there is no direct impact on its stock price.

Reliance’s partnership with Polygon Labs to boost blockchain and Web3 has attracted investor interest. The collaboration aims to integrate blockchain into Jio’s services, positioning Reliance as a digital leader in India. While the move is promising, its impact on the price of Reliance shares depends on official announcements and successful implementation.

For now, Jio Coin isn’t an investment opportunity—it’s a closed-loop digital reward token with no trading or cash-out options.

Expert opinion: Jio Coin could play a pivotal role in India’s evolving crypto landscape

According to the insights of analyst Anton Kharitonov, the potential launch of Reliance Jio Coin has generated significant interest among investors and cryptocurrency enthusiasts. While official details about the project remain scarce, Mukesh Ambani’s vision for blockchain and digital assets suggests that Reliance Jio Coin could play a pivotal role in India’s evolving crypto landscape. Investors seeking to understand the opportunities and risks associated with this initiative should take a strategic and informed approach before making investment decisions.

One of the key considerations for investors is regulatory clarity. India’s stance on cryptocurrencies has been evolving, with the government introducing taxation policies and exploring a framework for digital assets. Reliance, being one of India’s most influential conglomerates, is likely to work within regulatory guidelines, which could offer greater legitimacy and stability compared to decentralized cryptocurrencies. However, investors should stay updated on government policies and RBI regulations to assess how they may impact the viability of Jio Coin.

Another important factor is Reliance’s technological and infrastructural advantage. With Jio’s extensive digital ecosystem, including telecom, fintech, and e-commerce integrations, Jio Coin could have significant utility within Reliance’s platforms. If the cryptocurrency is designed for seamless transactions, loyalty rewards, or digital payments, it may gain widespread adoption among Jio’s vast user base. Investors should closely watch for announcements regarding Jio Coin’s use cases and technological framework, as these will determine its real-world application and long-term value.

Despite the excitement, Anton Kharitonov emphasizes the need for risk management. The crypto market is highly volatile, and even a corporate-backed digital asset can experience fluctuations in demand and regulatory scrutiny. Investors should diversify their portfolios, avoid excessive exposure to speculative assets, and consider Jio Coin as part of a broader investment strategy rather than a standalone opportunity.

According to Kharitonov, early-stage cryptocurrency investments require a balance of optimism and caution. While Reliance’s entry into the crypto space could drive innovation and mainstream adoption, investors must conduct thorough research, stay informed about policy developments, and wait for official announcements regarding Jio Coin’s launch, utility, and exchange availability. By adopting a measured and research-driven approach, investors can navigate potential opportunities in this emerging sector while mitigating unnecessary risks.

Conclusion

Reliance Jio Coin cryptocurrency could mark a new era for India’s digital economy. Unlike Bitcoin, it may operate as a corporate-backed token within Jio’s ecosystem. Its potential integration with CBDCs and the UPI payment network could reshape digital transactions.

However, its success depends on government regulations. However, if Jio expands its use case—allowing transfers, payments, or integration with India’s digital rupee—it could become a game-changer in digital transactions. Until then, investors should watch for regulatory changes and Jio’s long-term vision.

FAQs

Is Jio Coin a cryptocurrency like Bitcoin?

No, Jio Coin is not a traditional cryptocurrency—it’s a blockchain-based reward token designed for Jio’s ecosystem. Unlike Bitcoin, it cannot be traded, transferred, or used outside Jio’s platforms.

Can I buy, sell, or cash out a Jio Coin?

No, Jio Coin is not for sale or trading on any exchange, at least not yet. It is earned through Jio services like Jio Cinema and Jio Mart and can only be used within Jio’s network.

What is the value of one Jio Coin?

Reliance Jio has not officially disclosed its valuation, but media reports estimate it could be worth ₹43 ($0.50) per token. However, since it’s not redeemable, its value is purely theoretical for now.

Will Jio Coin be available for public trading in the future?

Currently, Jio Coin is a closed-loop system with no trading options. If Jio and regulators approve, it could evolve into a more flexible digital asset in the future.