Rebatron – Triangular Hedging EA for Low-Floating Multi-Pair Strategy

Rebatron is a fully automated Expert Advisor that utilizes a triangular hedging method across three major currency pairs (example) :

EURUSD – GBPUSD – EURGBP

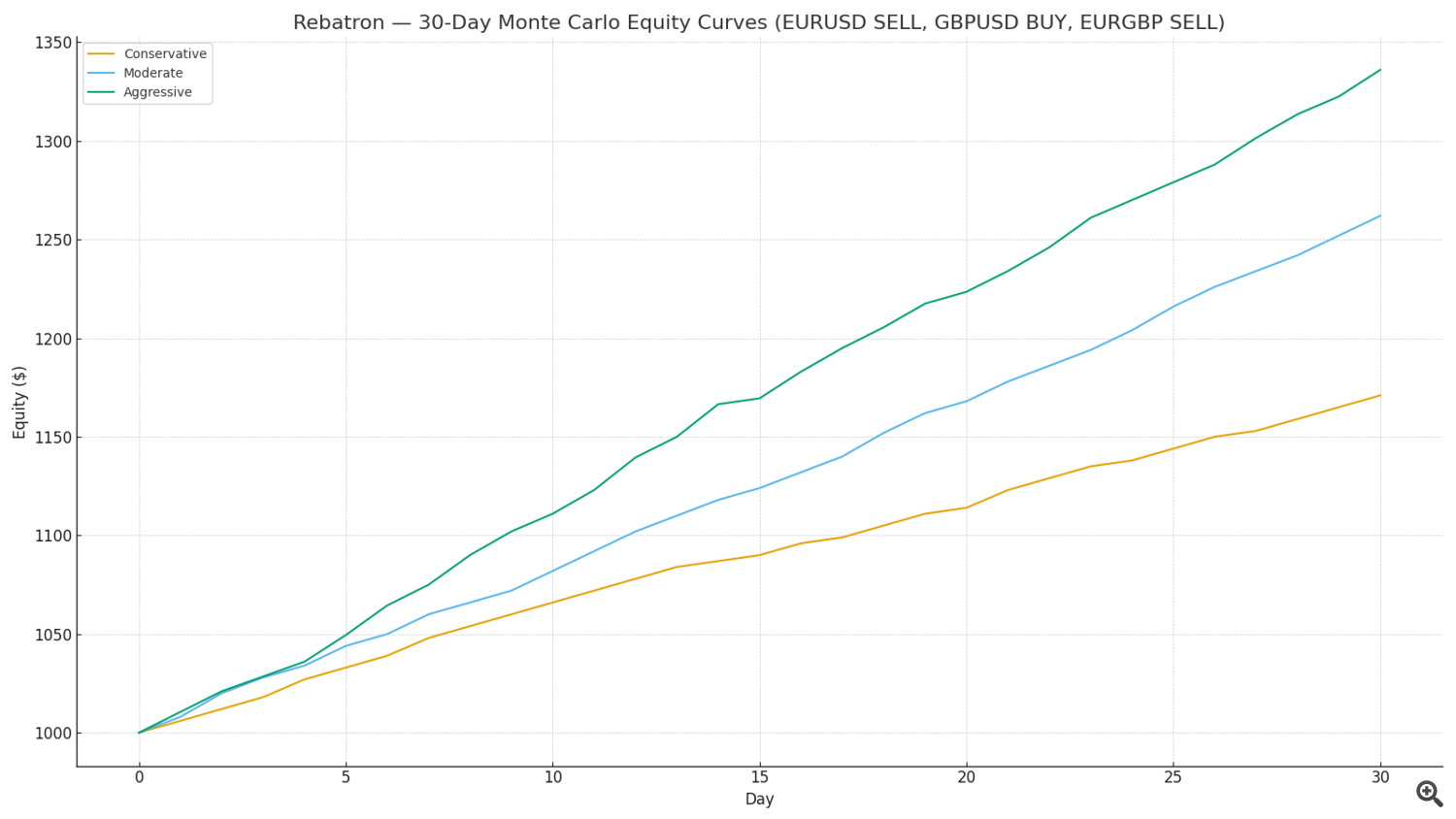

What’s shown in the chart:

30-day Monte Carlo equity curves for three presets (Conservative, Moderate, Aggressive) with $1,000 starting balance. Each preset uses different TP/grid scaling, simulating daily basket cycles based on typical EURGBP volatility. Results are illustrative and may vary on live accounts.

Presets used in the simulation:

-

Conservative: TP $3.0, Distance 4, Coefficients 0.03, Lot 0.01

-

Moderate: TP $2.0, Distance 3, Coefficients 0.035, Lot 0.01

-

Aggressive: TP $1.5, Distance 2–3, Coefficients 0.04, Lot 0.02

Key idea:

This basket keeps USD exposure neutral while taking a directional view on EUR vs GBP. Profits are taken per basket level; each level closes all three legs once the money TP is reached. The engine auto-repairs incomplete legs and filters entries by spread.

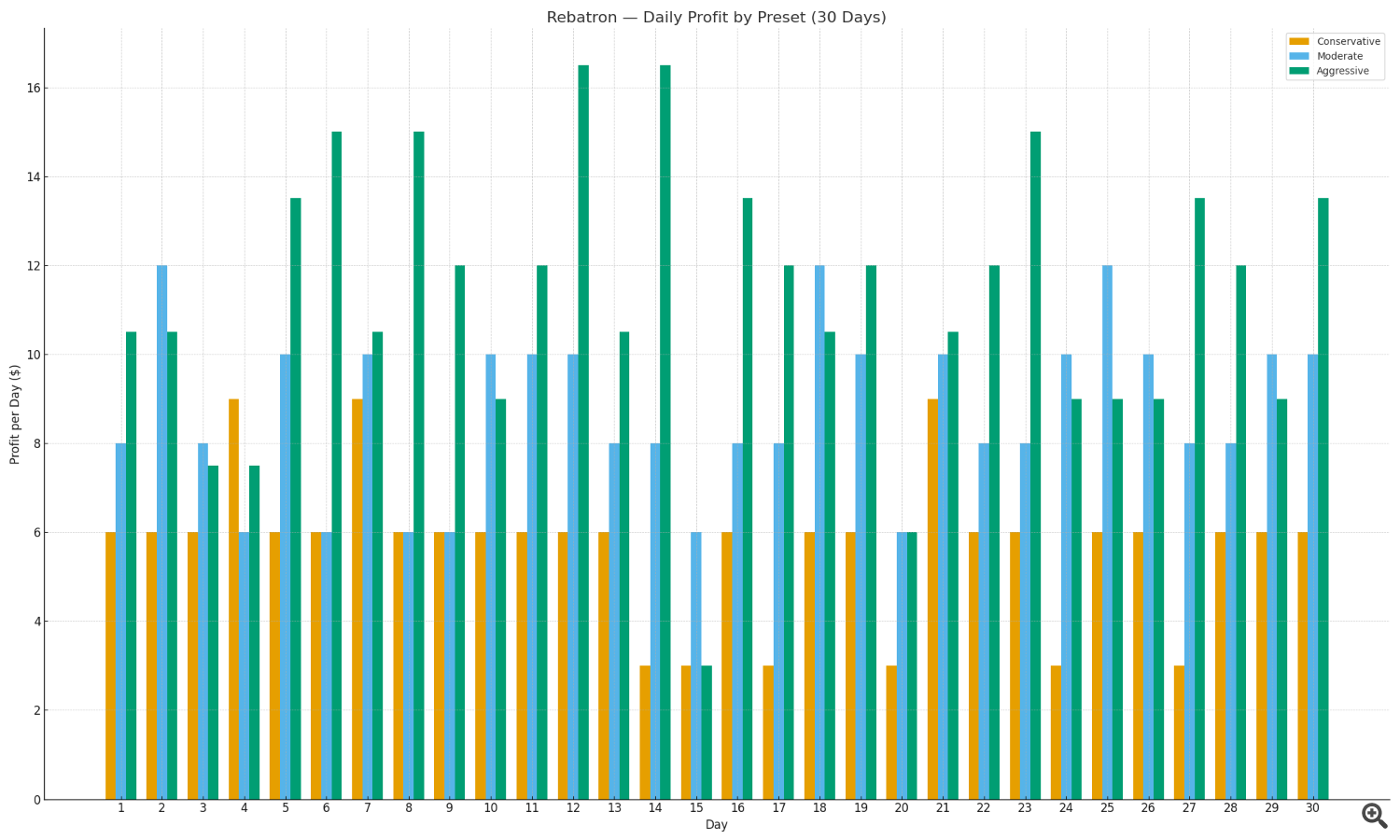

Grouped bar chart comparing simulated daily profits for three presets on the basket EURUSD SELL, GBPUSD BUY, EURGBP SELL with a $1,000 starting balance.

-

Conservative: TP $3.0, Distance 4, Coefficients 0.03, Lot 0.01

-

Moderate: TP $2.0, Distance 3, Coefficients 0.035, Lot 0.01

-

Aggressive: TP $1.5, Distance 2–3, Coefficients 0.04, Lot 0.02

The bars show the number of closed basket cycles per day × TP (money-based). Results are illustrative and depend on broker conditions (spread, commission, slippage) and risk settings.

Thank you

Regards

![REBATRON [tambangEA] - Trading Strategies - 31 August 2025](https://tradeonearth.site/wp-content/uploads/2025/08/1756622166_mql5-blogs.png)