Option Circle is a bot-based trading platform for options traders.

This means that you can set up a bot to automatically enter and exit trades based on your criteria.

The bots will scan for setups and initiate trades on your connected brokerage account (currently limited to select brokers, including Webull, Tradier, Tastytrade, and TradeStation).

Contents

What was once available only to institutional and hedge funds is now becoming accessible to retail traders.

A bot trading a strategy can take out the emotional aspect of trading.

How many times has a trader held a loss too long, taken profit too soon, or entered a trade without meeting all the criteria?

A bot instructed to exit at a particular stop loss would ensure tight risk management, without the trader needing to be present in front of the computer to monitor when the stop is hit or to second-guess their actions.

Even if the trader is trading with discipline and following their rules, it could save a significant amount of time if a bot helped run scans, place trades, monitor positions, and exit trades.

It might even uncover more opportunities for the trader, as it can scan more markets and place more trades in less time than a human can.

This is not to say that a bot can replace an experienced trader, especially one who can spot nuanced differences in order flow, price action, and volume that help determine whether to take a trade or not.

A skilled trader can also identify confluences and stack edges together.

At this point, it remains challenging to instruct a bot with this level of sophistication.

In such cases, humans still hold an edge.

Another benefit of bot trading is that it presents a low barrier for retail traders to enter the system trading market.

No longer is there a need to hire programmers to implement multiple strategies that execute simultaneously.

With the advent of AI, computers are now capable of writing code.

Via a point-and-click user interface, the retail trader can create a bot that executes the strategy they have in mind.

Let’s see an example of how.

Using the free account, which requires no credit card input, no deposit, and no broker connection, I can create a bot on Option Circle’s $400,000 simulated paper trading account.

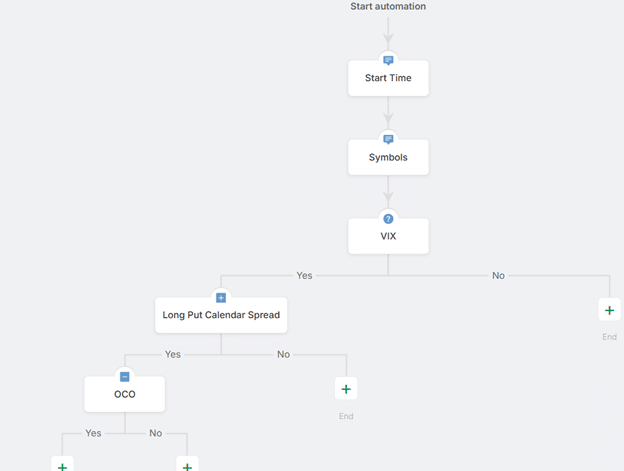

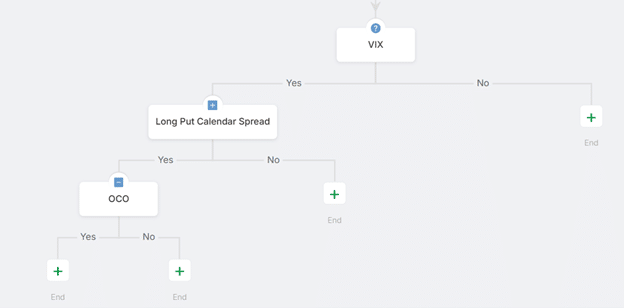

A bot is called an “agent”. Creating your agent involves you setting up a workflow tree like this:

Here, we have specified the “Start Time” for the agent to be able to initiate trades on a daily basis between 9:45 am and 4 pm:

Since the market opens at 9:30 am, we specified the bot to trade only after 9:45 am (15 minutes after the open, allowing volatility to settle a bit).

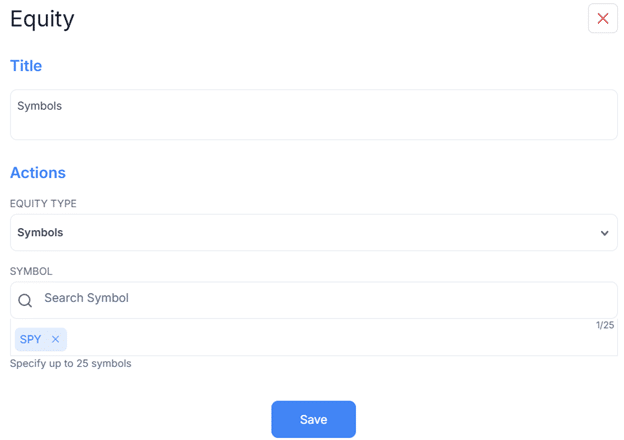

The next step, we told the bot to trade on an equity symbol SPY, which is the S&P 500 ETF:

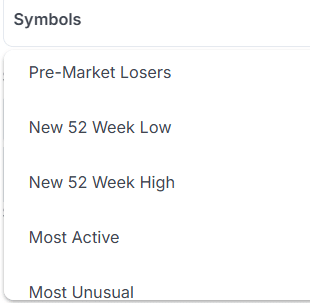

You can specify up to 25 symbols, or tell it to trade symbols meeting certain criteria, such as:

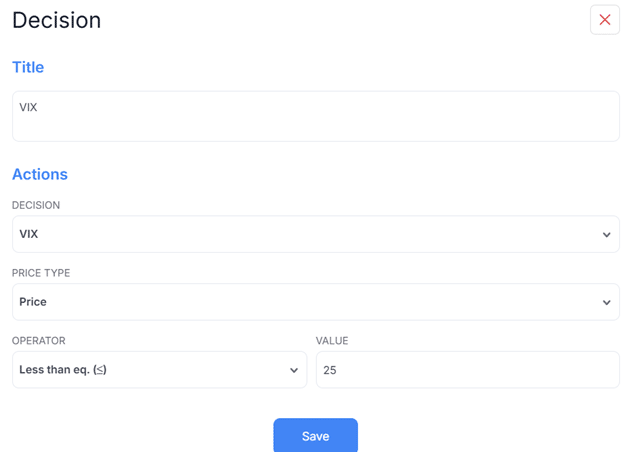

Next, we instruct the bot to make a decision to trade or not, depending on the value of the VIX.

Since we want the bot to trade a calendar spread, we specified that it should trade only when the VIX is 25 or less.

We filled in the “yes” branch for the decision…

Since we did not fill in anything for the “no” branch, it will do nothing if VIX > 25.

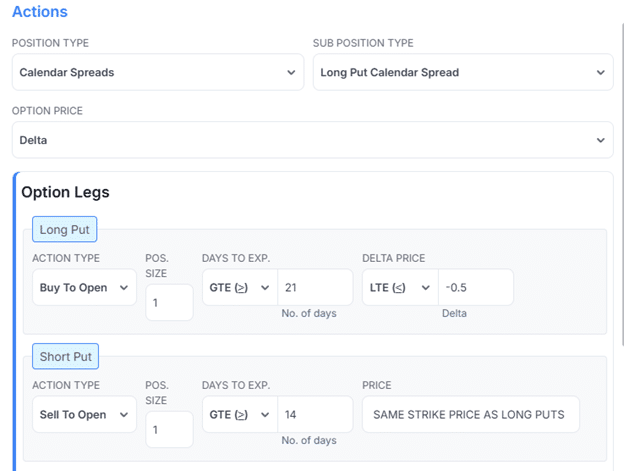

If yes to VIX less than or equal to 25, then initiate a “long put calendar spread“.

We specify the calendar spread to have a long put option greater than 21 days from now with an at-the-money strike (which is -0.5 delta):

And the short put option to be greater than 14 days-to-expiration with the same strike as the long put option.

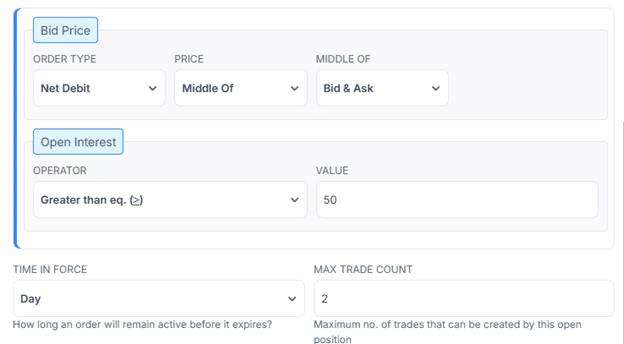

We further specify to set a “day order” to pay at the mid-price between the bid and ask for the debit of the calendar, and only when open interest is greater than 50…

We also told the bot not to have more than two open positions at a time.

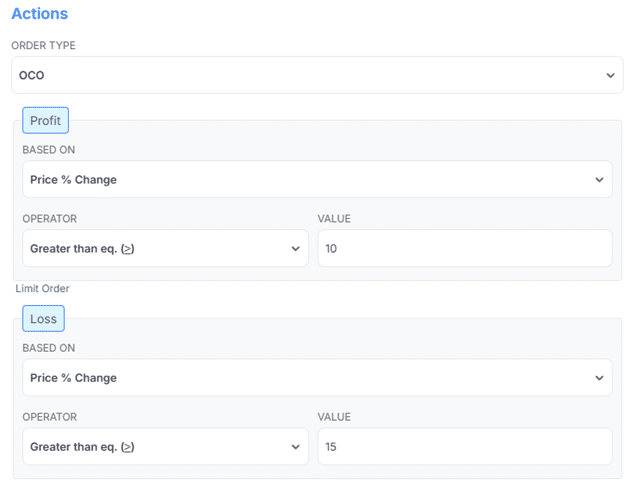

OCO is One-Cancels-Other.

This is how we can specify the bot to take profit or exit for a loss:

Here, we instructed it to take a profit at 10% or exit if the loss exceeds 15%, whichever comes first.

Once one of the conditions is met, the trade exits and cancels the other condition.

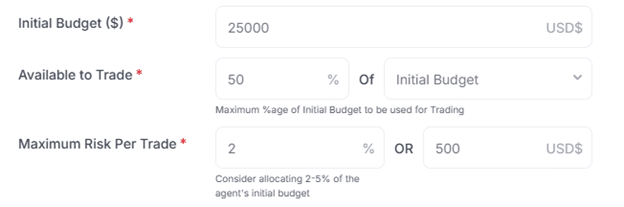

Once your bot is saved, you can give it a budget and set limits on its position size:

When creating a bot, you can make mistakes and/or have a wrong interpretation as to how to specify the inputs.

Therefore, always validate the bot’s correct behavior by running it on a paper account first.

Although the fill execution on the paper account may not be as realistic as live trading due to various market factors, such as liquidity and slippage, it can be useful for bot validation and for forward testing your strategy on unsampled data.

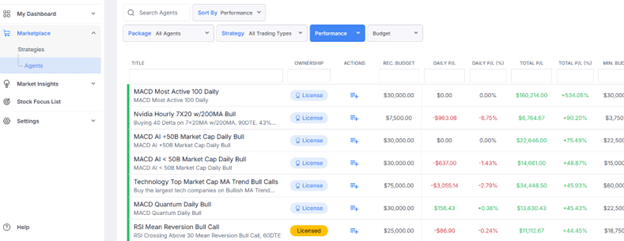

For those who don’t want to create their own bots, they can “license” and run a bot agent from the Option Circle Marketplace.

While the word “license” may imply that you have to pay money to run one of these bots, this cost is included in your subscription membership fee.

For example, if you purchase the Standard Plan, it allows you to license 25 bots.

The Premium Plan gives you 50 bots to run on live or paper accounts

And with the Pro Plan, you can run an unlimited number of bots.

The Free Plan gives you only two bots on a Paper Trading account.

There is also an opportunity for bot creators to monetize their bots in the marketplace.

A trader with a well-defined strategy and specific entry and exit criteria can scale up their trading by utilizing proper bot automation.

Bots can scan for many more opportunities and react instantly to market conditions, capturing opportunities that would be impossible for a human to execute manually.

It also eliminates hesitation, fear, or greed that often impacts manual trading.

However, effective automated options trading requires rigorous backtesting, real-time monitoring, risk management, and an ongoing commitment to refinement.

We hope you enjoyed this review article on Option Circle.

If you have any questions, send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.