1. Introduction

OASIS MT5 is a multi-asset Expert Advisor designed for disciplined risk management and professional-grade execution. This guide explains every user-adjustable parameter, their purpose, and provides best-practice recommendations for both retail and prop-firm traders. The inputs are grouped as seen in the MT5 interface for clarity.

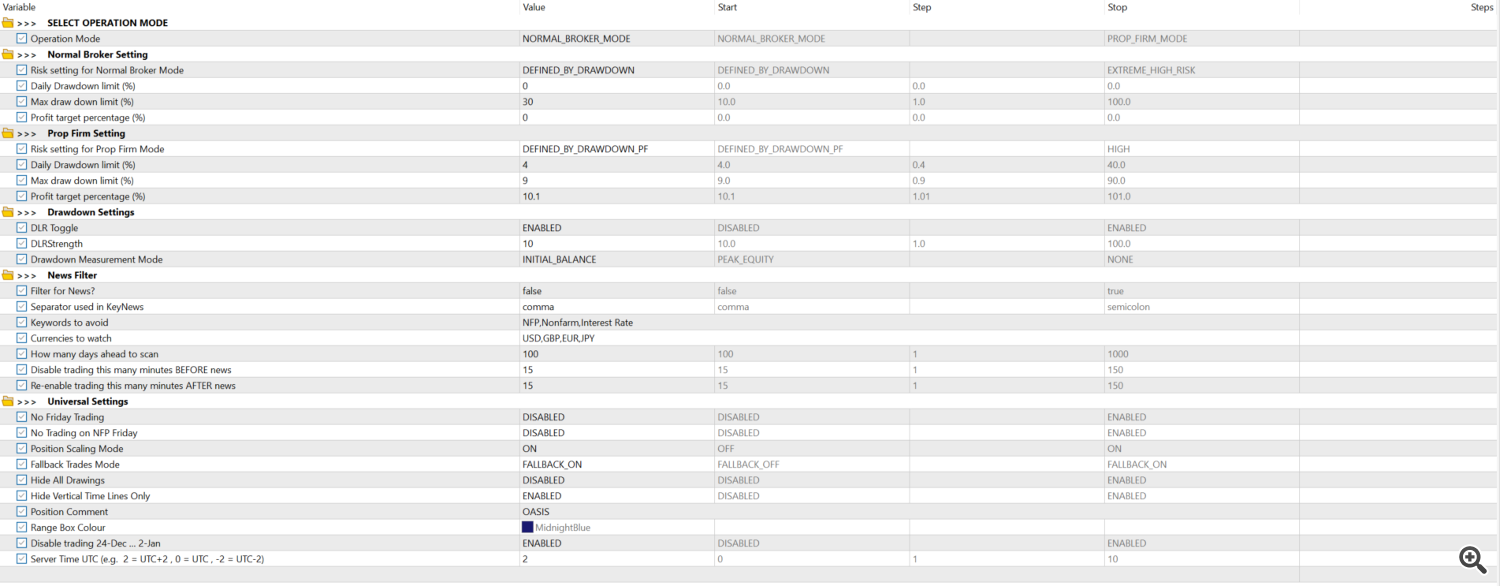

2. Input Parameters Explained

2.1 Select Operation Mode

Operation Mode: Determines whether the EA operates under retail broker settings (flexible risk rules) or prop-firm settings (stricter drawdown and profit-target rules). Options are:

- NORMAL_BROKER_MODE

- PROP_FIRM_MODE (limit orders are randomized by ±10 points to comply with prop firm requirements)

Best Practice: Use NORMAL_BROKER_MODE for personal accounts; PROP_FIRM_MODE for funded accounts with strict drawdown rules.

2.2 Normal Broker Setting

Risk setting for Normal Broker Mode: Sets the risk level per trade. Options are:

- EXTREME_CONSERVATIVE (0.1% risk)

- CONSERVATIVE (0.2%)

- MODERATE (0.3%)

- INTENSE (1%)

- EXTREME_HIGH_RISK (2%)

- DEFINED_BY_DRAWDOWN (based on max drawdown)

Typical Range: MODERATE or CONSERVATIVE for most users.

Daily Drawdown limit (%): Pauses trading if daily losses exceed this percentage of equity.

Typical Range: 2–5% (e.g., 5% for a $10,000 account pauses at $500 daily loss).

Max draw down limit (%): Stops all trading if total drawdown exceeds this percentage (based on the Drawdown Measurement Mode).

Typical Range: 10–30% (e.g., 30% stops at $3,000 loss on a $10,000 account).

Profit target percentage (%): Stops trading if this profit percentage is reached (e.g., 10% = $1,000 profit on a $10,000 account). Set to 0 to disable.

Typical Range: 0 (disabled) or 5–10% for conservative targets.

Best Practice: Start with DEFINED_BY_DRAWDOWN risk, a 5% daily drawdown, and 30% max drawdown. Set a profit target only if you have a specific goal.

2.3 Prop Firm Setting

Risk setting for Prop Firm Mode: Sets the risk level per trade in PROP_FIRM_MODE. Options are:

- LOW (0.05% risk)

- MEDIUM (0.1%)

- HIGH (0.2%)

- DEFINED_BY_DRAWDOWN_PF (based on max drawdown)

Typical Range: MEDIUM for most prop firms.

Daily Drawdown limit (%): Pauses trading if daily losses exceed this percentage in PROP_FIRM_MODE.

Typical Range: 2–5% (prop firms often require 4–5%).

Max draw down limit (%): Stops trading if total drawdown exceeds this percentage in PROP_FIRM_MODE.

Typical Range: 6–12% (prop firms often set 9–12%).

Profit target percentage (%): Stops trading if this profit percentage is reached in PROP_FIRM_MODE.

Typical Range: 5–10% (prop firms often require 10%).

Best Practice: Use DEFINED_BY_DRAWDOWN risk, 4% daily drawdown, 9% max drawdown, and a 10% profit target to align with common prop firm rules.

2.4 Drawdown Settings

DLR Toggle: Enables/disables Drawdown Linear Reduction (DLR), which reduces lot sizes as drawdown increases.

Typical Range: ENABLED for safety.

DLRStrength: Controls how aggressively lot sizes are reduced during drawdowns (1 = minimal reduction, 100 = aggressive).

Typical Range: 10 (default) for balanced reduction.

Drawdown Measurement Mode: Defines how drawdown is calculated:

- PEAK_EQUITY: Measures drawdown from the highest equity peak (e.g., if equity peaks at $12,000, a drop to $11,000 is an 8.3% drawdown).

- PEAK_BALANCE_TO_EQUITY: Measures drawdown from the highest balance peak against current equity (e.g., if balance peaks at $11,000 and equity drops to $10,000, that’s a 9.1% drawdown).

- INITIAL_BALANCE: Measures drawdown from the starting balance (e.g., if starting balance is $10,000 and equity drops to $9,000, that’s a 10% drawdown).

- NONE: Disables drawdown checks entirely.

Typical Range: INITIAL_BALANCE for simplicity; PEAK_EQUITY for stricter control.

Best Practice: Enable DLR with DLRStrength at 10. Use INITIAL_BALANCE for straightforward drawdown tracking, or PEAK_BALANCE_TO_EQUITY if you want to account for equity growth.

2.5 News Filter

Filter for News?: Enables/disables pausing trading during high-impact news events.

Typical Range: True to avoid volatility.

Separator used in KeyNews: Defines the separator for news keywords (comma or semicolon).

Typical Range: Comma (default).

Keywords to avoid: News events to avoid (e.g., “NFP,Nonfarm,Interest Rate” pauses trading during Non-Farm Payrolls and interest rate announcements).

Typical Range: “NFP,Nonfarm,Interest Rate,FOMC” for USD pairs.

Currencies to watch: Currencies to monitor for news (e.g., “USD,GBP,EUR,JPY”).

Typical Range: Match your traded symbols (e.g., “USD,JPY” for USDJPY).

How many days ahead to scan: Days to look ahead for news events.

Typical Range: 100 (default) to cover most events.

Disable trading this many minutes BEFORE news: Minutes before a news event to pause trading.

Typical Range: 15 minutes for safety.

Re-enable trading this many minutes AFTER news: Minutes after a news event to resume trading.

Typical Range: 15 minutes to let volatility settle.

Best Practice: Disable news filter as this system works well with news events. Depends if you need it or not for other reasons.

2.6 Universal Settings

No Friday Trading: Disables trading on all Fridays to avoid weekend gaps.

Typical Range: DISABLED unless you’re risk-averse.

No Trading on NFP Friday: Disables trading on Non-Farm Payroll Fridays (first Friday of the month).

Typical Range: ENABLED for USD pairs to avoid volatility.

Position Scaling Mode: ON: Allows clip sizing lot size for top of book and better execution; OFF: Enforces strict limits.

Typical Range: ON for flexibility; OFF for control.

Fallback Trades Mode: ON: Places market orders if pending orders fail; OFF: Disables fallback trades.

Typical Range: ON to ensure trade execution.

Best Practice: Disable No Trading on NFP Friday. Use Position Scaling Mode ON, and enable Fallback Trades Mode for reliability.

2.7 Visual Settings

Hide All Drawings: Disables all chart drawings (range boxes, lines, etc.).

Typical Range: DISABLED to visualize ranges.

Hide Vertical Time Lines Only: Hides only the vertical time lines marking range start/end.

Typical Range: DISABLED for clarity.

Position Comment: Custom comment for trades (e.g., “OASIS”).

Typical Range: “OASIS” (default) for identification.

Range Box Colour: Color of the range boxes drawn on the chart.

Typical Range: clrMidnightBlue (default) for visibility.

Disable trading 24-Dec … 2-Jan: Pauses trading during the Christmas/New Year period (Dec 24 to Jan 2).

Typical Range: ENABLED to avoid holiday volatility.

Server Time UTC: Sets your broker’s UTC offset (e.g., 2 for UTC+2, -5 for UTC-5).

Typical Range: Match your broker’s time zone (e.g., 2 for most EU brokers).

Best Practice: Keep Disable trading 24-Dec … 2-Jan enabled. Set Server Time UTC to your broker’s time zone (check broker documentation if unsure).

3. Best-Practice Deployment

- Account Size: $10,000 (or equivalent).

- Leverage: 1:100 or higher for flexibility.

- Risk Profile: Start with MODERATE risk, 5% DailyDrawdownLimit, and 30% MaxDrawdown.

- Broker: Use Standard low spread accounts.

- VPS: Essential for 24/5 operation and precise news filtering.

- Monitoring: Check MT5’s Trade and Journal tabs for real-time updates.

4. Setup Walkthrough

- Open MT5, drag OASIS onto a USDJPY H1 chart.

- In the input window, configure:

- Operation Mode: NORMAL_BROKER_MODE (or PROP_FIRM_MODE for funded accounts).

- Risk setting for Normal Broker Mode: DEFINED_BY_DRAWDOWN.

- Daily Drawdown limit (%): 5%.

- Max draw down limit (%): 30%.

- Filter for News?: False.

- Drawdown Measurement Mode: INITIAL_BALANCE.

5. Frequently Asked Questions

- Does OASIS require optimization? No, defaults are pre-tuned for supported symbols.

- Can I run other EAs? Yes, if they use unique Magic Numbers (OASIS uses 1–5 for its symbols). Keep a close eye on margin.

- Is OASIS broker-sensitive? No, but low-spread brokers enhance performance.

- What if I hit a drawdown limit? Trading pauses (daily) or stops (max), requiring manual restart.

6. Support

- Comments Tab: Post questions on the OASIS MT5 product page.

- MQL5 Messaging: Click “Write a Message” on the seller’s profile for private queries.

- Response Time: Within 24 hours.

7. Final Notes

OASIS MT5 combines institutional-grade logic with user-friendly automation. Test it on a demo account to confirm compatibility with your broker and risk tolerance. Share your experience in the Comments tab to help other traders!