Good-till-cancel orders can be a useful tool to lock in profits without needing to be at your computer watching the stock’s every move.

They are often abbreviated or labeled in your trading platform as the GTC order type.

In our example, these good-till-cancel orders are all limit orders (as opposed to market orders).

Contents

It can also be used in multi-leg option orders.

We will show an example with Netflix (NFLX).

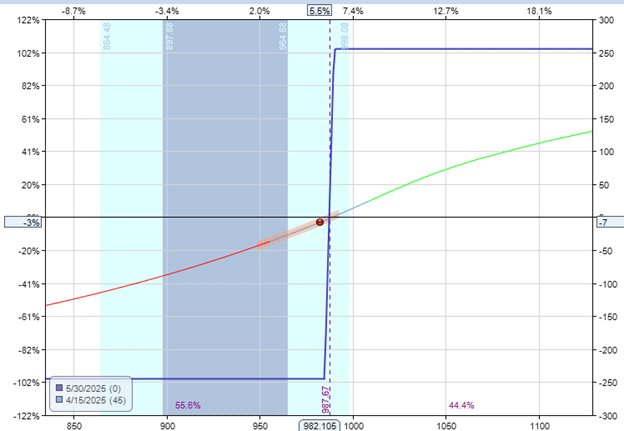

On April 15, 2025, the trader initiated a bull call debit spread expecting a bullish move in Netflix:

Date: 4/15/2025

Price: NFLX at $982

Buy one May 30 NFLX $985 call @ $63.41

Sell one May 30 NFLX $990 call @ $60.96

Debit: -$245

The trade profits as the price of NFLX moves up.

And if it does not, the max loss on this trade is the debit paid, which is $245.

What if an adjustment can give us a credit of $245?

If the market can give us a $245 credit, we would essentially pay nothing for the trade.

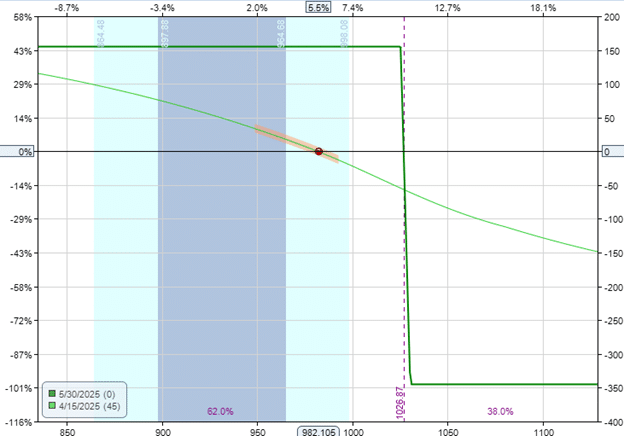

The trader asks the market for a credit of $245 with the following bear call credit spread.

Sell one May 30 NFLX $1025 call

Buy one May 30 NFLX $1030 call

GTC order for credit of $245

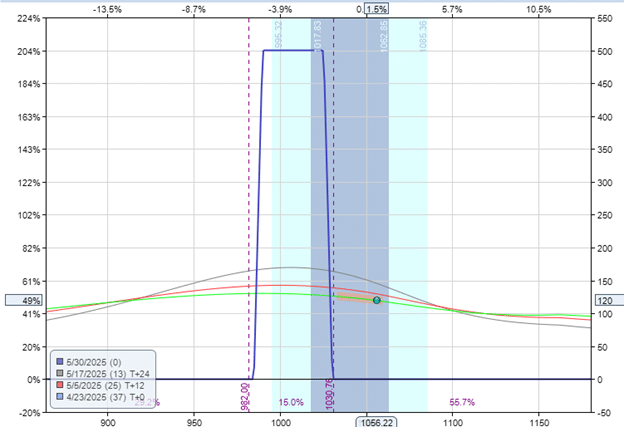

The bear call spread would look like this:

Setting a GTC limit order for a credit of $245 means that the order will be sitting out there in your brokerage account.

The order will not be filled until you can get a credit of $245 or more for the spread.

This is what is meant by “limit” order.

It limits the execution until a certain price is met.

Right now, the market is only willing to give a credit of $155 for the bear call spread.

So, no execution yet.

However, as the price of NFLX moves towards the bear call spread, the market will give a bigger credit for this spread.

With high volatility with VIX at 30, large swings in stock prices may cause the NFLX price to go up, even temporarily during intraday, such that the order is triggered.

On April 22, sometime during the day (the trader doesn’t know when because he was not at his computer), the order was triggered, and the bear call spread was automatically initiated for a credit of $245.

Sell one May 30 NFLX $1025 call @ $45.82

Buy one May 30 NFLX $1030 call @ $43.37

Credit: $245

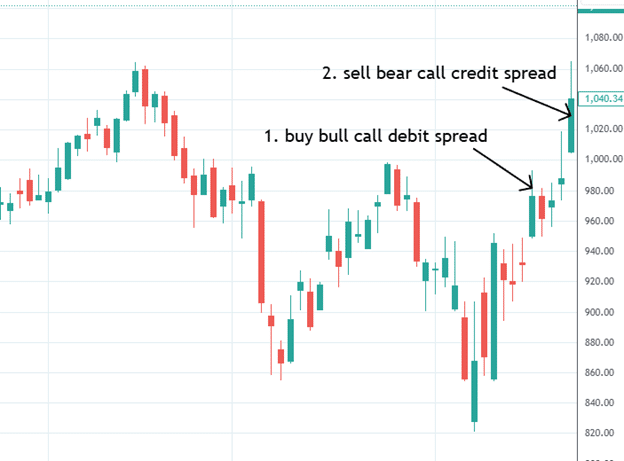

Upon looking at the charts, I noticed that NFLX had gone up (as the trader had anticipated).

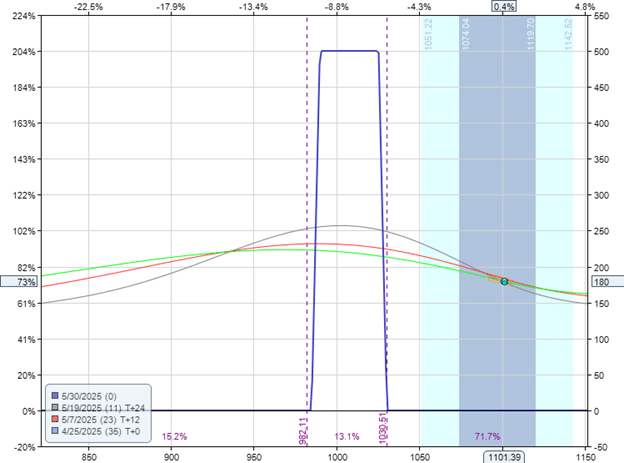

With both the bull call debit spread and the bear call credit spread in place, the risk graph now looks like this:

The net debit to get into this condor is zero, because the trader paid $245 for the first lower leg and received $245 for the second upper leg.

This is not an iron condor (because it does not have both calls and puts), but it is an “all-call condor” consisting of the following two spreads:

Bull call spread:

Short call at $990

Long call at $985

Bear call spread:

Long call at $1030

Short call at $1025

The trader has essentially “legged into” a condor that is risk-free.

his can sometimes happen if the price moves in the trade’s favor after initiating the first leg.

You can confirm that the trade is risk-free with the following thought.

If the price of NFLX is high (above $1030) at expiration, then the bear call spread would be at max loss of -$500, and the bull call spread would be a max gain of $500.

Net zero profit and loss (P&L).

If the price of NFLX is really low (below $985) at expiration, then the bear call spread would be at a max gain of $500, and the bull call spread would be at a max loss of -$500.

Net zero P&L.

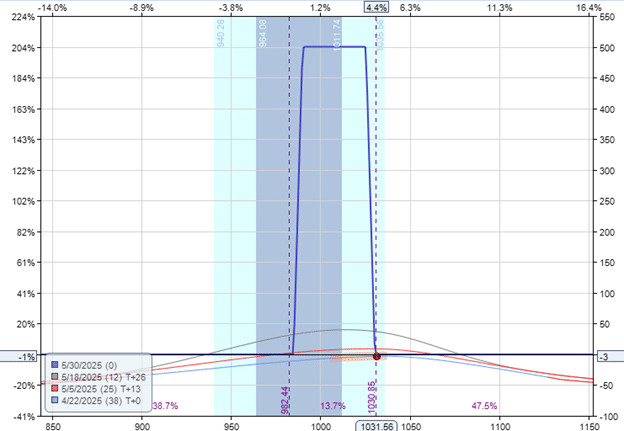

If the price of NFLX is between $985 and $1030, there will be some profit in the trade.

If the price of NFLX is between $990 and $1025 at expiration, the trade will have a maximum profit of $500 when both the bear call spread and bull call spread have maximum gain.

The trader is willing to get $100 out of the trade, which is 20% of the max potential profit.

Considering that the maximum risk in this trade is $245, a $100 return is already 40% of the capital at risk.

So the trader sets a GTC limit order to exit the condor for a credit of $100.

Sell to close May 30 NFLX $1030 call

Buy to close May 30 NFLX $1025 call

Buy to close May 30 NFLX $990 call

Sell to close May 30 NFLX $985 call

GTC order for credit of $100.

Again, this order will not execute until it can be executed for a credit of $100 or more.

To the trader’s surprise, the GTC order triggered the next day, exiting the trade for a net profit of $100.

According to the theoretical model in the above graph showing the T+0, T+13, and T+26 lines, one would expect it to take some time before the condor can show a profit of $100.

There are still 38 days till expiration.

However, due to the high volatility (VIX at 28), the bid-ask spread on option prices is wide, and they are jumping all over the place.

The order was triggered at some point during the day on April 23.

Even the historical prices shown in OptionNet Explorer can be seen to fluctuate wildly.

At certain points, a profit of $100 can be seen:

Can it really be filled at those prices?

Yes, it can because these were the actual fill prices that one of my students gave me from his live trade.

Date: April 23, 2025

Sell to close one NFLX $1030 call @ $63.69

Buy to close one NFLX $1025 call @ $66.66

Buy to close one NFLX $990 call @ $90.44

Sell to close one NFLX $985 call @ $94.41

Net credit: $100

This shows that things don’t always go according to theory in real life.

As the professional baseball catcher Yogi Berra once said:

“In theory, there is no difference between theory and practice. In practice, there is.”

Perhaps the trader might have even set the GTC credit too low.

Because on April 25, it might have even been possible to get $180 out of the trade:

Another drawback of GTC orders is that traders can overuse them.

Using GTC orders to take profit can work out in one’s favor.

But it can also take profits too early and exit your trade too soon.

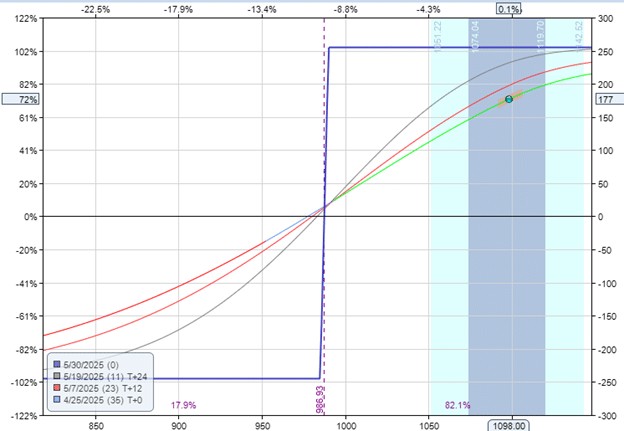

What if the trader did not use GTC orders in this NFLX example?

Then, if the trader waited until April 25, the original bull call spread would have shown a profit of $177:

Using the GTC order to make the trade risk-free reduces the trader’s ability to generate profits if the NFLX goes in the direction that the trader anticipated.

But of course, we can not tell in advance whether NFLX would go in our direction or not.

There is a distinction between using GTC orders as stop loss exits versus using GTC orders to lock in profits.

While the latter is often advantageous, the former can be problematic.

This is especially true during periods of high volatility when the bid/ask spread gets wide and when prices make more wild swings up and down.

The problem with using GTC orders as stop loss exits is that random price swings can trigger the order to exit your trade at a loss.

But if you set GTC orders to take profit, then wild swings can trigger the order to exit your trade at a profit.

A GTC limit order can execute favorable fills for you, as the computer can monitor the prices so that you do not have to.

The use of GTC orders is a good tool for a trader.

However, it needs to be used with discretion.

A hammer is also a good tool, but not everything is a nail.

We hope you enjoyed this article on a trade example on locking in profits with GTC orders.

If you have any questions, send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

That “golden age” feeling they describe at JLFF really resonates – it’s about more than just winning, isn’t it? Strategy & a bit of nostalgia go a long way. Check out the jlff app casino for a classic vibe & responsible play! It’s a neat platform.