TRADER’S GUIDE:

I decided, in order to share more information about my routine of using the EA, to write a short guide. I hope to be as clear and concise as possible and to satisfy all the requests and questions you may have.

First of all, let’s clarify what LL Hedge EA is.

It is an ExpertAdvisor developed exclusively for the MetaTrader5 and MetaTrader4 platform, based on a very simple hedging strategy.

Part 1: The hedging strategy

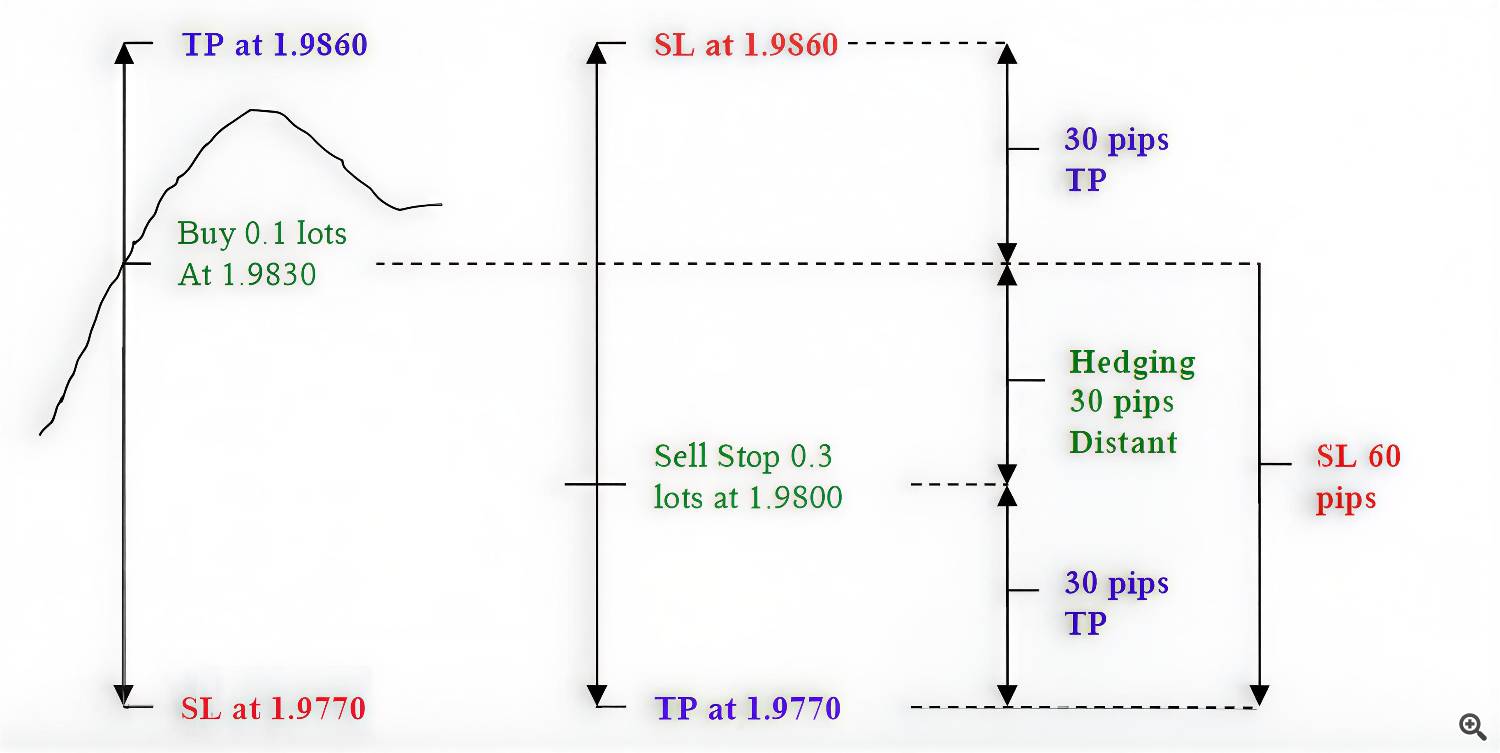

The EA open one first position in the trend direction (identified via an MA cross). A few milliseconds after placing the Buy market order, the EA places a Sell Pending Stop with the selected lot multiplier and distance (only on Legacy Mode).

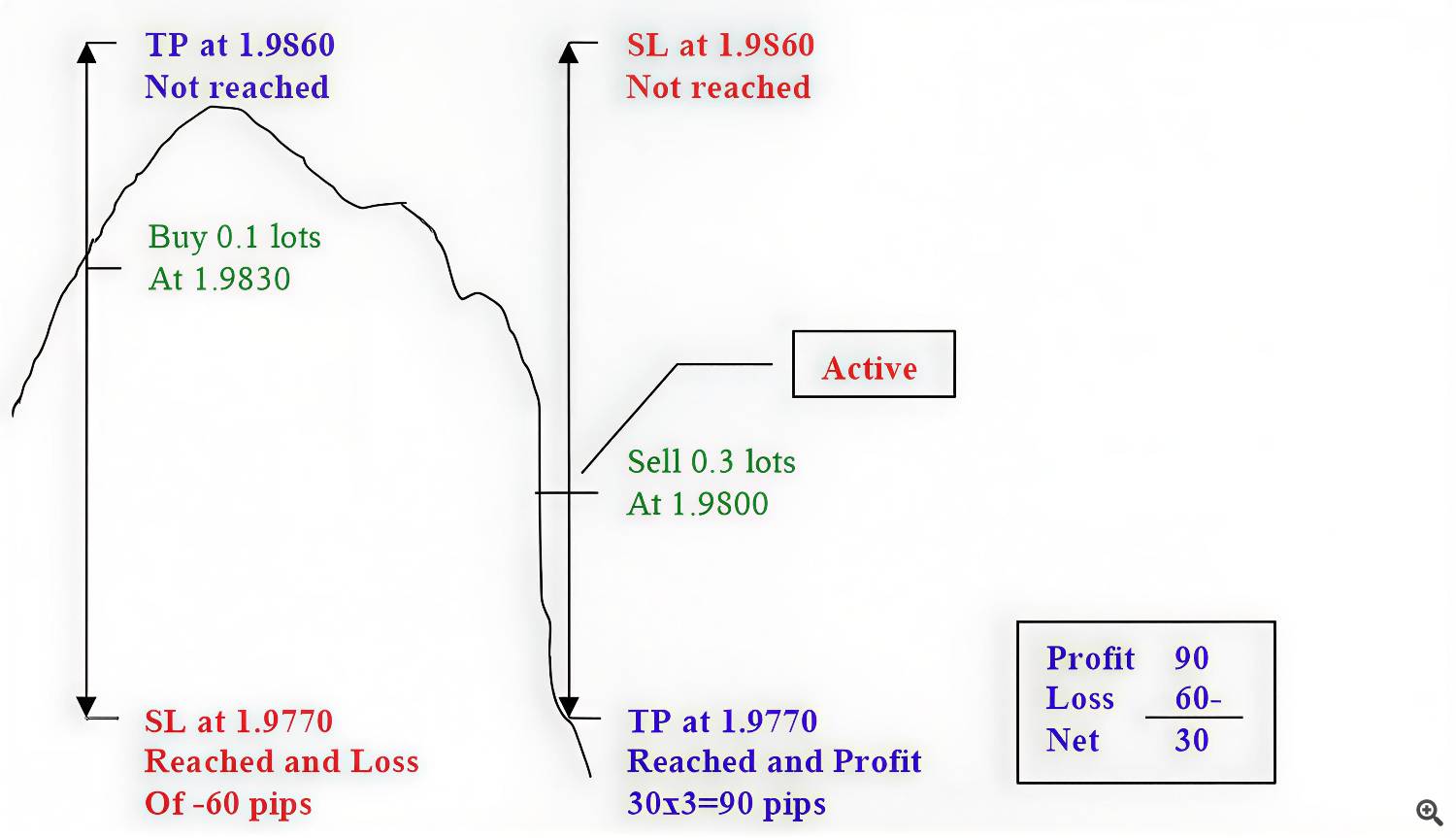

The TP and the SL are reversed for both orders, so if the first TP of the Buy is not reached, and the price goes down, the Sell Stop become an active Sell.

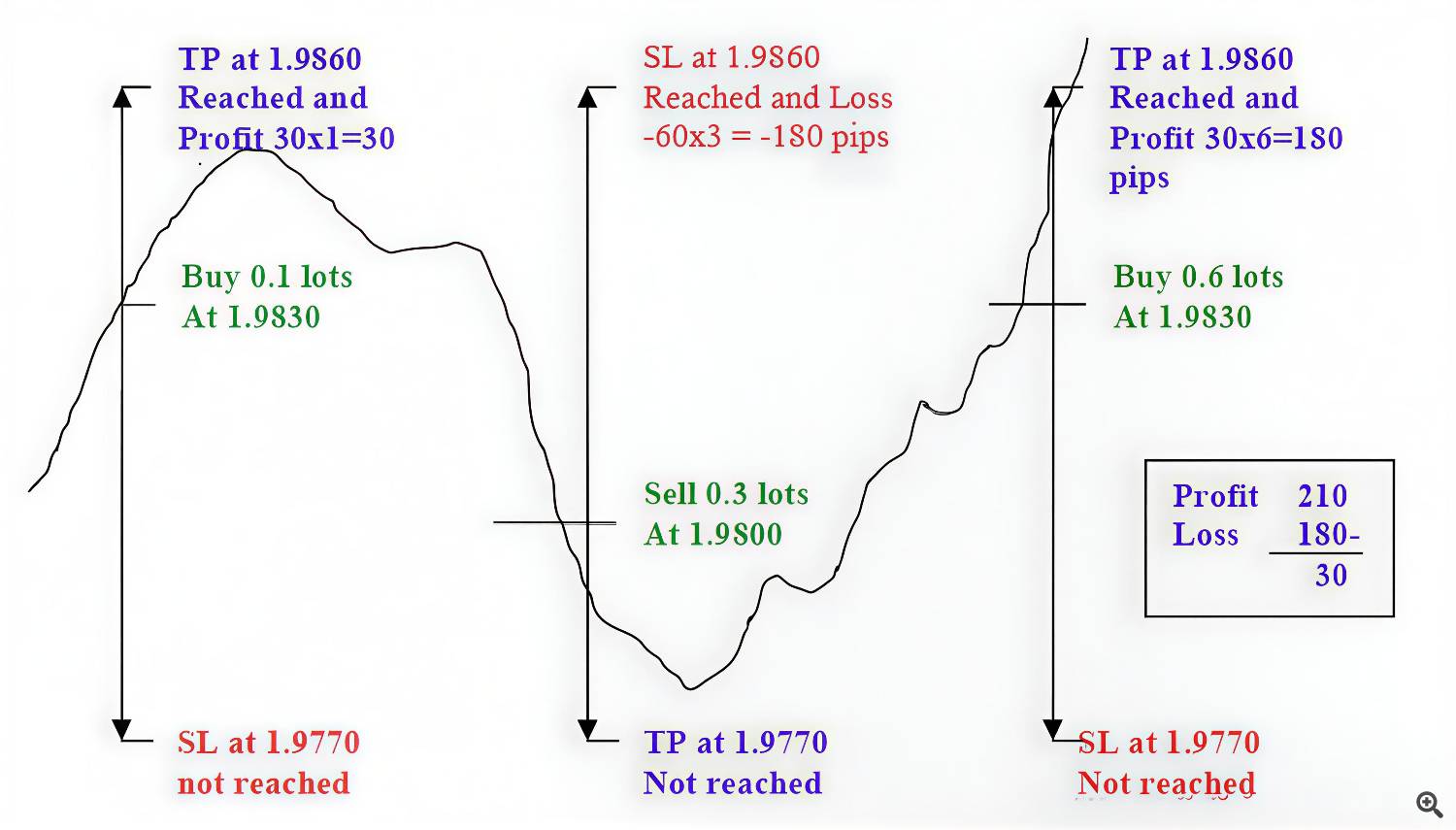

So when you hit the SL of the first Buy, you also hit the TP of the Sell, which is 2 o 3 times bigger than the SL, according to your selected multiplier.

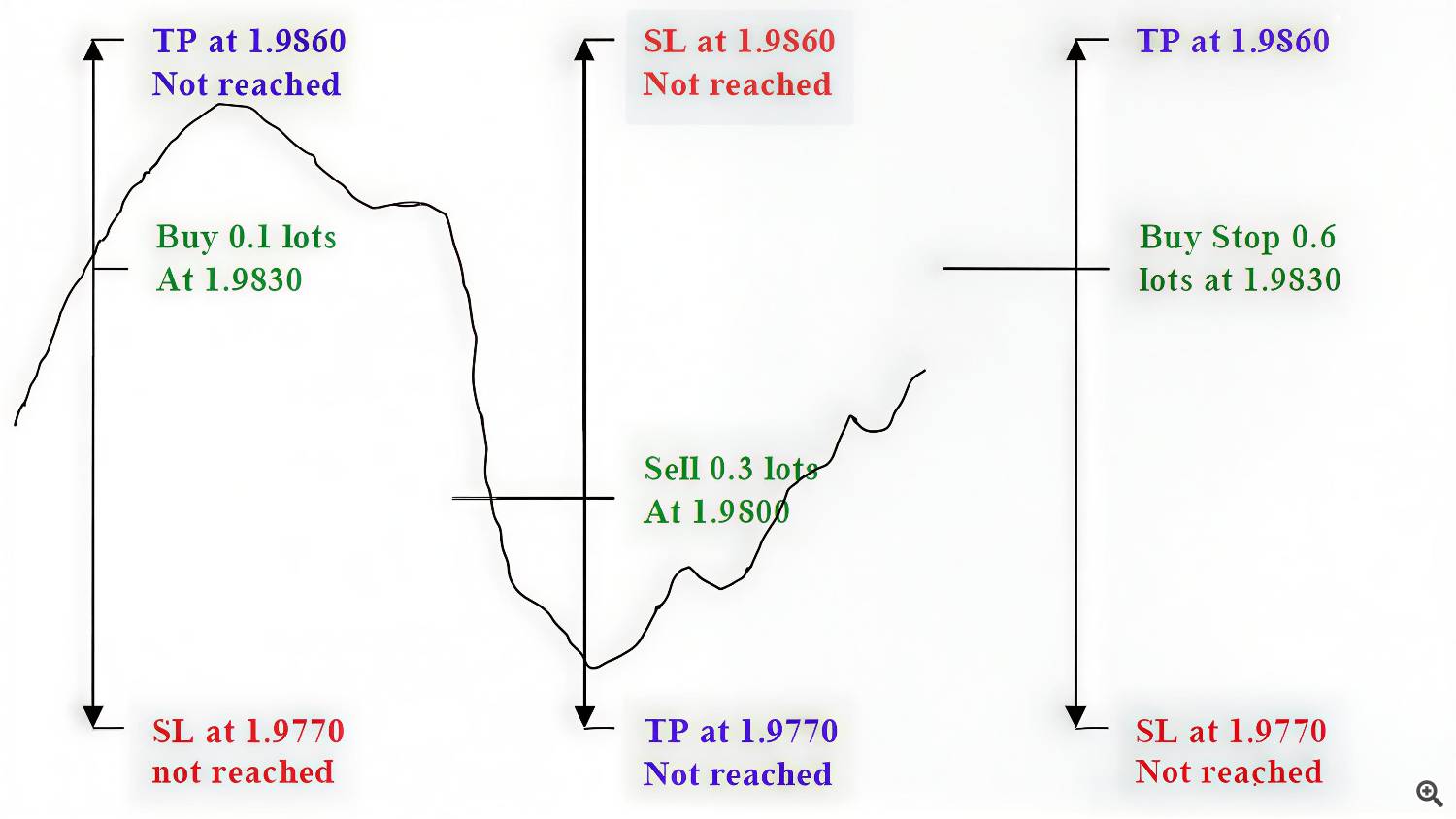

If also the Sell TP is not reached by the market price, a Buy Stop Pending is placed over the original Buy entry, so everywhere the market wants to go, you also hit SL and TP at the same time… And TPs are always bigger than SLs.

An example of settings for TP, SL and Distance is a constant ratio of 25/50/25 or 50/100/50 for forex pairs, or 1000/2000/1000 for Gold. So TP and Distance will be the same value, then the SL will always be 2 times TP/Distance values.

You can also experiment by yourself to find alternative settings that suits your trading target.

The crucial point of this strategy is to find a time period when the market will move enough. So you should prefer high volatility pairs and assets, like XAUUSD, than a ranging one.

Also money management is the second key, so you have to choose a low start lot to let the EA open larger pending orders, I suggest 0.01 cause you also have to consider a multiplier of 2.5 or 3.0 for each consecutive order.

See images below for a visual explanation of the strategy.

So here are my tips for using EA correctly and making the most of its potential.

Part 1: Setting up the EA for trading