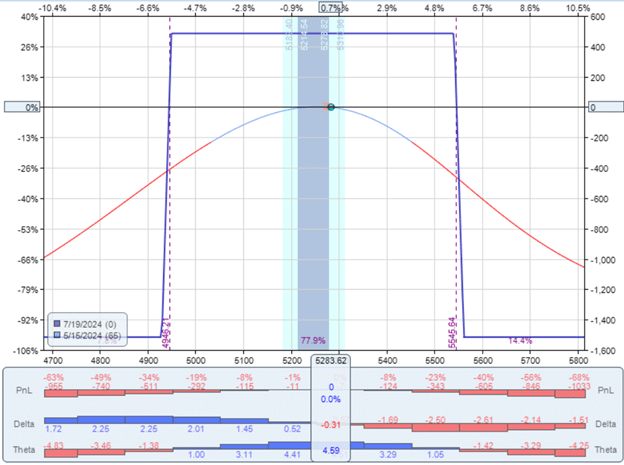

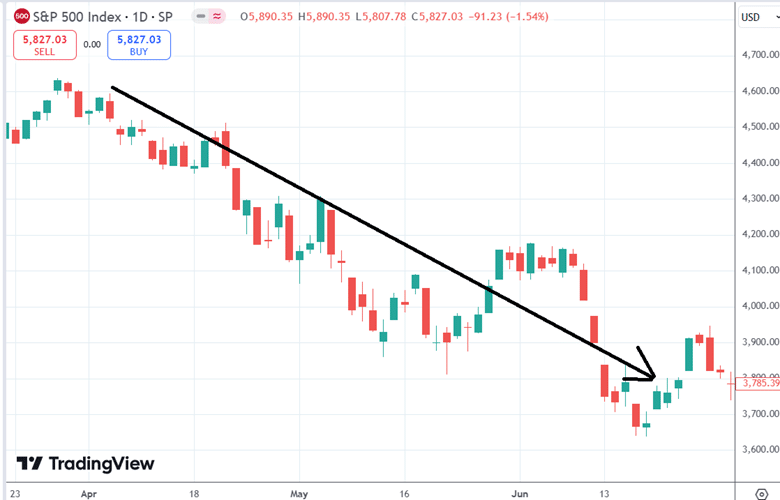

As shown, the iron condor, butterfly, and calendar are all delta-neutral option income strategies, which are so-called “non-directional.”

But are they really non-directional?

Their current profit and loss line (also known as the T+0 line) has the concaved downward curve typical of such strategies.

The current price dot of the underlying is at the top of the curve where the delta is close to zero, hence the term delta-neutral.

Looking at the Delta histogram, you can confirm that it is near zero.

An option strategy with a positive delta is bullish, where the trade will benefit if the underlying price goes up.

An option strategy with a negative delta is bearish, where the trade will benefit if the underlying price goes down.

An option strategy with a zero delta is neither bullish nor bearish.

It is non-directional in that, at this point in time, the trader is not picking the traditional up or down direction.

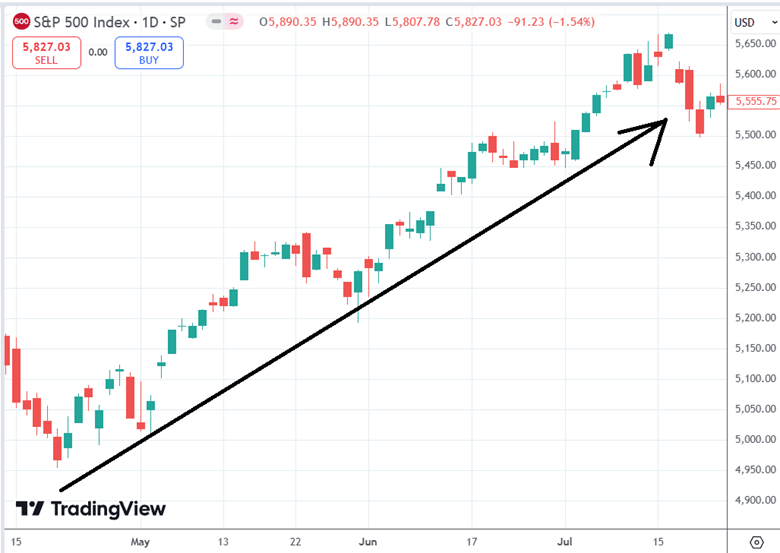

But the market can move in three directions:

A delta-neutral strategy IS picking a direction.

It picks the sideways direction, betting the price will remain within a certain range.

These strategies are also known as “range-bound” trades.

If a trader has chosen a sideways direction and the market moves up or down more than the specified range, the trader has picked the wrong direction, and the “non-directional” strategy loses.

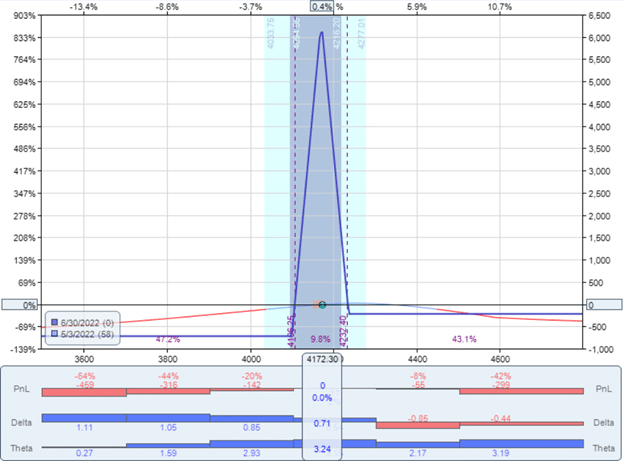

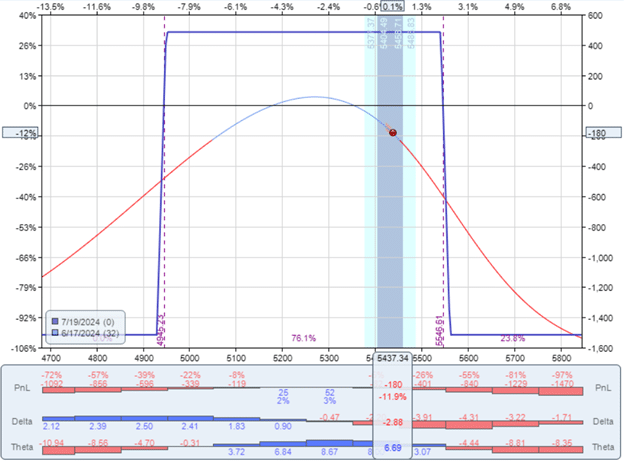

We can see this here where the price has moved up too much:

The original delta-neutral strategy does not stay delta-neutral for too long.

Here, the delta has now become negative -2.88.

The trade is now bearish, with the price going up – a losing scenario.

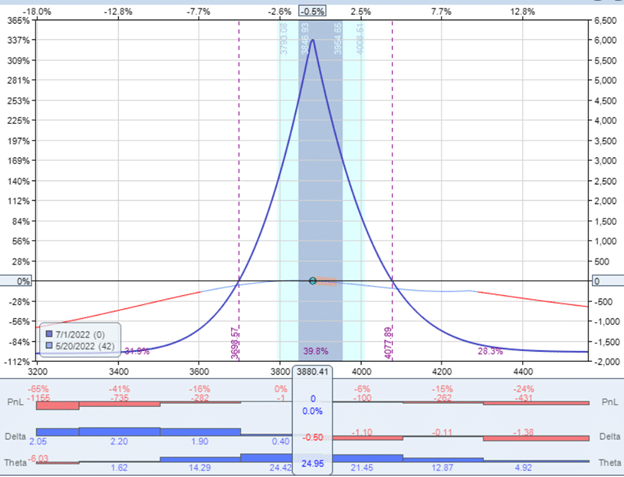

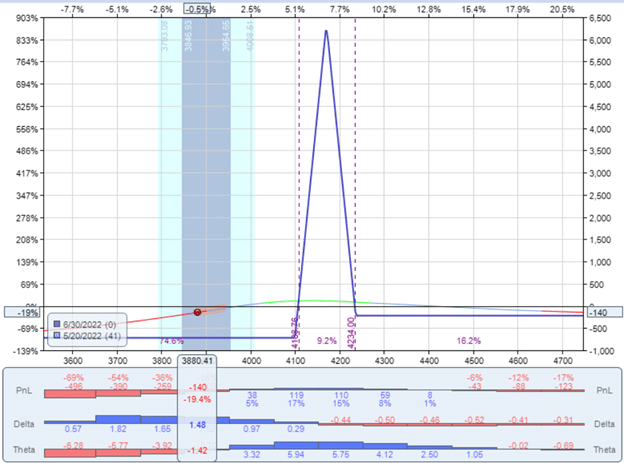

In the next graph, we see that the price has moved down too much:

The delta has become positive.

The trade is now a bullish directional trade that needs the price to go back up to be profitable.

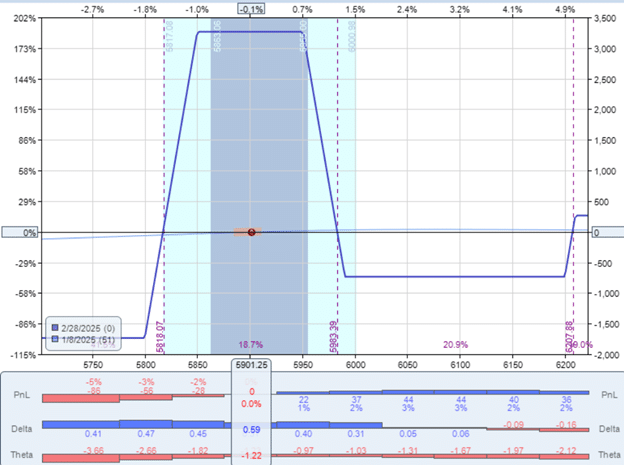

Is it possible to construct a delta-neutral option strategy for as wide of a price range as possible?

And eliminate delta completely?

One can try, as in the case here, where we see a very flat T+0 line that extends far to the left and right.

However, the more you flatten this T+0 curve, the less theta you have.

The above trade has no theta at all or even slightly negative theta.

Without positive theta, the strategy can not generate income from the passage of time.

You can confirm in the previous graphs that it is only when we have a concaved downward T+0 curve that we have a positive theta.

Perhaps it is just a matter of semantics.

A delta-neutral strategy is picking a sideways direction, expecting the underlying price to remain range-bound.

We can still call it a non-directional strategy because it does not pick the traditional direction of up or down at the current time, but in the back of our minds, we still have to know that the directional movement of the underlying still matters.

It can lose due to the uncooperative movement of the stock price.

It is not realistically possible to completely eliminate the delta or direction from the equation without also eliminating its income-generating theta.

It is just another way of saying it is impossible to make money (above the risk-free rate of return) without taking a directional risk.

If you want to completely eliminate directional risk, you can take positions in BIL ETF or buy U.S. Treasury Bills and make a risk-free rate of return.

We hope you enjoyed this article on whether a delta-neutral options strategy is really non-directional.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.