When investors talk about emerging markets, they often mean the likes of Brazil, India, or Indonesia.

But go one tier lower, and you reach an even less explored segment of the global economy: frontier markets.

These are countries that fall below the liquidity, size, or stability thresholds of emerging markets but offer something compelling in return—raw, underpriced growth potential.

For those willing to do the homework, frontier markets can be a powerful diversifier and a source of long-term alpha.

But they’re not for everyone.

Let’s unpack what they are, why they matter, and how to think about allocating capital to them.

Contents

Frontier markets are the smallest and least developed markets recognized by global index providers.

Think Vietnam, Nigeria, Kazakhstan, Bangladesh, and Romania.

These are countries with smaller capital markets, thinner trading volumes, and fewer institutional investors relative to their emerging market peers.

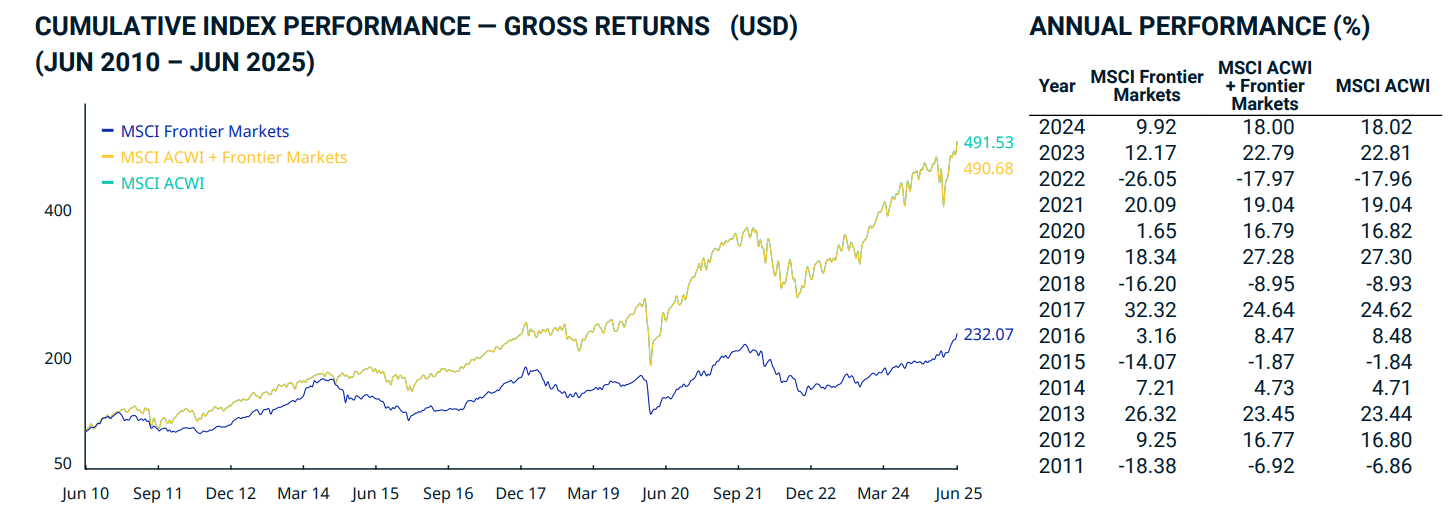

MSCI, FTSE, and S&P all maintain separate frontier market indices, each with its own set of inclusion criteria, typically based on factors such as market accessibility, liquidity, and capital controls.

What makes these markets interesting is not just their economic growth—but their under-representation in global portfolios.

Most institutional capital avoids them entirely, creating potential inefficiencies and opportunities for contrarian investors.

The case for frontier markets comes down to three points: diversification, growth, and valuation.

- Low Correlation to Developed Markets

Frontier markets often have little correlation with the S&P 500 or even MSCI EM. Their economies are more local, driven by domestic consumption or commodity cycles rather than global tech or macro trends.

- Higher Demographic and GDP Growth

Many of these countries have young populations, rising incomes, and improving infrastructure. GDP growth rates of 5–7% annually aren’t uncommon.

- Attractive Valuations

Valuation multiples in frontier markets tend to be low. You’ll find solid companies trading at 8–10x earnings with high dividend yields—not because they’re broken, but because they’re overlooked.

This combination of growth and neglect makes for compelling entry points—if you’re patient.

With opportunity comes risk—and frontier markets are full of it.

- Political instability

Regime changes, military coups, and nationalizations are real concerns. You can’t assume the rule of law operates like it does in developed countries.

- Currency volatility

Thinly traded currencies can fluctuate significantly and erode USD-based returns. Local inflation or debt defaults can also trigger devaluations.

- Liquidity risk

Markets are shallow. It’s not uncommon to see wide bid/ask spreads or limited ability to exit during times of stress.

- Transparency and governance

Financial reporting standards vary. Minority shareholder protections are weaker. You must be selective about which companies and jurisdictions you trust.

These risks don’t mean you should avoid frontier markets—but they must be sized accordingly. Think 1–5% of a diversified global portfolio, not a core allocation.

There are several ways to invest in frontier markets depending on your risk tolerance, expertise, and desired exposure.

- Frontier Market ETFs

Funds like the iShares MSCI Frontier and Select EM ETF (FM) or VanEck Vietnam ETF (VNM) offer liquid, diversified access.

Just be aware that these ETFs are often concentrated in a few countries and sectors (e.g., banks and telecoms).

- Actively Managed Frontier Market Funds

There are a handful of boutique managers specializing in frontier equities. They tend to focus on bottom-up stock picking, which is crucial in markets where passive indices may overlook genuine opportunities.

- Direct Investments via ADRs or Local Listings

Some frontier companies are available through American Depositary Receipts (ADRs) or via dual listings on the London or Singapore stock exchanges. This can give more targeted exposure but requires due diligence and comfort with single-stock risk.

It’s worth emphasizing that frontier markets behave differently from emerging markets—not just in size but in sensitivity to global flows.

EM stocks tend to move in sync with U.S. dollar strength, commodity cycles, or Fed policy.

Frontier markets, in contrast, often march to their own beat.

A rally in Bangladesh or Kenya might have nothing to do with what’s happening in China or the Nasdaq.

This isolation can help reduce overall portfolio volatility when used strategically.

Frontier markets tend to outperform during global risk-on environments when investor appetite for yield, growth, and diversification increases.

They also benefit from:

- Commodity bull cycles

- U.S. dollar weakening trends

- Improving local governance or capital market reforms

They’re less ideal during liquidity crunches, global recessions, or periods of heightened geopolitical tension.

Frontier markets are not for the faint of heart—but that’s exactly why they offer opportunity.

Most global capital is still concentrated in developed and large emerging markets.

That leaves pricing inefficiencies and long-term upside for those willing to go a layer deeper.

If you’re an investor looking to broaden your global exposure, hedge against developed market saturation, or add asymmetric return potential, frontier markets deserve a closer look.

Just go in with your eyes open.

Respect the risks.

Size appropriately.

And invest with patience.

We hope you enjoyed this article on investing in frontier markets.

If you have any questions, send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.