Interactive Brokers’ Risk Navigator is an essential tool for active traders, particularly those managing portfolios with multiple options positions.

Whether you’re selling premium, hedging deltas, or trading spreads, Risk Navigator provides a dynamic, real-time view of your exposure.

Understanding how to use this tool effectively can elevate your risk management and help you avoid major portfolio drawdowns.

This guide walks you through the key functions of Risk Navigator and how to apply them to your daily trading routine.

Contents

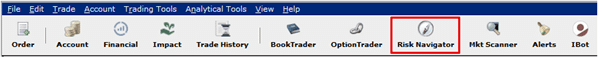

To open Risk Navigator inside Trader Workstation (TWS), navigate to Risk Navigator in the main header menus:

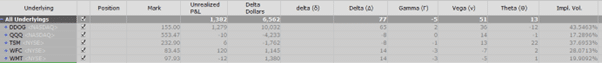

This will launch the core portfolio view, displaying all of your open positions, their Greeks, and margin data.

It updates in real time and can be customized extensively to suit your trading style.

If you’re not using this tool every day, you’re flying blind.

It’s one of the most underappreciated features in TWS, and my personal favorite.

When customizing your Risk Navigator columns, start by adding the most important metrics.

These are the ones I use:

These are the core elements that define the risk and reward characteristics of your portfolio.

Sometimes I will also add Time Value.

Delta Dollars is the most practical way to assess directional risk.

It’s calculated as:

Delta Dollars = Position Delta × Stock Price

This gives you a dollar-based measure of how much directional exposure you’re carrying on each position or the portfolio as a whole.

Unlike Delta alone, Delta Dollars accounts for the scale of the position and the price of the underlying.

For example, a Delta of -100 on a $50 stock equates to –$5,000 in Delta Dollars.

That’s the equivalent of being short 100 shares of the underlying. If the stock rises $1, your portfolio would lose $100.

My rule of thumb: keep your total Delta Dollars within a 1:1 to +1:1 ratio of account size.

If your account balance is $100,000, aim to keep the total Delta Dollars between– $100,000 and $100,000.

This keeps you from being overexposed to sharp market moves while still allowing for directional trades.

Risk Navigator shows Delta Dollars per ticker and for your total book.

Use it daily to make sure your exposure aligns with your market outlook.

For option sellers, Theta is the engine that drives returns.

But it needs to be managed with precision.

I typically recommend targeting a Theta equivalent of 0.06% to 0.10% of the account size per day.

On a $100,000 account, this translates to $60–$100 in daily time decay.

That’s a level that offers meaningful income without taking on excessive risk.

Too little Theta, and you’re not generating enough premium.

Too much, and you’re likely overexposed to tail risk.

Risk Navigator allows you to monitor Theta by position, ticker, and portfolio.

This makes it easy to trim or add exposure as needed.

You can also use the tool to backtest what would happen to Theta if you rolled or adjusted certain trades.

This helps you maintain consistent income across market conditions.

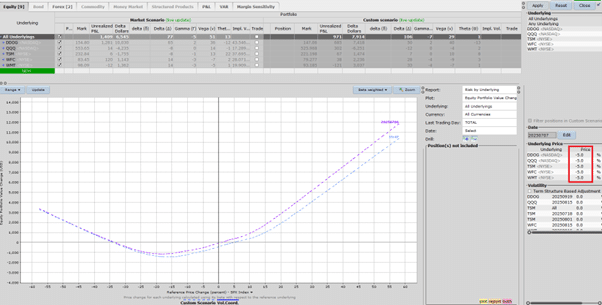

One of the most powerful features in Risk Navigator is its ability to simulate hypothetical market conditions and show the impact on your portfolio.

You can model a 5% or 10% move in the underlying, adjust implied volatility up or down, or run custom stress tests.

The tool recalculates your Greeks, P&L, and margin impact based on the new inputs.

This is critical for identifying risks, such as large losses from a single earnings trade or an over-leveraged position in a volatile company.

Before any major news event or macro catalyst, it’s worth spending five minutes in this window.

Risk Navigator is not a “set and forget” tool.

It should be part of your daily workflow, just like checking the VIX or reviewing your watchlist.

Each morning, I review:

- Total Delta Dollars – Am I too directional?

- Total Theta – Am I on pace to hit my income targets?

- Vega exposure – Am I at risk if volatility spikes?

- Margin levels – Am I operating with enough buffer?

Save your layout to avoid reconfiguring each time.

Group your trades by strategy or ticker to keep things organized and easily accessible.

Risk Navigator is more than just a reporting tool. It’s a real-time, interactive dashboard for managing portfolio risk with precision.

Whether you’re trading iron condors, naked puts, or spreads, this tool should be open on your screen every day.

By utilizing Delta Dollars, targeting Theta effectively, and conducting scenario tests regularly, you can build a resilient options portfolio that strikes a balance between income generation and capital preservation.

We hope you enjoyed this article on the Interactive Brokers Risk Navigator.

If you have any questions, send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.