Hybrid automobiles utilize both gasoline and electricity to generate power.

Hybrid option structures utilize both a vega-negative component and a vega-positive component to generate potential income.

We will explain Vega shortly.

Today, we will examine several hybrid structures: the Flyagonal, the A14, the Combo Trade, and the Rhino.

They are non-directional strategies that attempt to profit from time decay, hoping that the underlying does not move too much in one direction.

Contents

While these hybrid structures are commonly employed in larger indices, they can also be applied to the underlying stock if the trader so wishes.

The video below shows Steve Ganz giving an example of his Flyagonal trade on the stock PayPal (PYPL):

Source: YouTube

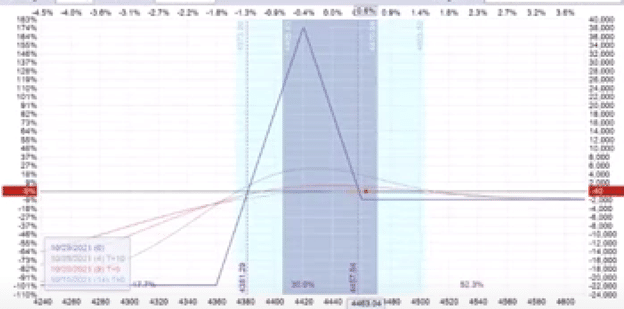

He calls it the Flyagonal, because the component on the right is a butterfly (or fly) constructed with call options.

The component on the left is a diagonal time spread constructed using put options.

As shown in the OptionStrat modeling software above, the trade consists of five different strike prices (five legs).

Since most trading platforms only allow up to four legs per order, this hybrid structure requires placing two separate orders to achieve the desired result.

However, the two parts together are considered one trade.

By doing so, you see that it gives a wide range between the two breakeven points at expiration.

As long as PayPal falls in the green shaded area of the graph at expiration, the trade is profitable.

Amy Meissner’s A14 trade starts as a non-directional broken-wing butterfly:

Source: YouTube

This butterfly structure is non-directional, meaning it does not rely on the market moving up or down.

The option Greek delta, which measures directionality, is close to zero.

As time passes, the position gains value due to positive theta (or time decay).

The butterfly benefits if volatility decreases.

This is reflected by its option Greek vega being negative.

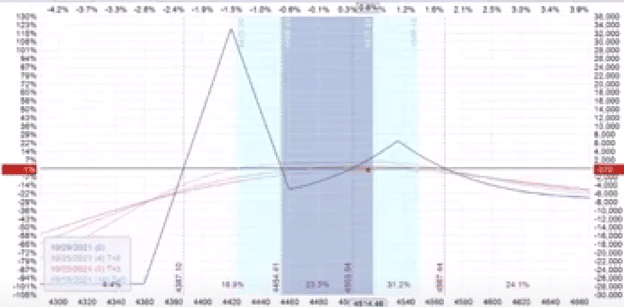

When the underlying price moves above the butterfly’s expiration tent, the trade is adjusted into a hybrid structure.

The adjustment involves adding an upside calendar spread above the current price.

Source: YouTube

The calendar itself has positive theta.

And it has positive Vega.

This means that the calendar will gain value when volatility increases.

This is the opposite effect from that of the butterfly.

Therefore, when the butterfly (negative Vega) and the calendar (positive Vega) are combined, their overall volatility effects are muted.

The combined trade is less sensitive to volatility than if each were to stand on its own.

One may ask if it is better to place the time spread to the left of the butterfly (as in the Flyagonal)?

Or place the time spread to the right of the butterfly (as in the A14)?

Here is the argument for spreading the time to the left of the fly.

If the market drops, volatility increases.

The time spread will benefit from the increase in volatility, as well as from the price moving down towards it.

If the underlying price rises towards the strike, then volatility generally decreases.

This benefits the negative vega fly.

The fly also benefits from the move into its expiration graph.

Now, here is the argument for having the time spread above the fly on the right.

If the market drops, the time spread will be hurt due to directionality because the price is moving away from it.

However, volatility is increasing when that happens, which would benefit the time spread.

Therefore, it will not be hurt as badly.

If the market goes up, the fly is hurt because the price is moving against it.

However, volatility will drop when this happens, which benefits the fly.

The short answer is that it probably doesn’t make a significant difference whether you place the time spread below or above the fly.

Or, if you cannot decide, you can place a time spread to the left and to the right of the fly.

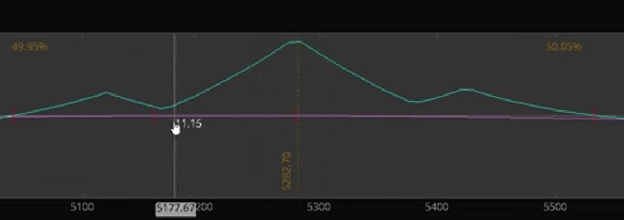

This was what Mark Fenton did on the SPX index as he overlaid a double-diagonal on top of a broken-wing-butterfly…

Source: YouTube

This trade has seven legs and is very wide.

As the index becomes larger and perhaps starts to make larger moves, some traders are finding that they can increase the profitability range on the trade by combining two or more option structure components into one trade.

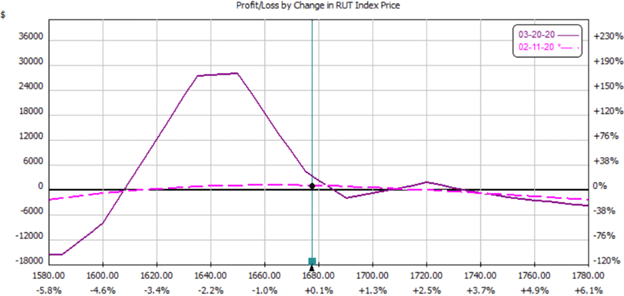

And if trade does not have enough strikes for you, how about the eight-legged Rhino trade with two butterflies merged on the left and one calendar to the right:

Because it has this many legs, it probably isn’t a good idea to adjust them too frequently to save on commissions.

That’s why it is a longer 60+ DTE (days to expiration) trade.

You have seen several delta-neutral positive-theta option structures that have both positive Vega and negative Vega components.

The option structure is just a tool.

What is also needed is a strategy for utilizing that tool.

The strategy includes determining when and how much to adjust, when to take profits, and when to exit a trade, among other considerations.

It is not enough to test the structure a couple of times, get a couple of losses, and say it doesn’t work.

You need to develop and refine your strategy over time with practice.

A particular strategy that works for one trader may not work for another.

“You can make all of the above structures work if you have practiced with them enough to understand how to manage them successfully.

We hope you enjoyed this article on hybrid options structures.

If you have any questions, send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.