Candlestick charts, also referred to as Japanese candlestick charts, are tools used in the technical analysis of price movements of shares in the stock market. These charts analyze price fluctuations just like bar and line charts. With a certain amount of skill in mastering candlesticks, predicting future movement and direction of prices of shares is possible. In this article, I will highlight my top five bullish candlestick patterns and pass on some tips and tricks I’ve learned over the years to help maximize your profits and minimize your losses.

How to Read Japanese Candlesticks Patterns

Before we get into the list there are a few tips and nuances that I’ve picked up over the years that should be discussed. I’ve found candlesticks to be one of the most powerful tools in predicting future price movements. What I’ve learned is it needs to be cut and dry, for example, it’s rare to see a bullish reversal candlestick pattern formed on a daily stock chart followed by the stock bouncing hard. It’s rarely that picture-perfect.

The timeframe is key when trying to predict future price movement. Over the years, I’ve found that bullish candlestick patterns are formed on the monthly or weekly chart way more meaningful than those formed on the daily or 60-minute chart.

Often on a daily, you will see a nice bullish candlestick pattern, followed by a few red days, followed by a few more bullish candlestick patterns, and then the price finally takes off. The point here is, there isn’t always a perfect setup. Price either undershoots or overshoots theoretical bounce targets, as well as taking more time than one would expect for the price to change direction. This is why reading charts is an art form.

When reading charts and trying to create a profitable trade setup you ALWAYS want to see a cluster of signals. For example, if you see a candlestick reversal pattern, you would want this to occur on the lower Bollinger Band, and on an important moving average (let’s say the 50 SMA). When you have 3 signals telling you there is a reversal the signal is much stronger in this case. Just like in poker, you want a “cluster of tells”, the same goes with chart reading.

Again technicals alone are not always enough, you need to understand upcoming catalysts (such as earnings or product launch) as well as whether earnings are near (earnings always trump technical analysis).

Now with these tips out of the way let’s get to my top 5 most useful ones!

1 Three White Soldiers

2 Morning Star

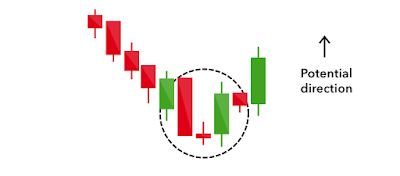

This bullish candlestick pattern instills a ray of hope in the minds of investors in an otherwise gloomy market. In this pattern, a short candle is seen in between two long green and red candles. It tells the investor that the selling pressure of the market is slowly ending and they can expect a bullish market at the end of the tunnel. The potential direction of the market in this candlestick pattern is upward. I often see these with major bullish news events whether it be stock-related news, or global events lifting the stress of the market.

3 Piercing Line

4 Hammer

This is my favorite, nothing like it forming on a major moving average which coincides with the lower Bollinger band (again remember a cluster of signals confirming a direction), If you look at the havoc that COVID did to many stock charts you will see at the bottom, a ton of hammers formed across multiple stocks and indexes!

5 Bullish Engulfing

This is a candlestick pattern formed by two candles, one of which is red and the other one is green. The first candle is red, which is short and it is seen completely engulfed by the 2nd green candle. The large green day is often formed with a “gap down” (which usually means exhausted selling pressure). So always keep in mind what potential candle can be formed in real-time, so you can capture the entire move (i.e. look for those gap downs as a buying opportunity especially when things start to get very oversold)

Conclusion

When looking for bullish candlestick patterns, remember not everything is cut and dry you won’t instantly see a reversal once you see these out in the wild. Also keep in mind, if these patterns are formed near the lower Bollinger Band or around a significant moving average this will yield a more powerful confirmation.

These slight nuances and deviations from theory to practice are what make trading stocks equal parts art and technicals.

To learn more about candlesticks check out our article on Mastering Japanese Candlestick Reading.

Also, credit to IG for providing the images above for candlesticks.