In this article, we are talking about selling put options for income generation rather than for acquiring stock.

Contents

Investors generate income by collecting premiums for selling put options with a strike price below the current stock price, expecting that the stock will not come down to the strike price before expiration of the option.

An investor can trade this strategy conservatively or aggressively.

This is determined by the strike price and how far it is below the current stock price.

If the strike price is very far below the stock price, then there is a lower probability that the stock will ever drop to the strike price.

Therefore, this is a conservative way to trade it.

For a more aggressive investor who wants to collect a larger premium, the strike price is closer to the stock price.

In this case, there is a higher chance that the stock might drop below the strike price at option expiration.

If that were to happen, the investor is obligated to buy the stock at the strike price.

It is said that the investor is “assigned” the stock.

The investor does not want to be assigned the stock for income generation.

They just want to collect the premium, letting the option contract that they sold expire worthless.

In certain account types, the broker will require that the investor have enough free cash available to purchase 100 shares of the stock for every one put option contract sold.

When an investor sells put options with enough cash on the sidelines, this is known as selling “cash-secured puts”.

How far below the stock price to set the strike price is subjective.

“How far” is a relative term.

A strike price that is 10 points below the stock price in a $30 stock has a different risk than a 10-point distance in a $150 stock.

In addition, it also depends on how far away the option’s expiration is.

A better way to quantify this risk in a comparable comparison is to look at the delta of the strike price.

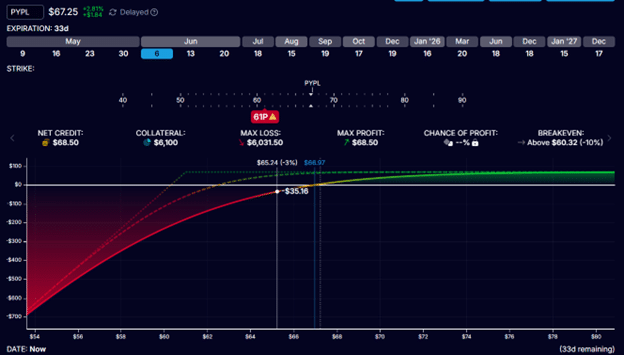

Suppose an investor sells a put option on PayPal (PYPL) that is about a month till expiration.

Paypal is trading at $67.25 at the close of May 3rd, 2025.

The investor sells the put option with the $61 strike price expiring on June 6th, 33 days away.

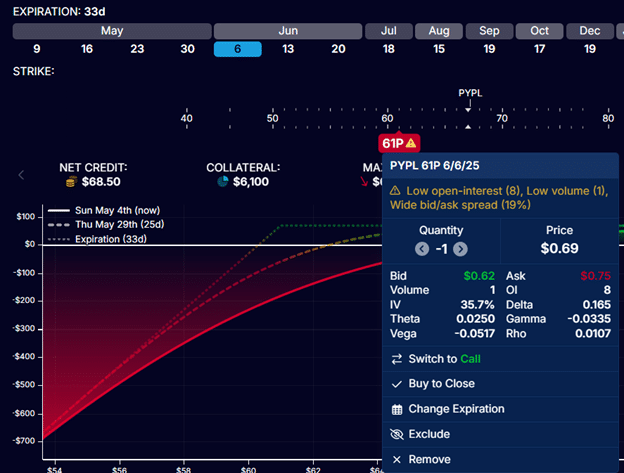

If we look closer at this option, we see that it has a delta of 0.165:

We simply say that this put option is at a “delta of 16”.

The lower the strike price, the lower this delta.

The closer the strike price is to the stock price, the higher the delta.

You can see for yourself as you slide the put option up and down in OptionStrat.

A delta of 16 means there is about a 16% chance that PYPL will be at or below the strike price at expiration.

Incidentally, the price of this 16-delta is the one-standard-deviation expected move of PYPL from now to expiration.

But we won’t worry about this topic for this discussion.

By selling the $61-strike put option, the investor collects a $68.50 credit.

This trade ties up $6100 of the investor’s capital because he has to have this much cash on hand in the event of assignment to purchase 100 shares of stock at $61 per share.

A maximum potential profit of $68.50 on $6100 of capital held is a 1% return on investment in one month.

$68.50 / $6100 = 1%

The rate of income generation for this trade is roughly 1% per month.

Or a 12% annualized return on capital.

This is assuming that each of the options expires worthless at expiration.

The return might be slightly lower if there are any stock assignments, taking profits earlier, etc.

This was a conservative put selling example.

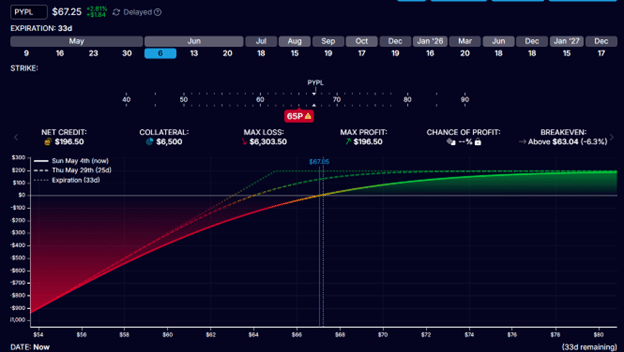

For a more aggressive put selling example, the investor might sell the put option with the $65 strike, same PYPL stock at the same June 6th expiration.

This way, the investor collects a larger credit of $196.50.

But he needs to put up $6500 of capital in the event that he needs to buy 100 shares at $65 per share.

So the return on capital for this trade is:

$196.50 / $6500 = 3%

A 3% return per month, or 36% annualized, would be an aggressive put-selling example.

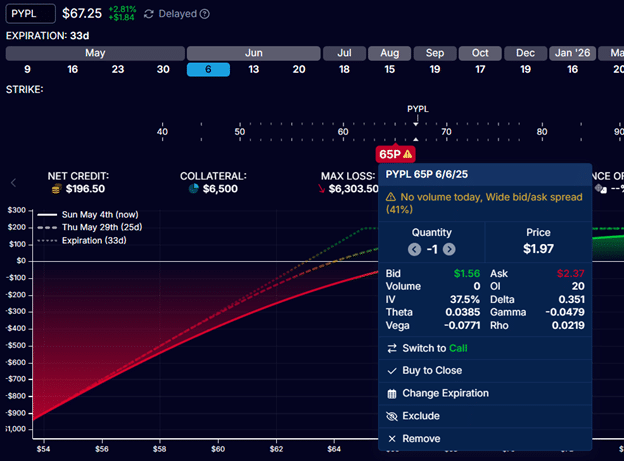

The $65 put option is at the 35-delta:

There is about a 35% chance that PYPL will be below the strike price at expiration, and the investor would have to buy 100 shares.

To be precise, the capital at risk in the last example is $6303.50.

If an investor buys 100 shares for a total of $6500 and PayPal goes to zero, he would only lose $6303.50 (as opposed to $6500) since he had collected the extra $196.50 credit upfront.

Whether you calculate the return based on true capital at risk:

$196.50 / $6303.50 = 3.12%

Or whether you use a simplified calculation:

$196.50 / $6500 = 3.02%

The difference is not much.

You may be selling put options for income generation.

In general, a 1% monthly return is conservative, and a 3% monthly return is aggressive.

Selling at the 16-delta is conservative, and selling at the 35-delta is more aggressive.

What is conservative for one investor may be aggressive for another investor, and vice versa.

And some investors will sell even more conservatively.

And some investors aim even more aggressively at 4% per month.

Now you know whether your methods are considered conservative or aggressive.

We hope you enjoyed this article on how conservative or aggressive your put options selling is.

If you have any questions, send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Solid article! Thinking about variance & making data-driven decisions is key to long-term success. Platforms like phlwim app download apk are interesting because they emphasize stats – a smart approach for serious players! 👍

сервисный ремонту телевизоров тошиба телевизор тошиба не включается – профессиональный ремонт с гарантией качества.