In this example, we will demonstrate how a profitable options calendar spread can be adjusted to extract money from the trade, thereby locking in a profit and making the trade a no-lose proposition.

Contents

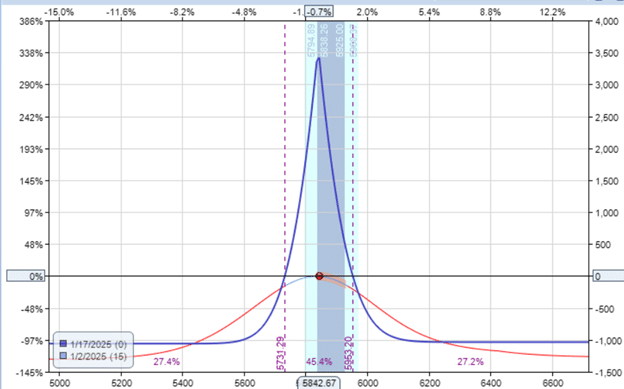

Suppose an investor entered the following at-the-money calendar on SPX:

Date: Jan 2, 2025

Price: SPX @ 5842.67

Sell to open one contract Jan 17 SPX 5840 put @ $69.10

Buy to open one contract Jan 24 SPX 5840 put @ $79.45

Net debit: -$1035

With a reward-to-risk ratio of about 3-to-1, the investor has a total maximum risk of $ 1,035, which is the debit paid for this at-the-money calendar.

The short leg (the one with a near-term Jan 17 PM expiration) has 15 days until expiration.

The long leg expires one week after the short leg.

After opening the trade, the investor sets a good-till-cancel (GTC) limit order to “thin” the calendar for a credit of $1035.

GTC limit order for credit of $10.35 per share:

Sell to close one contract SPX Jan 24 SPX 5840 put

Buy to open one contract SPX Jan 21 SPX 5480 put

The reason will become clear soon.

If this order is filled – and it will only be filled if a net credit of $1,035 is returned – then the investor will receive back the initial debit of $1,035 that was invested in the trade.

In other words, the investor will no longer have any money at risk.

The SPX price fluctuates, swinging up and then down.

With three days left till the expiration of the short leg, the SPX price swung back to 5841, near where the trade had started.

This investor was lucky, or has very good predictive powers.

It is at this point that the GTC order is triggered, giving the investor back the original $ 1,035 that he paid for the calendar.

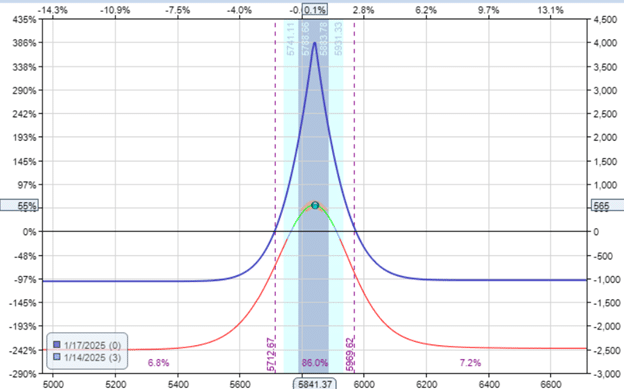

Date: Jan 14, 2025

Price: $5841.37

Sell to close one contract SPX Jan 24 SPX 5840 put

Buy to open one contract SPX Jan 21 SPX 5480 put

Credit: $1035

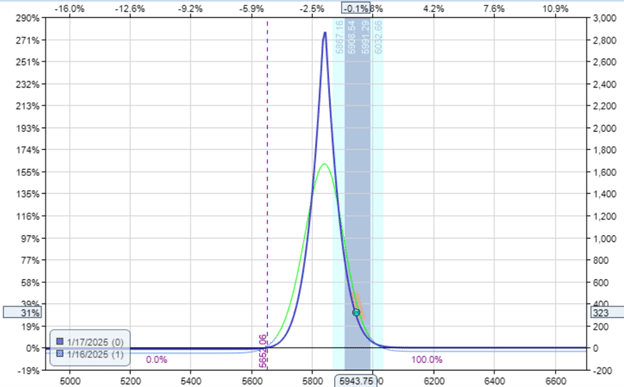

The resulting “thinned” calendar now looks like this:

There are now only three days in between the two expirations instead of seven days.

The time spread between the two expirations has narrowed, or thinned.

The trade currently has a profit of $540.

From the resulting risk graph, we see that regardless of where the SPX price moves, the blue P&L expiration graph always remains above the zero-profit horizontal line.

The investor can lose the entire $540 profit. However, the trade cannot be at a net loss anymore, because the investor is now “playing with the house money” (as they say).

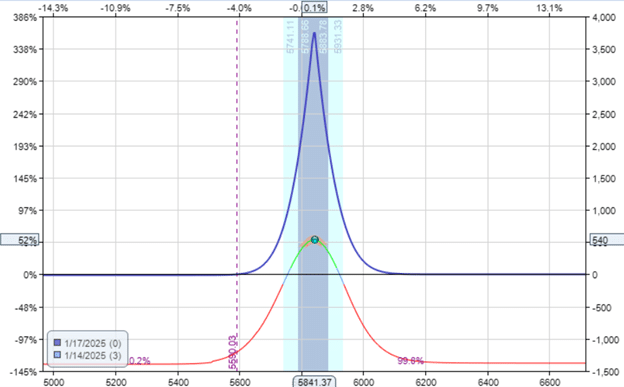

The investor presses his luck and holds the trade one more day.

Oh, not so lucky anymore.

P&L dropped from $540 to $360.

Maybe he should have just taken the $540 profits from yesterday.

But since he knows that he can not have a net loss in the trade, his mind is carefree, and he gambles one more day, hoping that the price of SPX comes back to the peak of the calendar so that he can hit the jackpot.

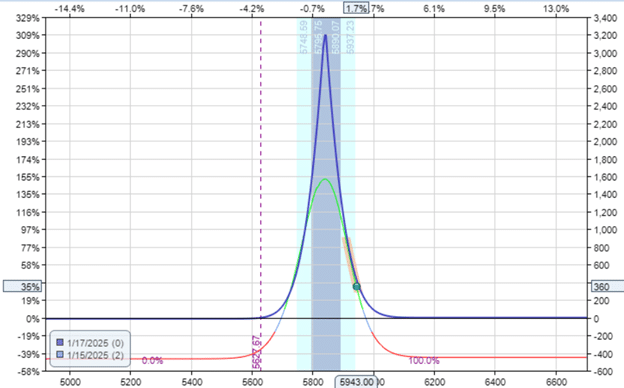

One day till expiration:

Lady Luck is not with him; the P&L drops further to $323.

Not wanting to squander the existing profit he got, he closes out the trade at this time.

Date: Jan 16

Price: 5943.75

Buy to close one Jan 17 SPX 5840

Sell to close one Jan 21 SPX 5840

Net credit: $322

In this example, the investor paid $1035 to initiate a SPX at-the-money put calendar.

The time difference between the further-dated expiration and the shorter-dated expiration was 7 days.

He sets up his GTC order to reduce the time gap between the long option and the short option from 7 days to 3 days – thereby thinning the calendar.

When his GTC order was filled, he received a credit of $ 1,035.

A couple of days later, he sells the thinned calendar for a credit of $322.

Initial debit for calendar: -$1035

Thinning adjustment: +$1035

Sell to close remainder: $322

Net profit in trade: $322, or 30% of the original capital at risk.

Could the calendar be thinned by buying back the short and selling another short that is closer to the further-dated expiration?

Yes, it can—either way.

Sometimes one will trigger first, and sometimes the other will.

We hope you enjoyed this article on how to thin an option calendar spread.

If you have any questions, send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

**breathe**

breathe is a plant-powered tincture crafted to promote lung performance and enhance your breathing quality.

I enjoy the efforts you have put in this, thanks for all the great blog posts.

There are some attention-grabbing closing dates on this article but I don’t know if I see all of them center to heart. There’s some validity however I’ll take hold opinion until I look into it further. Good article , thanks and we wish extra! Added to FeedBurner as effectively

I do agree with all the ideas you’ve presented in your post. They’re very convincing and will certainly work. Still, the posts are very short for novices. Could you please extend them a little from next time? Thanks for the post.

Hello there! Would you mind if I share your blog with my myspace group? There’s a lot of folks that I think would really enjoy your content. Please let me know. Cheers