The Real Face of Funded Accounts

Swing Account vs Real Account Comparison

Recently, funded accounts have become popular among losing traders. They recommend prop firm accounts to give hope and reduce stress. Does it work? I think yes. Because leverage and amounts confuse traders. When they can’t calculate properly, it is presented to them as an advantage.

At its core, the system offers traders the opportunity to trade with high-capital accounts for a small fee. However, when we look into the details, we see that this model is far from fair. Let’s examine it together.

Leverage Difference: Swing Account vs. Real Account

In funded accounts, especially for Swing accounts, leverage is given as 1:30.

In real accounts, however, you can trade with 1:1000 leverage.

This difference dramatically shifts the high-profit potential in favor of the real account when trading with a small capital.

The 10k balance in a 1:30 account actually corresponds to the trading volume of a 3k real account. However, because you have to pass certain stages, this 7k advantage disappears.

Starting Point: $160 for a 10K Funded Account

Today, you can get a challenge for a $10,000 funded account by paying $160.

Sounds attractive, right? But when we do the math, the picture isn’t so rosy.

The rule for funded accounts is:

-

There is a 5% Drawdown (DD) limit. If you reach 5% in a day, you are out. In short, you risk the entire $160 balance

-

You need to make a 15% profit.

-

This 15% is not in one go: first you make 10%, then your profits reset and you are expected to make 5% again. (we will ignore this for simplicity).

-

There are 3 stages, and we will consider each as 5%.

So essentially: “A marathon made harder”. It is presented to you as easy but is full of disadvantages.

Profit Calculation: Funded vs. Real Account

Let’s say you passed the 3 steps of 5% each in a funded account. Still, you have no profit. Now we want to take our first profit and grab a coffee.

Assume you earned as much as the highest DD limit of 5%.

But pay attention here:

In a 10,000$ account, this equals $400.

It may not sound bad, but let’s compare with a real account:

In a real account, starting with $160, you can use the 5% loss limit provided for challenges to double 3 times consecutively.

In a winning scenario, you would double 4 times in a row. So for 16x: $160 → $2560.

In the same scenario, the funded account gives you only $400 profit. While you have $160 + $400, the real account would have $2560. In short, you lost $2,000 right at the start.

You Can Sell Prop Firm Accounts Too!

Imagine: You sell a demo account giving 1:30 for a Swing account to a client. Using copy-trade systems, they can open the same trades on a real account with 1:1000 leverage and 30x multiplier for every paid trade. Even if your client passes the stages, you don’t spend a penny. On the contrary, $2000 stays with you.

Since passing these stages is difficult, let’s apply this model;

- Do not link the paid money to the real account until they pass 2 stages.

- For the last stage requiring 5%, use 1:1000 leverage with a 30x multiplier.

- Deposit the client’s $160 to the real account.

- Continue trades when the client reaches 5% and earns the funded account; your money hasn’t been spent yet.

- When the client requests to withdraw the first 5% profit, they will request 4% since you pay 80%

- By this point, you have doubled twice. So the money in the real account will be 4x. $160×4 = $640.

- The expected withdrawal is $400. Your net remaining amount is $240.

If you are still excited about prop firm or funded accounts, give me your money and I’ll create a challenge account for you =))

Conclusion

The appeal of funded accounts comes from the idea of trading with high capital. However, when you do the math, a system is set up that actually benefits the firm, not the trader.

If you really want to grow, managing your own capital, controlling your risk properly, and progressing with a real account in the long term is a much smarter approach.

Never see your budget as insufficient!

Even with $10, you can open a cent account and trade like $1,000. Very useful if you use a robot.

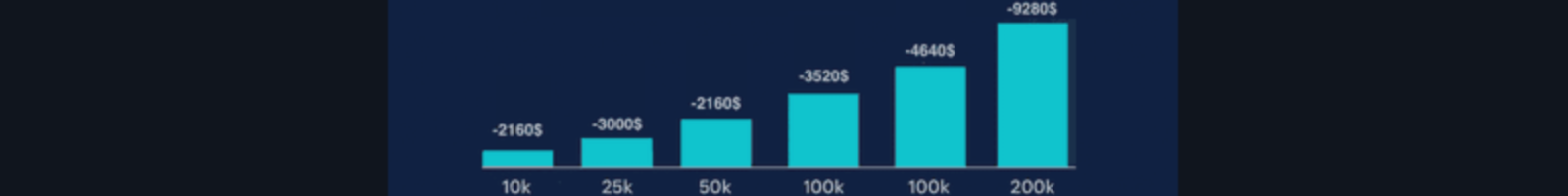

Calculations

| Funded Account | Initial Payment | Account Size | Funded 4% Profit | Real Account 16x Profit | Disadvantage / Difference |

|---|---|---|---|---|---|

| 10k | $160 | $10,000 | $400 | $160 × 16 = $2560 | 2560-400 = $2160 |

| 25k | $250 | $25,000 | $1000 | $250 × 16 = $4000 | 4000-1000 = $3000 |

| 50k | $345 | $50,000 | $2000 | $345 × 16 = $5520 | 5520-2000 = $3520 |

| 100k | $540 | $100,000 | $4000 | $540 × 16 = $8640 | 8640-4000 = $4640 |

| 200k | $1080 | $200,000 | $8000 | $1080 × 16 = $17280 | 17280-8000 = $9280 |