A calendar is an option spread consisting of two options of the same strike but at different expirations.

It is also known as a time spread.

Both legs of the calendar must be of the same type (either both puts or both calls).

Many options traders wonder if it really matters if we use put options or call options when constructing an at-the-money calendar.

Some traders will tend to have a preference for one over another.

Whether this is a personal preference or if there is any real difference is the topic of today’s discussion.

Contents

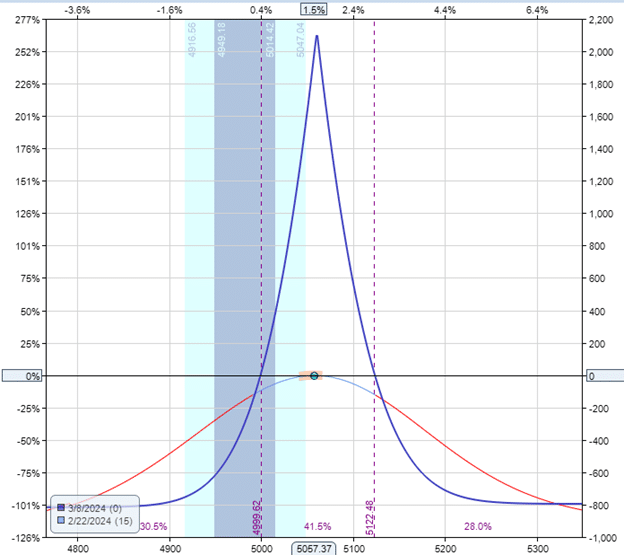

Here is an example of a calendar constructed using put options on SPX (S&P 500 index):

Date: February 22, 2024 (at 1.5 hours after market open)

Price: SPX @ $5057

Sell one March 8 SPX 5060 put @ $44.55 (IV = 10.63)

Buy one March 15 SPX 5060 put @ $52.50 (IV = 10.41)

Net debit: -$795

(The March 15 expiration is the PM expiration)

Both options are entered and exited as a single order.

In the case of the expiration of the short option, the long option is assumed to exit at the same time.

Most traders would exit the calendar before the short option expires.

The blue line is the payoff graph at the expiration of the short put option (which expires within two to three weeks).

The data and graph come from OptionNet Explorer historical options data.

The maximum potential loss in a calendar is the initial debit paid.

In this case, the blue line never goes below -$795 in loss (which is the initial debit paid for this calendar).

Here is a call calendar of the same strike and expiration as the previous example:

Date: February 22, 2024 (at 1.5 hours after market open)

Price: SPX @ $5057

Sell one March 8 SPX 5060 call @ $49.95 (IV = 12.47)

Buy one March 15 SPX 5060 put @ $61.75 (IV = 12.66)

Net debit: -$1180

As you can see, the cost of the call calendar is significantly higher.

Since the maximum loss of a calendar is the initial debit paid, it is advantageous to buy the less expensive calendar in case a maximum loss occurs.

A sampling of some calendars in SPX shows that put calendars tend to be less expensive than call calendars, at least for the type of calendars in our examples during the years 2024 and 2025.

This, however, may change depending on market conditions and volatility skew in the future.

What determines the cost of the calendar is how much you have to pay for the long option versus how much credit you are getting back for selling the short option.

Since the value of an option is correlated with its implied volatility (IV), the difference in IV between the short and long options is the key factor.

You would get a more favorable price if the IV of the short option that you are selling is higher and the IV of the long option that you are buying is lower.

In our above example, look at the IV value of the short and long options for the put calendar.

We are selling at an IV of 10.63 and buying at an IV of 10.41.

We are selling 0.21 points more than we are buying.

This is known as positive IV skew.

Also known as backwardation.

In the call calendar, we are selling an IV of 12.47 and buying at an IV of 12.66.

We are buying 0.19 IV points more than we are selling.

This is known as negative IV skew (or negative horizontal skew).

This is also known as contango.

Some traders say this does not matter that much.

You are more likely to get a positive skew when you have shorter dated calendars.

Having a contango condition is normal in most longer-dated calendars during typical market conditions.

And the skew can change during the trade anyway.

So what is more important is whether the price moves into or out of your calendar tent.

The counterargument is that positive skew results in lower cost calendars. And cost matters, especially when the max risk is related to the debit paid.

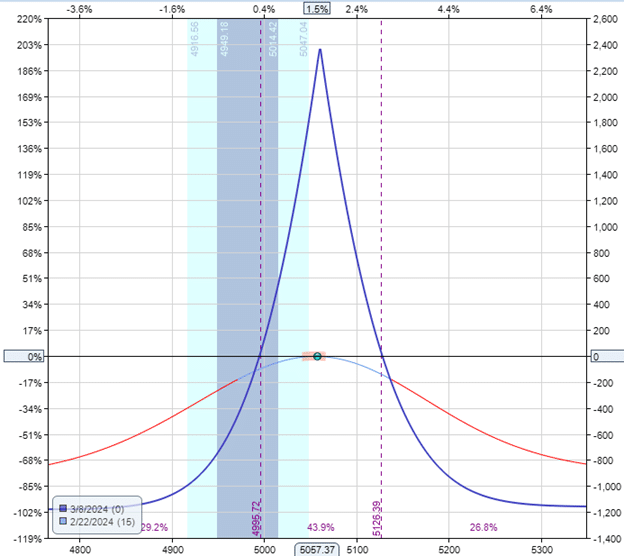

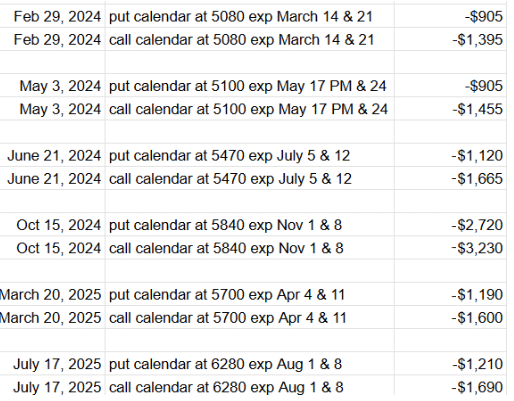

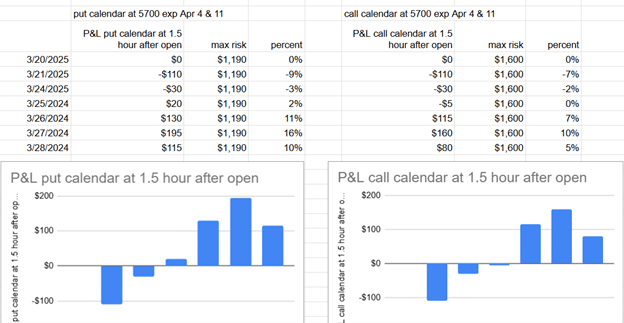

Here is the simulated P&L of the put and call calendar that was initiated on May 3, 2024:

This calendar was taken all the way to expiration and didn’t do too well.

In this case, when taken all the way to expiration, the call calendar lost more in dollar terms, but less in percentage terms.

Most traders do not take their calendars to max risk as they close their calendars before expiration.

The P&L percentage in relation to the capital at risk would be about the same, as is their reward-to-risk ratio.

Let’s look at a calendar that starts on March 20, 2025, which did a bit better and has not taken to expiration:

The graph looks similar.

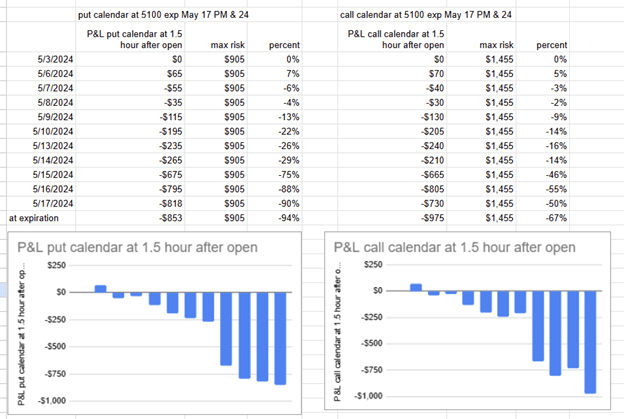

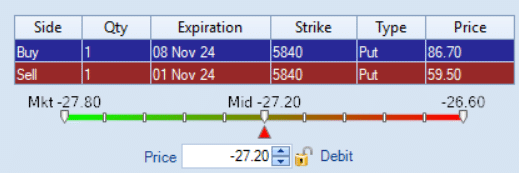

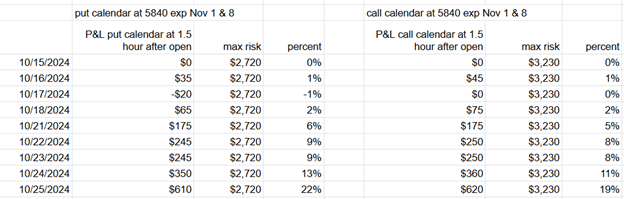

Let’s look at the calendar that starts on October 15, 2024:

Sell one Nov 1 SPX 5840 put @ $59.50 (IV = 11.93)

Buy one Nov 8 SPX 5840 put @ $86.70 (IV = 14.62)

Net debit: -$2720

This put calendar costs a lot because it has an unfavorable skew – selling at IV of 11.93 and buying at IV of 14.62 – a negative skew difference of 2.69.

When a calendar costs a lot, its reward-to-risk ratio will be poor.

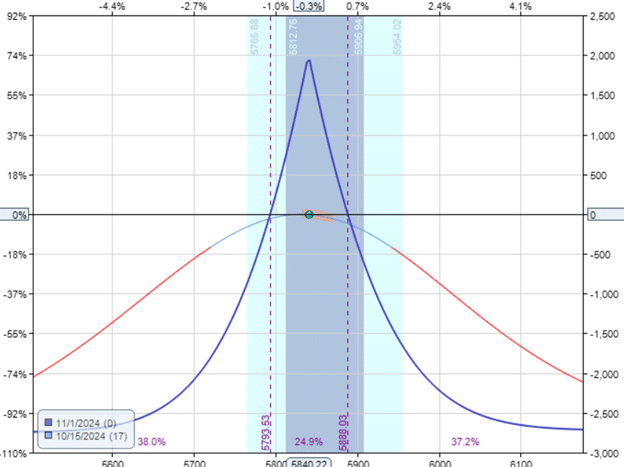

Look at how low the peak of the tent is and how high the base is as compared to our previous examples:

Put calendar reward-to-risk ratio: $2000 / $2720 = 0.74

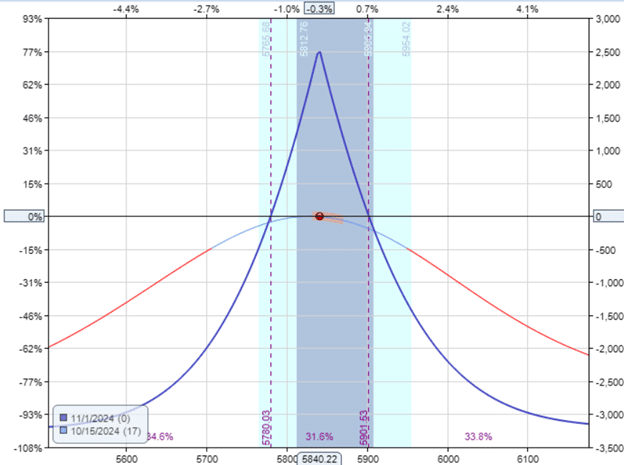

The call calendar costs even more:

Sell one Nov 1 SPX 5840 call @ $74.75 (IV = 14.78)

Buy one Nov 8 SPX 5840 call @ $107.05 (IV = 17.83)

Net debit: -$3230

However, its reward-to-risk ratio and shape of the expiration graph are about the same as the put calendar:

Call calendar reward to risk ratio = $2500 / $3230 = 0.77

This call calendar has a negative skew difference of 3.05.

Any calendar with a skew difference of more than 1, you might want to reconsider.

Nevertheless, these calendars happen to be profitable because SPX moved sideways during the whole trade:

Learn Options the Right Way — Step by Step

Calendar spreads represent just one of many sophisticated options strategies that can enhance your trading arsenal.

If you’re interested in learning a systematic approach to options trading:

- Options Income Mastery: Learn proven option strategies with proper risk management techniques ($397). 1-month program.

- The Accelerator Program: 12-month program covering 9 major strategies with comprehensive portfolio management for serious options traders ($1,497).

Both programs include detailed modules on managing assignment scenarios, technical analysis, trading psychology, and proper position sizing techniques.

Do you see any difference between a calendar constructed with puts or one with calls?

If there is any, it is not big enough to lose sleep over.

The cost of the calendar will tell you whether you have a favorable skew.

Favorable skew means lower cost.

In theory, the profit and loss of a calendar in percentage of capital at risk should be the same regardless of whether it is a put calendar or a call calendar.

This is due to the concept of put-call parity.

In practice, there is no denying that the cost of the calendars can be different depending on whether you are using calls versus puts.

And since the two are supposed to be at parity, why not buy the one that costs less?

We hope you enjoyed this article on the difference between selling put or call calendar spreads.

If you have any questions, send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.