The option wheel strategy involves selling puts to acquire a stock and then selling calls to relinquish that stock at equal or higher prices.

Not only do we get potential stock appreciation, but we also collect the premiums from selling the options.

In addition, if the underlying stock we are holding gives a dividend, that is an additional source of income.

Contents

Today, we will go through an example where we use a high-dividend underlying for which to apply the wheel strategy.

We will use Realty Income Corp (with ticker symbol O). It is a REIT (Real Estate Investment Trust) that invests in single-tenant commercial properties and leases them out to names of the likes of Walmart, Walgreens, CVS, 7-Eleven, FedEx, Dollar General, etc.

It is a favorite among many dividend investors because it is known to pay out dividends every month (whereas many stocks pay a dividend once a quarter).

Realty Income Corp is on the coveted list of 69 stocks known as Dividend Aristocrats.

These companies in the S&P 500 have increased their dividends each year for the last 25 years.

On January 2, 2024, an investor wants to own 100 shares of Realty Income Corp, which is currently trading at $58 per share.

Hence, this would roughly be about a $6000 investment.

He sells a put option with a strike price of $57.50, expiring on February 16 (about 45 days away).

He receives a credit of $120 for this sale.

If the stock price is above $57.50 at the end of February 16, the put option will expire worthless and disappear.

The investor would have profited $120 for having to wait 45 days (which equates to about 1.3% a month’s return from a $6000 investment).

It turns out that on February 16, Realty Income Corp closed at $52.33, below the put option’s strike price.

Therefore, the investor is assigned 100 shares at $57.50 per share.

This means that he bought 100 shares of Realty Income Corp for a total cost of $5,750.

The following Tuesday, February 20 (Monday being a holiday), he sells one call option on the 100 shares that he owns.

This call option expires on March 15.

This is known as selling a covered call.

With ownership of 100 shares of the stock, the investor sells a call option with a strike price above the current stock price.

If the stock price goes up and is above the strike price at expiration, the investor must sell the 100 shares at the strike price.

Not wanting to relinquish his shares at a price below for which he purchased them, he had selected the call option’s strike price to be $57.50.

With the stock trading at $52.45, this strike price is very far above the current price.

Hence, he could only collect $7 to sell this call option.

No matter.

He is just waiting for the stock to recover and back up to his purchase price.

In the meantime, he is collecting the dividends on the stock.

On March 15, he received a dividend of $25.70 for the 100 shares that he owns.

Since the 100 shares are worth $5200 at the moment, this dividend amount equates to an annualized yield of about 6%:

(12 x $25.70) / $5200 = 6%

The first call option expires out-of-the-money because the stock price never reached $57.50 at expiration on March 15.

The following Monday, March 18, he sells the April 19th expiry call with the strike of $57.50.

Again, we are collecting only $7 for the sale.

For some investors, it is not even worth selling these calls.

They would wait for the stock price to recover before selling call options.

The April 19th call expires worthless.

On April 22, the investor sells the $57.50 call expiring May 17, collecting another $7. This call option also expires out-of-the-money.

On May 20, he sells the $57.50 call option expiring June 21.

This time, he could collect $17 because the price of Realty Income Corp had come up closer to the strike of $57.50.

Nevertheless, the stock never made it up to the strike price, and the call option expired worthless.

On June 24, he sells the $57.50 call expiring July 19.

This time, we are only collecting $2 for the call option sale.

Other more active investors watching the technicals of the chart might attempt to sell call options closer to the stock price to collect larger premiums.

However, that places a cap on the potential profits if Realty Income Corp stock price jumps up quickly, as it would mean relinquishing the stock at a lower price than it was bought for.

Let’s see how our investor turned out.

At the expiration of the call option on July 19, the stock price of Realty Income Corp closed at $57.58 after a strong 7-day rally. This is higher than the strike price of $57.50.

Therefore, the 100 shares of Realty Income Corp were called away – sold at $57.50 per share (the same price at which it was bought).

Some more dividends were collected on March 28, April 30, June 3, and July 1.

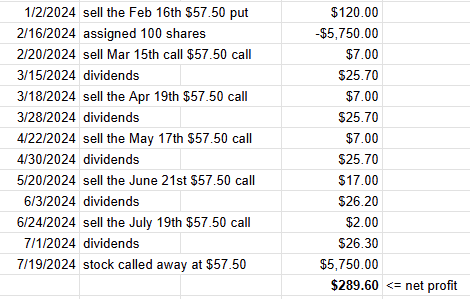

The amount of the dividends is shown in the below table.

In this example, the Wheel strategy showed no profit from stock appreciation because Realty Income Corp was assigned at $57.50 and called away at $57.50.

However, a total dividend of $129.60 was received.

The investor received $120 from the put option sale and $40 from the sale of all the call options.

Altogether, it is a net profit of $289.60 from this seven-and-a-half month-of-the-wheel option strategy.

That is equivalent to an 8% annualized return on a $6000 investment.

We hope you enjoyed this article on applying Dividend Aristocrat stocks to the wheel strategy .

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.