What is the difference between the stock ticker symbols KO and COKE?

They are two completely different companies.

The stock ticker symbol for The Coca-Cola Company, the beverage company everyone knows, is KO.

The ticker symbol COKE represents Coca-Cola Consolidated, Inc.

This company is a bottling facility licensed to produce Coca-Cola beverages.

However, it is not owned by the Coca-Cola Company, the brand company.

Since the names of the two companies sound similar, we will use “KO” and “COKE” to refer to the respective companies.

It is much shorter to write than writing “Coca-Cola Company” and “Coca-Cola Consolidated Inc.” respectively.

Contents

KO is the company that owns the Coca-Cola brand, the trademark, its logo, and most importantly, the “secret recipe” for the world-renowned Coca-Cola beverage.

Some investors prefer to invest in KO partly due to its dividend yield.

Warren Buffett, through his company Berkshire Hathaway, has historically owned KO.

As of mid-2025, KO has an annual dividend yield of 2.8%.

KO is a select group of 69 stocks that are known as Dividend Aristocrats.

To qualify, the company must be a member of the S&P 500 and have paid consistent or increasing dividends for at least 25 consecutive years.

These tend to be stable, large blue-chip consumer products businesses and manufacturers.

In 1985, Coca-Cola became the first soft drink to be consumed in space when it was carried aboard the Space Shuttle Challenger in a specially designed “Coca-Cola Space Can.”

COKE started as a family-owned business in 1902 and has grown to become the largest Coca-Cola bottler in the United States.

Back then, it was known as the Coca-Cola Bottling Company.

It changed its name to Coca-Cola Consolidated Inc. in 2019.

Coca-Cola is based in Atlanta, Georgia, and markets.

It distributes nonalcoholic beverages, primarily products such as bottled water, ready-to-drink coffee and tea, enhanced water, juices, and sports drinks.

Roughly half of its revenue comes from Coca-Cola-branded products specifically.

COKE also has quarterly dividends.

However, with an annual yield of 0.8%, it is significantly lower compared to KO.

This is the relative performance of KO (blue line) versus COKE (red line) over the past five years from mid-2020 to mid-2025:

COKE is growing more than KO over the past five years.

In fact, COKE had grown so much that it underwent a 10-to-1 stock split on May 27, 2025.

What had been $1,157.30 per share has become $115.73 per share.

The shareholders owning the shares would have 10 times as many, of course.

KO – even with its high dividend yield – could not catch up with the investment returns of COKE.

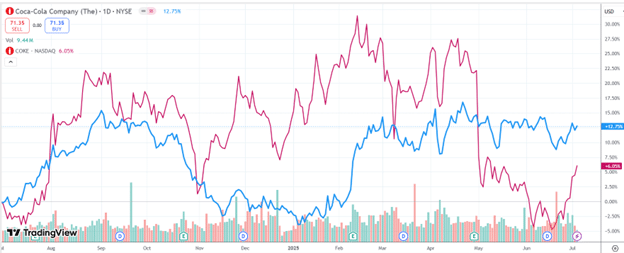

Here is the chart comparison of KO (blue line) versus COKE (red line) for the trailing twelve months:

We see that COKE is much more volatile than KO.

That is, its price swings are much larger.

During the trailing twelve months, COKE has a peak-to-trough ratio of about 35%, while KO has a peak-to-trough ratio of about 20%.

This is consistent with the fact that COKE has a much lower float than KO – a float of 87 million versus 4.3 billion.

Generally, low-float stocks tend to be more volatile.

Float refers to the number of shares available for public trading.

The larger the number, the more difficult it is for any one investor or group to move the price.

We can also look at the beta. COKE’s 60-month beta is 0.79. KO’s beta is 0.45.

Since the volatility of the S&P 500 has a beta reference value of 1.0, both COKE and KO are less volatile than the S&P 500.

Since a lower beta means lower volatility, KO is less volatile than COKE.

People have been known to confuse the two Coca-Cola stock symbols, KO and COKE.

Now you won’t be one of them.

We hope you enjoyed this article on the difference between the KO and COKE stocks.

If you have any questions, send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.