A bull put credit spread in options expresses an investor’s view that the underlying stock price will go up.

The nice thing with options is that if that view changes, the investor can alter the trade to express another viewpoint.

Contents

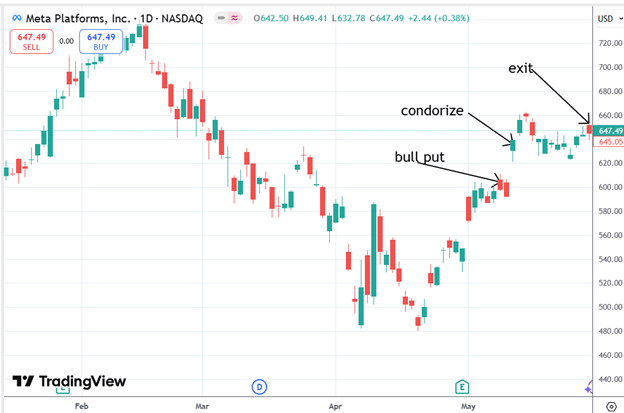

In this example, a bull put spread is changed into an iron condor by adding a bear call spread to it.

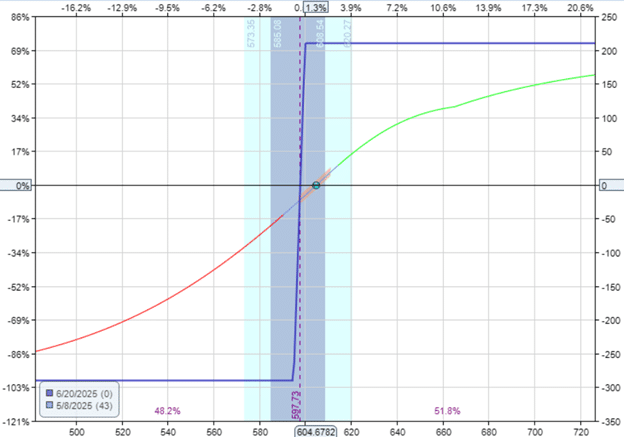

Here is the initial bull put credit spread:

Date: May 8, 2025

Price: META @ $604.68

Sell one June 20 META $605 put @ $23.38

Buy one June 20 META $600 put @ $21.28

Credit: $210

The spread is fairly close to the money because the investor has a strong conviction that the stock will go up.

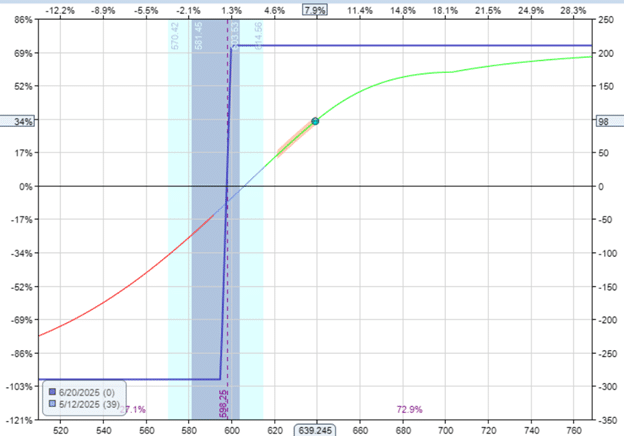

And on May 12, META did go up as speculated.

The bull put spread is now showing a profit of $98:

The investor believes that META has made a significant move in a short period and is likely to pause for a while, moving sideways.

So he sells a bear call spread to turn the trade into an iron condor:

Date: May 12, 2025

Price: META at $639.25

Sell one June 20 META $700 call @ $5.75

Buy one June 20 META $705 call @ $4.95

Credit: $80

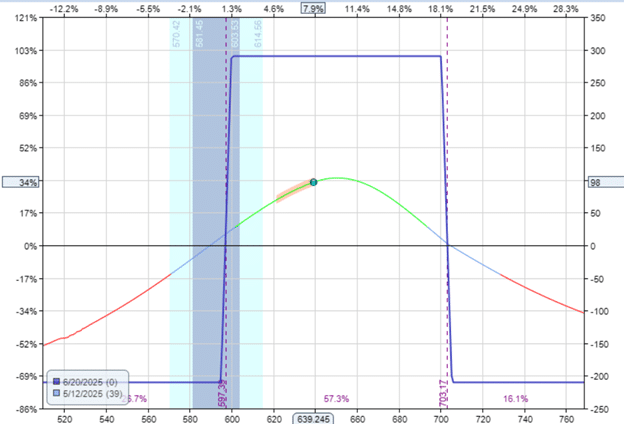

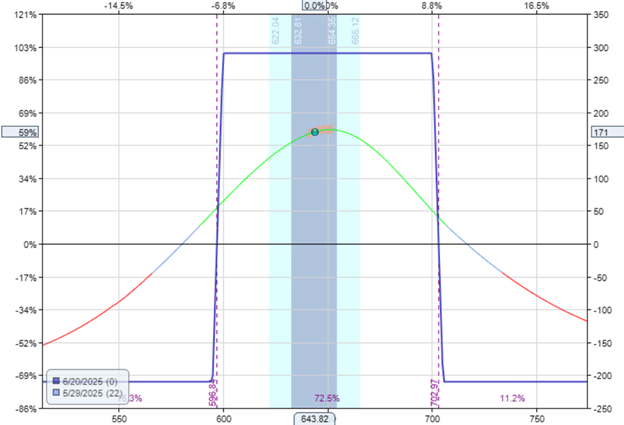

The resulting risk graph looks like this:

For another week, META did move sideways.

On May 29, the trade is showing a profit of $171:

This is half the profit potential of the iron condor.

So, the investor decides to exit on May 29:

Sell one June 20 META $705 call @ $2.21

Buy one June 20 META $700 call @ $2.70

Buy one June 20 META $600 put @ $5.10

Sell one June 20 META $595 put @ $4.40

Debit: -$119

The final profit in the trade is:

Sell bull put: $210

Sell bear call: $80

Close condor: -$119

Net profit: $171

Another benefit of selling the bear call spread to turn it into a condor is that it reduces the risk of the bull put spread.

Note from the above graphs that the initial bull put spread has a max risk of $290.

After selling the bear call spread, the maximum risk is $210.

The risk decreased by the amount of credit received from the call spread.

Would the Investor Make as Much Without Condorizing the Bull Put Spread?

In the case of just the bull put spread, the profit would be.:

Sell bull put: $210

Close bull put: -$70

Profit: $140

Still good, but not quite as much.

How was the max risk of the bull put spread calculated?

Width of the spread minus the credit received:

$500 – $210 = $290

The width of the spread is $5 per share from $600 to $605.

Since one contract represents 100 shares, the dollar value of one contract of the spread is $500.

How was the max risk of the iron condor calculated?

Width of the spread minus the credit received:

$500 – $210 – $80 = $210

There are three reasons why an investor might turn a bull put credits spread into an iron condor:

- To change the directional opinion of the trade

- To reduce risk

- To take partial profits out of the trade

The third item may not be immediately apparent.

By selling the bear call spread, you can think of it as taking money out of the trade and putting it back in your bank account.

It reduces the size of your trade, which, in turn, reduces your risk.

We hope you enjoyed this article on condorizing a bull put spread.

If you have any questions, send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.