Moomoo has earned recognition as TradingView’s Best Stock Broker for 2024, achieving a 4.7-star rating from over 3,300 users.

Founded in Palo Alto, California, in 2018 and now serving 24 million users worldwide, this commission-free platform consolidates professional-grade tools traditionally scattered across multiple platforms.

Moomoo launched across all 50 states after securing a U.S. trading license from the SEC.

It is registered with the SEC and FINRA, and insured by SIPC.

The platform has since expanded operations to Singapore, Australia, Japan, Canada, Malaysia, and New Zealand.

The parent company of Moomoo is Futu Holdings Limited, a fintech company headquartered in Hong Kong and founded by Leaf Hua Li.

Futu Holdings operates Futubull and Moomoo trading platforms.

While Futubull targets users in China and Hong Kong, Moomoo caters to a global audience of traders and investors.

Futu Holdings went public in March 2019 and trades on the Nasdaq with the ticker symbol FUTU.

Revenues and gross profits have consistently increased year-over-year from 2021 to 2024.

While U.S. client money in Moomoo brokerage is already insured by SIPC (Securities Investor Protection Corporation) up to $500,000, clients can rest assured that a financially strong parent company backs Moomoo.

Contents

Moomoo’s award-winning platform has earned recognition across multiple categories:

- TradingView’s Best Stock Broker 2024 – 4.7/5 stars from 3,300+ users

- Fintech Breakthrough’s Best Stock Trading App 2024

- Best Mobile App in the business and finance category (August 2023)

- Benzinga’s Best Day Trading Software 2023

- Global Recognition: “Influential Broker 2024” (Singapore), “No.1 US Stock Investment Platform” (Japan), Technology Excellence Award (Malaysia)

In July 2024, Moomoo integrated its platform with TradingView, allowing users to trade directly from the TradingView charting platform.

Among dozens of brokerages that TradingView connects to, Moomoo achieved the highest user rating.

The heart of Moomoo’s user experience is its downloadable desktop trading platform, which users run on their own trading machines.

In September 2024, Moomoo introduced a redesigned desktop platform designed to enhance the trading experience for U.S. retail investors.

They call it the “Next-Gen Workspace.”

The platform provides access to 100+ technical indicators for comprehensive market analysis, 38+ drawing tools, real-time Level 2 data refreshing every 0.3 seconds for precise entry timing, fundamental data, split screens showing up to 6 charts simultaneously, heat maps, stock screener, news feeds, watchlists, alerts, analyst ratings, and target prices.

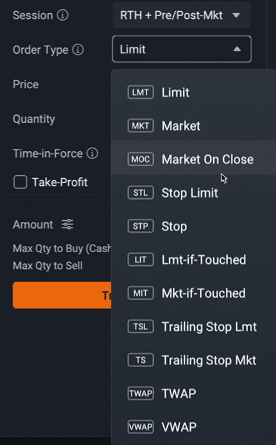

Beyond basic market and limit orders, Moomoo offers institutional-quality execution options:

- Conditional Orders – Execute trades based on specific market conditions

- Combination Orders – Simultaneously execute multiple legs of complex strategies

- Take Profit and Stop Loss Orders – Automated risk management

- TWAP (Time-Weighted Average Price) – Splits large orders into smaller trades at regular intervals to achieve average market pricing

- VWAP (Volume-Weighted Average Price) – Executes more trades during high-volume periods and fewer during quiet times, targeting volume-based average pricing

TWAP and VWAP represent institutional-level trading capabilities where large institutions execute sizeable orders without moving the market or revealing their intentions.

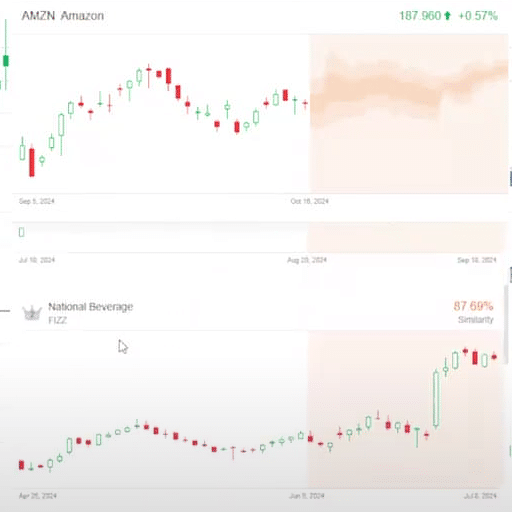

For technical analysis, Moomoo’s chart pattern finder screens for head-and-shoulders, double/triple tops and bottoms, arch top/bottom, flags, wedges, triangles, and diamond patterns.

The trend projection feature analyzes current stock chart patterns and matches them with similar historical patterns from other equities.

Based on the historical outcome, it projects potential price movements for the current stock.

For example, Amazon’s (AMZN) chart pattern matched with 87% similarity to National Beverage’s (FIZZ) historical pattern, providing traders with probabilistic insights for position sizing and entry timing.

Source: YouTube

The mobile app maintains full synchronization with the desktop platform.

Alerts set on desktop appear on mobile, allowing traders to view and draw on charts while accessing technical indicators and making timeframe adjustments.

The chart pattern finder and trend projection features are also available on mobile.

This creates a professional trading environment in your pocket for both Android and iOS users.

Source: screenshot from YouTube

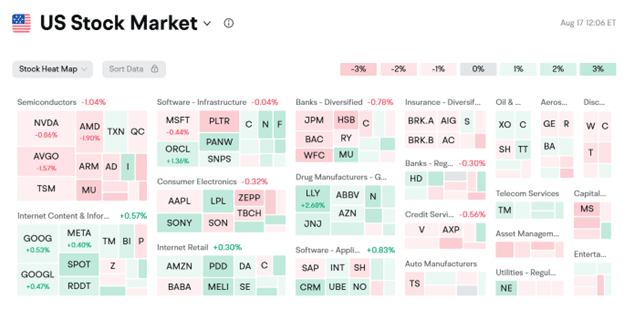

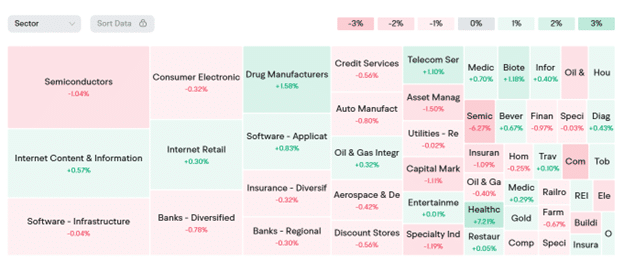

Moomoo offers heat map views of large-cap companies organized by sectors.

The size of each square corresponds to market capitalization, while colors indicate the magnitude of performance – green for gains and red for losses.

Beyond providing quick market overviews, heat maps reveal sector rotation patterns.

For instance, traders can quickly identify that semiconductors declined 1% while drug manufacturers gained 1.6%, with Eli Lilly (LLY) leading the group.

Heat maps are available for markets beyond the U.S., including Hong Kong, Canada, Japan, Australia, Singapore, Malaysia, and China, providing a global market perspective.

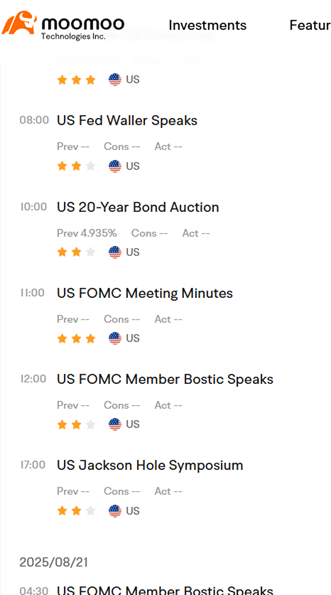

For event-driven trading strategies, Moomoo provides comprehensive calendar tools.

The financial calendar tracks market-moving events like FOMC meetings, filtered by date and affected countries.

This enables traders to prepare for volatility around major announcements.

The earnings calendar identifies upcoming company announcements, essential for earnings plays, pre-earnings strategies, and post-earnings trades.

Since earnings announcements often trigger significant price movements, this calendar enables traders to time their positions accordingly.

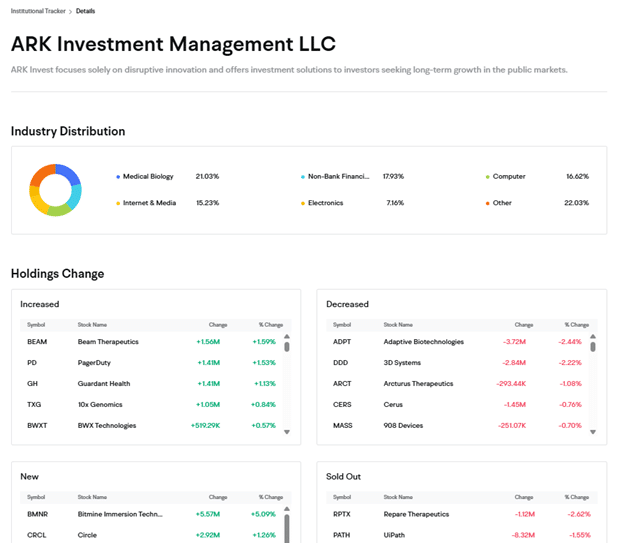

Institutional Tracker

Moomoo’s Institutional Tracker reveals holdings and trading activity of major institutional investors based on SEC filings.

This includes positions from Vanguard, BlackRock, Goldman Sachs, Warren Buffett’s Berkshire Hathaway, and other notable companies.

For example, traders can monitor changes in ARKK ETF holdings to understand Cathie Wood’s positioning and shifts in sector allocation.

This feature provides retail traders with insights typically reserved for institutional research departments.

Moomoo enables partial share ownership for eligible stocks, making high-priced equities accessible to smaller accounts.

To invest $500 in Meta (META) trading at $785 per share, an investor would purchase 0.64 shares ($500 ÷ $785 = 0.64). If Meta rises $10 per share, the fractional position would profit $6.40.

The minimum order size for fractional trading is 0.0001 shares, with a minimum order value of $5.

Active traders benefit from Moomoo’s competitive fee structure.

The platform offers zero commission for stocks, ETFs, and options for U.S. residents trading U.S. markets.

However, regulatory fees, exchange fees, and index option contract fees may apply.

While some brokerages charge $0.65 per equity options contract, Moomoo charges zero fees on equity options for U.S. residents.

For index options, Moomoo charges $0.50 per contract, lower than competitors, who charge $0.65.

Equity options include contracts on individual stocks, such as Microsoft (MSFT) and Nvidia (NVDA), as well as ETFs like GLD, IWM, and SPY.

Index options cover broader market indices like SPX (S&P 500), RUT (Russell 2000), VIX, and NDX.

Moomoo’s cash sweep feature automatically moves idle cash into FDIC-insured interest-earning bank accounts.

When trades are placed or funds withdrawn, money automatically returns to the brokerage cash balance without affecting buying power.

Since options strategies naturally use leverage, most options investors don’t have 100% of their accounts tied up in positions.

The cash sweep ensures idle funds earn interest rather than sitting dormant.

While standard bank interest rates of 0.03% APY may seem modest, Moomoo occasionally offers promotional rates of 4.1% APY for new users who meet deposit conditions or existing users who make referrals or transfers of at least $500.

Moomoo provides paper trading with simulated trade execution using virtual money.

This risk-free environment allows learning, strategy practice, and platform familiarization without commissions or fees.

Paper trading proves ideal for beginning traders, as statistics show that most new traders lose money until they gain experience and refine their strategies over time.

Testing new approaches with virtual funds prevents real capital losses during the learning curve.

Moomoo structures options trading privileges across four levels:

Option Level 1: Selling covered calls on equities and cash-secured puts

Option Level 2: All Level 1 privileges plus buying long calls and puts on equities and options, enabling protective puts and collar strategies

Option Level 3: All previous levels plus vertical spreads, allowing butterfly and iron condor construction

Option Level 4: Full options privileges, including naked selling of puts and calls, enabling short straddles and strangles

Naked options selling involves no hedging protection.

Naked call sales can result in unlimited losses, while naked put losses are limited but can be substantial.

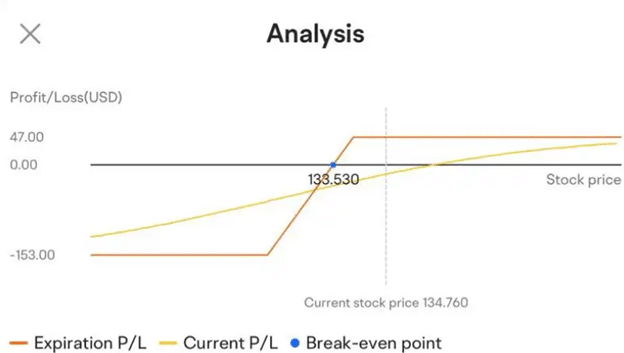

For options traders, Moomoo provides theoretical profit and loss (P&L) graphs at expiration and current P&L curves.

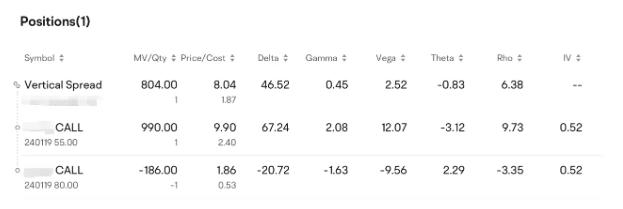

Here’s an example of a vertical spread visualization:

Source: moomoo community

The Moomoo community serves as a platform where users discuss financial topics, share trade ideas, react to news, and ask platform questions.

Similar to other social platforms, users can follow contributors posting relevant content.

Moomoo displays comprehensive options data, including Delta, Vega, Theta, Gamma, and Rho for all positions.

The platform also shows intrinsic and time value calculations.

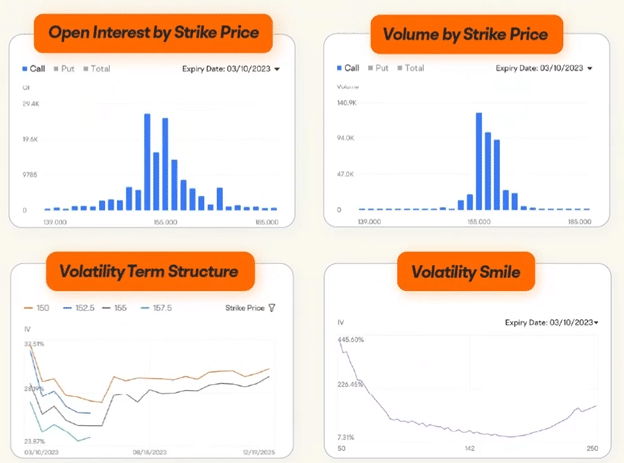

For liquidity analysis, traders can view open interest and volume by strike price to ensure adequate trading activity before entering positions.

Source: moomoo.com

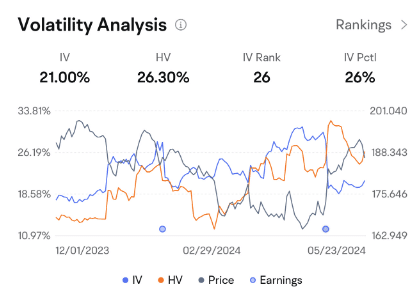

Advanced traders can analyze volatility term structure and volatility smile patterns.

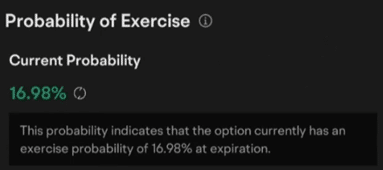

The platform charts implied versus historical IV relationships and calculates the probability of exercise for individual options.

Source: moomoo.com

There is even a calculation of the probability of the exercise of an option.

Source: moomoo.com

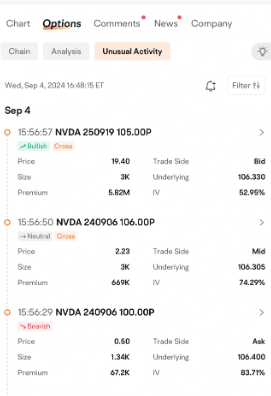

Beyond standard screens for “Most Active Options,” “High Open Interest,” and “High Options Volume,” Moomoo provides unusual options activity monitoring to identify potential informed trading.

Source: moomoo

Moomoo offers cryptocurrency trading through Moomoo Crypto, powered by Coinbase, starting May 2025. U.S. residents aged 18 and above with a Social Security number residing in supported states can trade 32 coins, including Bitcoin and Ethereum.

Futures trading is not yet available for U.S. users as of mid-2025.

However, futures and futures options are available on Moomoo Singapore, suggesting potential future expansion to other markets.

Traders can chat with Moomoo AI for questions related to trading and investment.

The AI rapidly reads market data and news, providing summaries and analysis that are faster than those generated through manual research.

Customer support includes publicly available telephone numbers for human assistance during business hours. 24/7 chat support handles most inquiries; however, complex topics may require a phone consultation during standard business hours.

Support telephone numbers are publicly available, where you can speak with a live representative (availability may be limited to certain hours/days).

24/7 chat customer support is always available.

However, some topics involving additional support may require a call during standard phone hours.

Moomoo consolidates professional-grade tools traditionally scattered across multiple platforms into one comprehensive workspace.

Rather than jumping between stock screeners, charting software, earnings calendars, and trading platforms, traders access institutional-quality features through a single interface.

For traders seeking professional functionality without institutional fees, Moomoo delivers award-winning capabilities with zero commissions.

The platform requires no joining fees, monthly account fees, or minimum balance requirements, making it accessible for traders at all experience levels.

We hope you enjoyed this review article on the trading and investment platform Moomoo.

If you have any questions, send an email or leave a comment below.

Keywords: Moomoo trading and investment platform review

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

**mind vault**

mind vault is a premium cognitive support formula created for adults 45+. It’s thoughtfully designed to help maintain clear thinking