Today, we are going to look at an example of a failed bull put credit spread trade.

In fact, the trader woke up Friday morning to see that he was assigned 100 shares of Tesla, even though it was not at the expiration of his option.

This is known as an early assignment.

Let’s see what happened and how to get out of this mess.

Contents

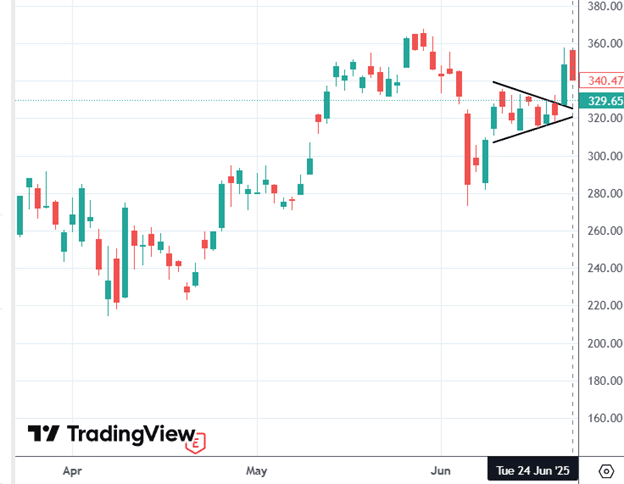

The trader entered a bull put credit spread on June 24, 2025, because Tesla (TSLA) broke out of a pendant chart pattern with a strong bullish green candle the day before…

The bull put credit spread consists of selling the $350 strike put option.

This is the option that he is short, also known as the short strike.

And it consists of buying the $345 strike put option to limit the potential loss.

This is the long strike.

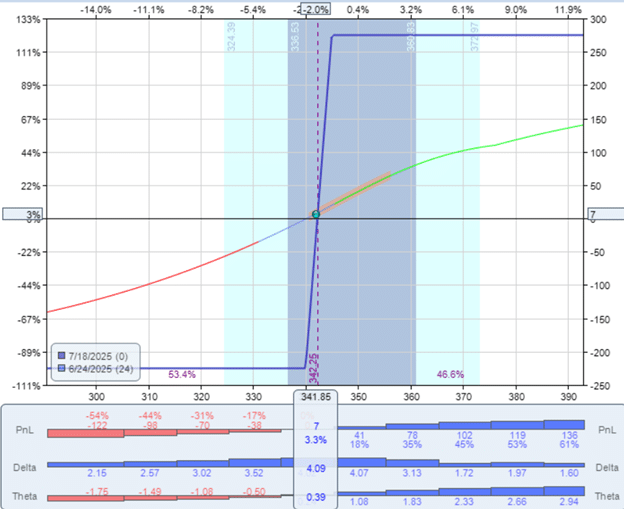

Date: June 24, 2025

Price: TSLA @ $341.85

Sell to open one July 18 TSLA $350 put @ $23.73

Buy to open one July 18 TSLA $345 put @ $20.98

Credit: $275

Both options expire on July 18, and the P&L graph at expiration looks like this…

Unlike typical credit spreads that are placed far out-of-the-money, this put credit spread is placed at-the-money, right where TSLA’s current price is.

When it is placed this close to the money, the spread behaves like a bull call debit spread. The risk graphs of the two looks would look the same.

The purpose of this at-the-money credit spread is not to collect credit and profit from time decay but rather a directional bet on the upward movement of TSLA stock.

This is evidenced by the very low theta (0.39) and the significant positive delta of 4.09.

We can see from the upward-sloping T+0 line that the profit of the spread increases as the price of TSLA increases to the right along the horizontal axis.

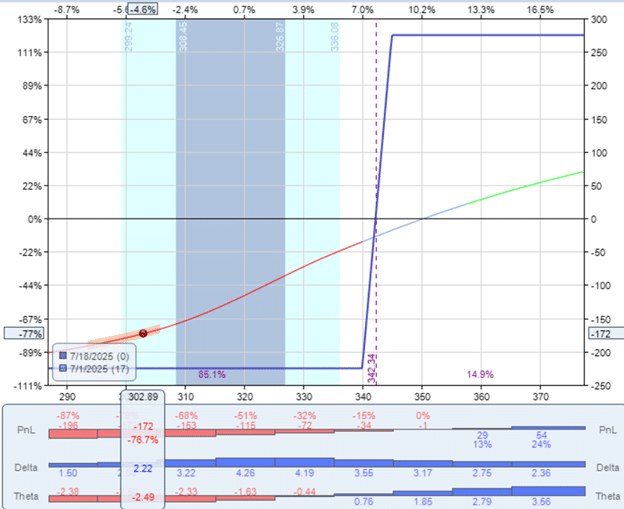

On July 1, TSLA dropped to $300.

Oops, the stock is moving in the wrong direction.

This is also a failed breakout pattern.

The pattern broke out to the upside, which is the thesis of the trade.

But now the stock is below the pendant pattern.

This invalidates the pattern.

The bull put credit spread is at a loss of -$172:

Because the spread is a defined-risk trade and the trader could not lose more than $225, the trader probably thought the stock might bounce back and continue to hold the spread.

Max potential loss = width of spread – credit received = $500 – $275 = $225

The morning of Friday, July 18, is expiration day.

While some expiration dates are AM expirations where settlement is at the morning of the day of expiration, this was not one of them.

This Friday, July 18, is a regular PM expiration, which means that the bull put credit spread is due to expire at the end of the trading day.

However, when the trader checked his account one hour after the market opened, he saw that he had 100 shares of TSLA stock that he did not have before.

Furthermore, he saw that he no longer had the short put option.

The July 18 TSLA $350 put that he had shorted (initially sold) was no longer in his account.

The trader realized that his short put option was assigned.

Since this was technically not at the expiration of the short option, it meant that he was early-assigned.

This meant that someone on the other side of the trade, who is holding the long July 18 TSLA $350 put contract, decided to exercise that contract.

To exercise this put contract means to exercise the right to sell 100 shares of TSLA at the strike price of $350.

The counterparty must have wanted to unload 100 shares of their TSLA stock for any number of reasons — one of which might be that TSLA is announcing earnings the coming week.

Because the price of TSLA was around $326 at the time, selling at $350 is a good deal.

The $350-strike put option is considered “in-the-money” because it has intrinsic value (the person who exercises it would profit).

In any case, if this put option continues to be in-the-money at expiration at the end of the trading day (which it most likely would), the brokers would have automatically exercised this option of the counterparty.

Since the counterparty sold the 100 shares, someone had to take those 100 shares. Our trader was the holder of the short put of that contract.

Our trader had to take (or buy) those 100 shares at a price of $350 per share.

That is a cost of $35,000 to buy those shares.

Well, if the account size is large enough and the trader does not mind owning 100 shares of TSLA, he can continue to just hold TSLA stock.

But if the account size is only $50,000, then those 100 shares of TSLA represent a high directional risk and an oversized allocation of the account to one stock.

Fortunately, the trader still has a long $345-strike put option that enables him to sell those 100 shares at $345 per share if he decides to exercise this put option.

The put option is about to expire at the end of the trading session.

He can call his broker to exercise the put option now.

Or if TSLA is still below $345 at the time of expiration, his broker will auto-exercise that put option for him at expiration.

Either way, he ends up selling his 100 shares at $345. Having bought at $350 and sold at $345, he loses $5 per share.

Lost $500 overall, but partially offset by the $275 credit that he received initially at the start of the trade.

Therefore, his net loss is -$500 + $275, or -$225, which is the max risk of the credit spread (as calculated previously).

There is another way he can handle it.

No need to call his broker.

No need to wait for expiration. Clean up this mess right away.

He sells his 100 shares of TSLA right away at the market price of $326.30.

Then he sells his long $345 put option, fetching a price of $19.50 (on a per share basis), or a net price of $1950 for one contract.

Initial credit from bull put spread: $275

Assigned 100 shares at $350 per share: -$35,000

Sold 100 shares at $326.30 per share: $32,630

Selling this long put option: $1,950

Net P&L: -$145

This loss is less than the maximum potential loss.

Either the position was not at max loss at the time, or it could be that TSLA moved favorably after the assignment.

Note that it is possible to sell the 100 shares and the long put in a single transaction. Because one is a hedge for the other, it is ideal to sell them both about the same time.

Credit spreads are defined-risk trades.

So they are suitable for beginning options traders.

If you trade enough of them, you might encounter a situation where shares of stock are assigned early.

But that is not anything scary if you know what to do and how to handle early assignments.

The defined max risk of the credit spread continues to hold true up to the point of expiration, even if you have been assigned early — as long as you manage it properly.

Want to Master Credit Spread Trading?

Early assignment scenarios like this are exactly why proper education and risk management are crucial for options traders.

If you’re interested in learning a systematic approach to options trading:

- Options Income Mastery: Learn proven option strategies with proper risk management techniques ($397). 1-month program.

- The Accelerator Program: 12-month program covering 9 major strategies with comprehensive portfolio management for serious options traders ($1,497).

Both programs include detailed modules on managing assignment scenarios, technical analysis, trading psychology, and proper position sizing techniques.

We hope you enjoyed this article showing an example of a bull credit spread assignment.

If you have any questions, send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.