At-the-money option calendars are range-bound trades intended to generate income from the passage of time.

But what happens if you have a bull market on the run?

One way is to leapfrog the calendars to move with the market.

Contents

Let’s look at a trade example on SPY to see what we mean.

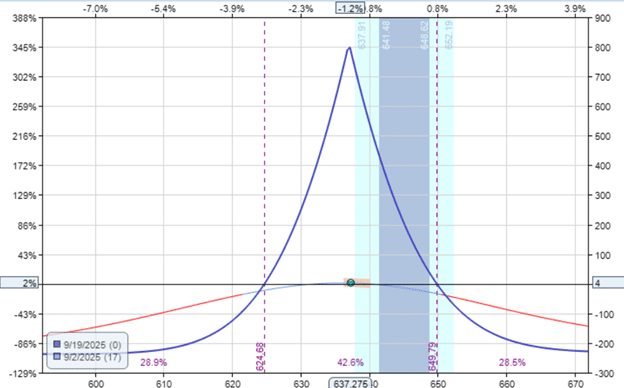

Date: September 2, 2025

Price: SPY @ $637.28

Sell two contracts September 19 SPY $637 put @ $8.85

Buy two contracts September 26 SPY $637 put @ $10.01

Debit: -$232

Commissions and Fees: -$2.70

As the market moves, we add another calendar above the market to create a double calendar structure.

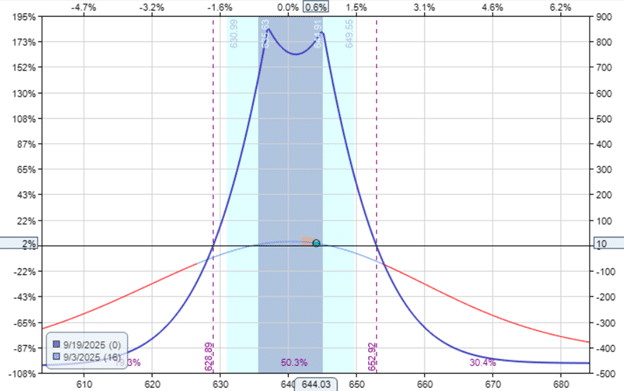

Date: September 3, 2025

Price: SPY @ $644

Sell two contracts September 19 SPY $645 put @ $8.37

Buy two contracts September 26 SPY $645 put @ $9.52

Debit: -$230

Commissions and fees: -2.70

This contains the price of SPY between the peaks of the expiration graph of the two calendars.

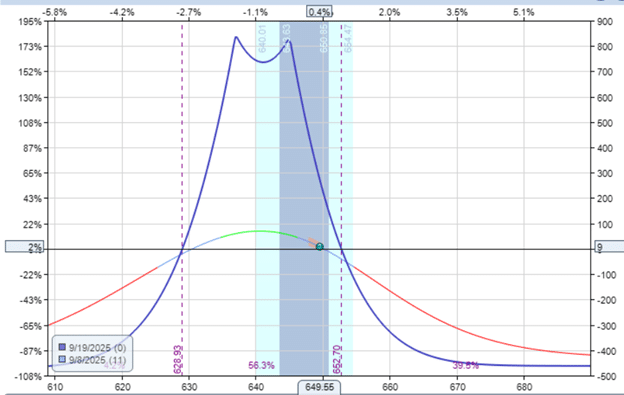

On September 8, 2025, the market continues to move up past the peak of the upper calendar:

We close the lower calendar:

Date: September 8, 2025

Price: SPY @ $649.55

Buy to close two contracts September 19 SPY $637 put @ $2.24

Sell to close two contracts September 26 SPY $637 put @ $3.37

Credit: $226

Commissions and Fees: -$2.70

And open another calendar above the current price:

Sell to open two contracts September 19 SPY $652 put @ $6.90

Buy to open two contracts September 26 SPY $652 put @ $8.00

Debit: -$220

Commissions and Fees: -$2.70

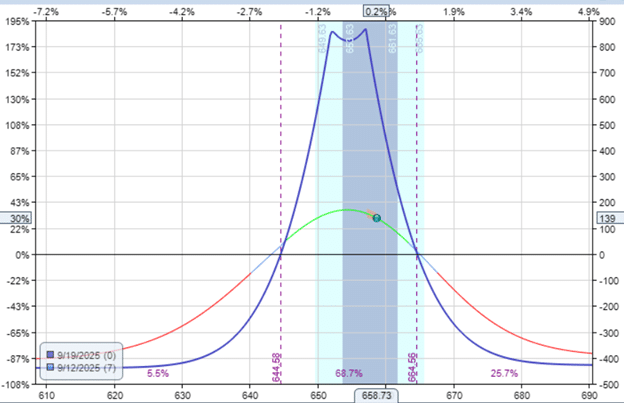

In effect, the lower calendar has leapfrogged over the existing calendar to go above it:

Thereby recreating the double calendar structure flanking the price of SPY in the middle again.

SPY keeps going up.

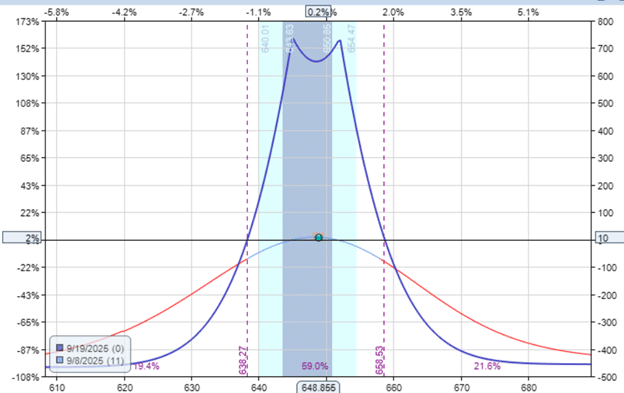

On September 10, 2025, we needed to leapfrog the lower calendar again to keep SPY in between the two calendar peaks.

Date: September 10, 2025

Buy to close two contracts September 19 SPY $645 put @ $2.52

Sell to close two contracts September 26 SPY $645 put @ $3.71

Sell to open two contracts September 19 SPY $657 put @ $7.49

Buy to open two contracts September 26 SPY $657 put @ $8.54

Credit: $28

Commissions and fees: $5.40

If we group the accounting for the closing and opening of the calendars, we obtain a credit of $28 for the leapfrog move.

On September 12, the price is starting to head upside again.

With only one week left until the near-term option expires, we decided to take a profit and close the entire trade instead of attempting to leapfrog again.

Date: September 12, 2025

Buy to close two contracts September 19 SPY $657 put @ $4.16

Sell to close two contracts September 26 SPY $657 put @ $5.58

Buy to close two contracts September 19 SPY $652 put @ $2.44

Sell to close two contracts September 26 SPY $652 put @ $3.82

Credit: $560

Commissions and fees: $5.40

Final P&L

Initial calendar:

Debit: -$232

Commissions and Fees: -$2.70

Double calendar:

Debit: -$230

Commissions and fees: -2.70

First leapfrog:

Credit: $226

Commissions and Fees: -$2.70

Debit: -$220

Commissions and Fees: -$2.70

Second leapfrog:

Credit: $28

Commissions and fees: $5.40

Close both calendars:

Credit: $560

Commissions and fees: $5.40

P&L without commissions and fees: $132

Commissions and fees: -$21.60

P&L including commissions and fees: $110.40

With a max risk of about $500, this trade returned 22% on capital at risk.

This took into account commissions and fees, which ate up 4% of the profits.

Over the course of 10 days, SPY ran straight up:

Yet we were still able to capture a decent return by leapfrogging calendars to contain the price between the peaks of the double calendar.

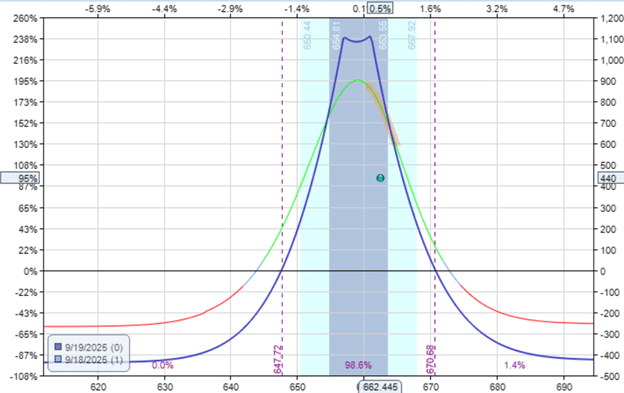

In hindsight, if we were bold enough to leapfrog one more time again.

And then hold until the day before expiration, and we could have captured even greater profits of $440.

This is because the calendar’s peak profits are achieved only when we are close to expiration, provided the price remains within the range of the expiration graph.

Oh well, hindsight is always hindsight.

We hope you enjoyed this article on leapfrog calendars.

If you have any questions, send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.