Yes, it does.

Investors holding the SPY receive a dividend payout once every quarter.

A quarter is three months.

There are four dividend payments made annually.

This is because SPY is the ticker symbol for the ETF (Exchange-Traded Fund) that tracks the S&P 500 index.

As an ETF, it is treated very similarly to a stock.

You can buy and sell shares of SPY just like you can buy and sell shares of stock.

You can get dividends in certain ETFs, just like you can get dividends in certain stocks.

Contents

The SPY fund’s original name is Standard & Poor’s Depositary Receipts (SPDR).

Hence, investors sometimes informally refer to it as the “Spiders”.

The dividend amount isn’t fixed.

It depends on the dividends paid by the underlying S&P 500 companies held by the SPY fund.

Many of those companies pay dividends.

So, SPY collects them and then distributes them to shareholders who own the SPY ETF.

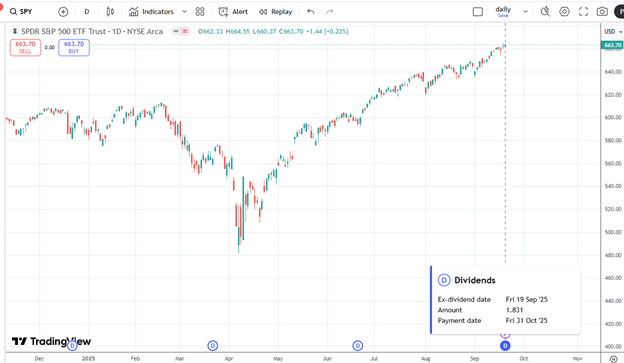

You can see when and how much the dividend was paid on various platforms.

Here is an example:

Shareholders who are holding SPY before the Ex-dividend date of September 19, 2025, will receive a dividend of $1.831 for every share of SPY held.

This dividend will be paid out on October 31, 2025.

With the price of SPY at $663, the payout is 0.276% each payout:

$1.831 / $663 = 0.28%

Annualized, SPY has an annual dividend yield of about 1.1%:

4 x 0.276% = 1.1%

This amount will vary based on market conditions and the size of SPY.

Note the significance of the Ex-dividend date.

A shareholder who buys SPY on the payout date will not get the dividend.

A shareholder who buys SPY on the Ex-dividend date will not get the dividend.

Only shareholders who buy SPY the day before the Ex-dividend date will get the dividend.

The stock purchase transaction must settle by the record date.

However, most investors focus on the ex-dividend date, as buying the day before the ex-dividend date will usually settle by the record date.

It appears that there is a noticeable gap (approximately a month) between the ex-dividend date and the payout date – a larger gap than what we typically see in stocks (which is usually just a few days).

This is because SPY collects dividends from hundreds of S&P 500 companies at different times.

The fund has to wait until it receives all the cash, then it aggregates and distributes it to SPY holders.

This is typical of large ETFs.

Many places.

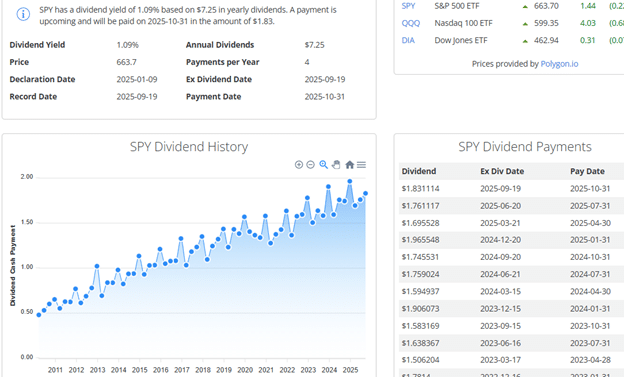

As an example, here is what SlickCharts provides:

Source: SlickCharts.com

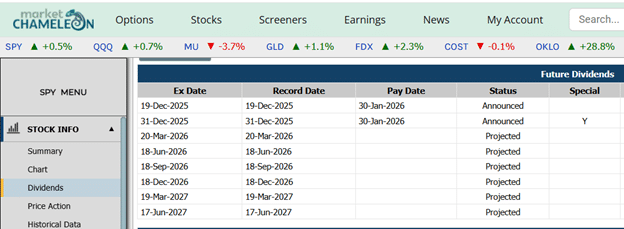

You can see upcoming dividends in MarketChameleon:

Note that the December 31, 2025, ex-dividend date is marked as a “special dividend,” which appears to be an additional payout inserted in addition to the regular four quarterly payouts.

A special dividend is a one-time, non-recurring payment in addition to the regular dividends.

This can occur if a company in the S&P 500 issues its own special dividend, and SPY passes that cash along.

Or corporate mergers, spinoffs, or liquidations can result in unexpected cash being distributed.

And SPY is required to distribute all income it receives.

No.

Because SPX is an index, we can not buy shares of SPX.

SPX is a calculation of the weighted prices of 500 large U.S. companies in the S&P (Standard and Poor’s).

As we have covered most of the frequently asked questions about SPY dividends, this should give you a better understanding of how dividends work.

Additionally, you came across a few valuable resources where you can obtain dividend information.

We hope you enjoyed this article on SPY dividends and how they work.

If you have any questions, send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.