In the fast-paced, often exhilarating world of algorithmic trading, it’s easy to get swept up in the pursuit of quick profits. The MQL5 Market, a hub for innovative trading robots and indicators, offers a seemingly endless array of tools promising to unlock market riches. But amidst the excitement, one fundamental truth remains: patience and a conservative approach are often the most reliable paths to sustained success.

This isn’t to say that aggressive strategies don’t have their place, but for the vast majority of traders, especially those looking to build long-term wealth, embracing a more deliberate and measured style can be a game-changer. Let’s explore the profound benefits of conservative trading within the MQL5 ecosystem.

The Siren Song of High Returns and Why We Should Resist It

Many EAs (Expert Advisors) on the MQL5 Market will display impressive backtest results, often showing astronomical percentage gains over short periods. While these can be enticing, it’s crucial to remember that past performance is not indicative of future results. Moreover, such aggressive strategies often come with hidden costs:

-

Massive Drawdowns: High returns frequently correlate with significant drawdowns. A large portion of your capital can be wiped out in a single adverse market move, making recovery an uphill battle.

-

Over-optimization Risk: Some EAs are highly optimized for specific historical data, making them brittle and vulnerable to changing market conditions.

-

Stress and Emotional Burnout: Constantly monitoring highly volatile trades and facing large drawdowns can be incredibly stressful, leading to poor decision-making and emotional exhaustion.

The Power of “Slow and Steady” in Algorithmic Trading

Conservative trading, by contrast, prioritizes capital preservation and consistent, albeit smaller, gains. This approach leverages the power of compounding over time, ultimately leading to more robust and sustainable growth. Here’s how it benefits you in the MQL5 Market:

1. Reduced Risk and Capital Preservation: The cornerstone of conservative trading is strict risk management. This means using smaller position sizes, setting tighter stop-losses, and avoiding highly volatile instruments. For MQL5 EAs, this translates to:

-

Lower Max Drawdown: A well-designed conservative EA will have a significantly lower maximum drawdown, protecting your capital during inevitable market fluctuations.

-

Sustainable Growth: By preserving capital, you ensure that you remain in the game to benefit from compounding returns over the long haul. You’re not trying to hit a home run every time; you’re aiming for consistent singles and doubles.

-

Peace of Mind: Knowing your capital is relatively safe allows for a much less stressful trading experience, freeing you from constant anxiety.

2. Consistency Over Explosiveness: While an aggressive EA might generate a 50% return in one month, it could just as easily lose 30% the next. A conservative EA, aiming for a more modest 3-5% consistently, builds wealth far more reliably.

-

Compounding at its Best: Even small, consistent returns compound powerfully over years. Think of it as planting a tree; it grows steadily, not in explosive bursts, but its roots run deep.

-

Predictable Performance: While no trading is 100% predictable, conservative strategies tend to exhibit more stable equity curves, making financial planning easier.

3. Adaptability and Robustness: Conservative EAs are often built on more fundamental, time-tested principles rather than highly specific market anomalies.

-

Less Prone to Over-optimization: They tend to be less sensitive to minor market shifts, making them more robust across varying market conditions.

-

Longer Lifespan: An EA designed for conservative growth is more likely to remain profitable and relevant for a longer period, reducing the need for constant strategy overhauls.

4. The Psychological Edge: Perhaps one of the most underrated benefits is the psychological advantage.

-

Reduced Stress: Less risk means less stress. This allows for clearer thinking and prevents emotional decisions when things get tough.

-

Patience is Rewarded: Conservative trading cultivates patience. You learn to trust your system and the power of time, rather than chasing every fleeting opportunity.

-

Avoiding Overtrading: Aggressive traders often overtrade, leading to increased transaction costs and poor decision-making. Conservative approaches typically involve fewer, higher-quality trades.

Implementing Conservative Principles in the MQL5 Market

When evaluating EAs on the MQL5 Market, look beyond just the “profit factor” and consider these conservative metrics:

-

Max Drawdown: This is critical. Aim for EAs with a maximum drawdown you are comfortable with, ideally below 20-30% for most strategies.

-

Recovery Factor: How quickly does the EA recover from drawdowns? A higher recovery factor indicates a more resilient strategy.

-

Profit per Trade (Average): While not a direct conservative metric, consistent small profits per trade are often a hallmark of conservative systems.

-

Number of Trades: A lower number of trades can sometimes indicate a more selective, conservative approach, avoiding unnecessary market exposure.

-

Backtest Period and Data Quality: Ensure the backtest covers a long period (several years, including various market conditions) and uses high-quality tick data.

-

Strategy Description: Read the developer’s description carefully. Do they emphasize risk management, capital preservation, or aggressive growth?

-

Live Monitoring: If available, observe live signals. Do they align with conservative principles?

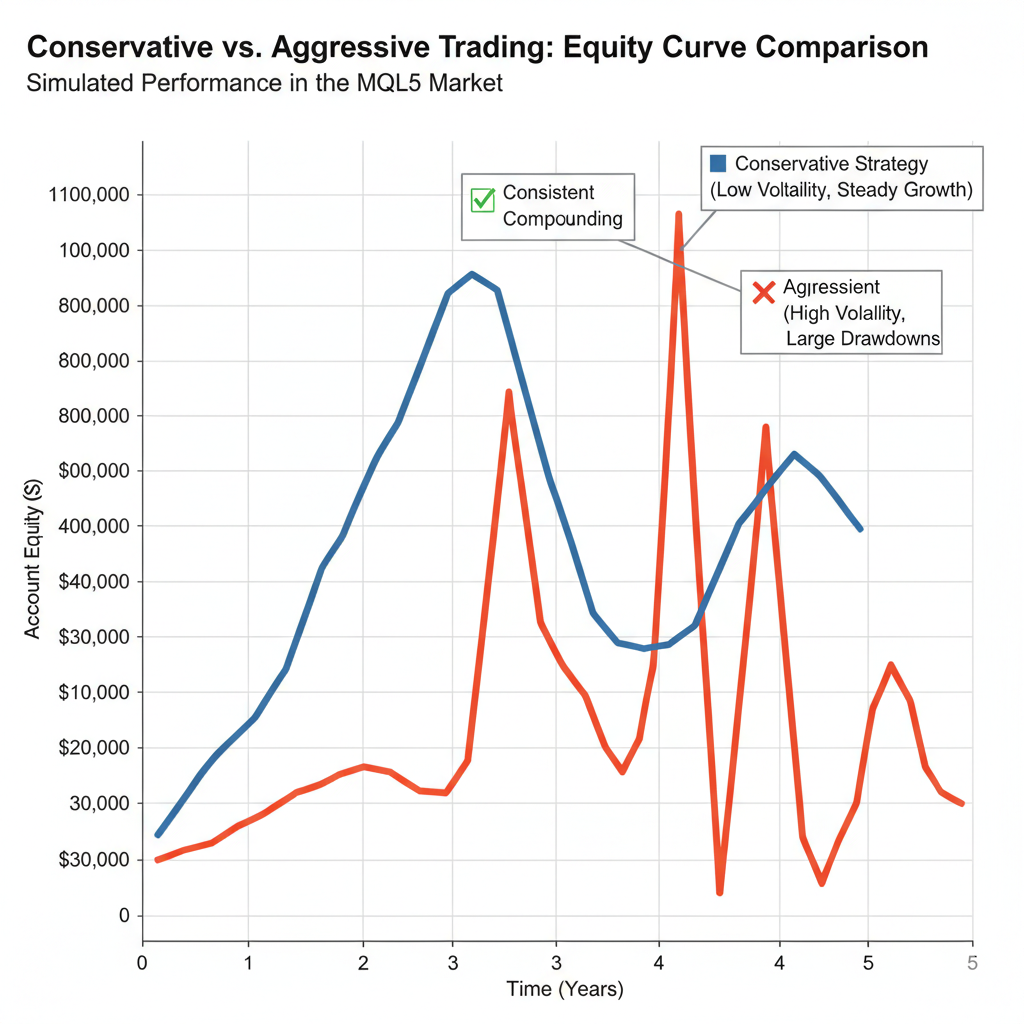

Here’s an example of what a stable, conservative equity curve might look like compared to a volatile, aggressive one:

As you can see, the blue line represents a conservative strategy with consistent, steady growth and manageable drawdowns. The red line, representing an aggressive strategy, shows rapid spikes and severe drops, making it far riskier and harder to sustain.

Conclusion: The Marathon, Not the Sprint

The MQL5 Market provides incredible opportunities for traders, but success isn’t about finding the EA that promises to make you a millionaire overnight. It’s about finding robust, well-managed systems that align with a philosophy of patience and capital preservation.

By embracing conservative trading principles, you’re choosing the marathon over the sprint. You’re prioritizing the longevity of your trading career and the consistent, compounding growth of your capital. In a world where instant gratification often leads to disappointment, the virtue of patience in algorithmic trading truly pays off.