Autonomous taxis are rolling out to neighborhoods near you — though the exact timing remains uncertain.

As of this writing in mid-2025, some cities already have them on the streets.

This is a growing industry, and investors seeking to capitalize on this growth may want to explore related stocks.

Contents

Waymo

Waymo now provides over 250,000 fully autonomous paid rides each week.

That means there is no one else inside the car except for you, the passenger.

It is available in select metropolitan areas in the United States, including Phoenix, San Francisco, Los Angeles, Austin, and Atlanta.

If you are in the heart of these cities, it is not uncommon to see a Waymo Jaguar I‑Pace EV car driving around with no one inside.

More cities, such as Miami, Washington , D.C., New York, and Philadelphia, are in the testing stage and may become available soon.

Source: Waymo

While Waymo is still a private company and therefore not traded on any stock exchange, Waymo is a subsidiary of Alphabet Inc.

Investing in Alphabet allows you to indirectly benefit from Waymo’s growth; however, Waymo is only a small factor in determining Alphabet’s stock price. The tickers for Alphabet are:

GOOGL – Alphabet Class A common stock

GOOG – Alphabet Class C common stock

Tesla (TSLA)

Tesla’s robotaxi service is not available to the general public at the moment, but to a limited invite-only passengers in a geo-fenced area in Austin, Texas, with a human “safety monitor” in the passenger seat (in case there needs to be human intervention to press a stop button or grab the steering wheel).

Tesla relies on its Full Self-Driving (FSD) software, which utilizes only cameras, AI, and extensive data.

One criticism is that Tesla does not use LiDAR or radar, which can accurately measure the speed and distance of other cars, a feature nearly all other autonomous vehicles have.

Another criticism is that Tesla uses GPS maps instead of HD maps, like those used by Waymo and Cruise, which are pre-scanned with laser precision to accurately determine the position of curbs, lanes, poles, and other features.

The counter-argument is that human drivers use only their eyes as cameras – they don’t have radar, nor do they have HD maps in their heads.

Tesla is betting that its lower-cost approach — relying on camera vision and AI — can replicate how humans drive.

For AI to work, it needs a lot of data, which Tesla has a lot of data.

Tesla cars have a feature called “shadow mode,” which runs the FSD software in the background, allowing it to “think” about driving decisions without actually controlling the vehicle.

By comparing its performance with that of a human Tesla owner in real-world driving, the AI model can learn and improve its driving skills.

As of mid-2025, FSD still requires active driver supervision and is classified as Level 2 automation by industry standards.

Waymo, on the other hand, is classified at a higher Level 4, which is just short of the fully autonomous Level 5.

The primary difference is that Level 4 is restricted to being operated in specific, defined geographical regions, whereas Level 5 can operate anywhere.

But Tesla has grand plans for the future.

It plans to eventually offer Tesla owners the opportunity to integrate their vehicles into Tesla’s robotaxi network, allowing them to earn income by having their cars provide autonomous rides when they’re not in use.

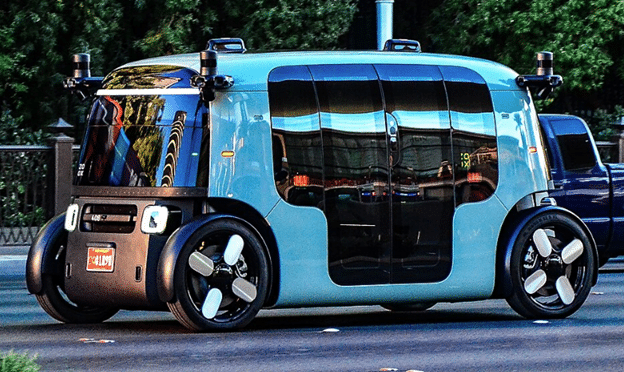

Zoox

Zoox is headquartered in Foster City, California. It is not as mature as Waymo, as it has not yet launched full commercial service.

However, San Francisco and Las Vegas will be the first two cities to have it available soon.

Unless you are an accredited private investor, there is no publicly available stock of Zoox that you can buy.

You can gain exposure by investing in Amazon’s (AMZN) parent company.

Source: Tomás Del Coro, CC BY-SA 2.0, via Wikimedia Commons

International

Baidu (BIDU) is the parent company of Apollo Go, a fully autonomous Level 4 robotaxi service that operates in over 10 cities in China, carrying paying passengers.

You can think of Baidu as the Chinese equivalent of Google. And Apollo, as the Chinese equivalent of Waymo.

What Happened To Cruise?

The Cruise story illustrates why building a robotaxi service is not an easy task.

Cruise was founded in 2013 by Kyle Vogt & Dan Kan with robo-taxi ambitions.

It was acquired by General Motors (GM) in 2016.

In February 2022, Cruise offered rides to a select group of the public in San Francisco, with no human safety drivers present.

A major setback occurred in October 2023 when the fleet was grounded because a driverless Cruise robotaxi at 9:30 pm dragged a woman pedestrian about 20 feet.

The pedestrian was thrown into the path of the robotaxi after being struck by another car with a human driver.

While the robotaxi detected a collision, it was unable to see the full woman on the ground, except for her feet and lower legs, which were visible in the wide-angle left-side camera.

It was not able to correctly classify what it saw and made a critical judgment error to pull to the side of the road, dragging the woman at 7.7 miles per hour when it should have made an emergency stop.

There were other issues with Cruise, such as other collisions, unexpected stops, blocking of emergency vehicles, and poor nighttime performance.

In December 2024, GM halted further funding for Cruise’s robotaxi business due to high cost and mounting competition.

This was after spending over $10 billion on it. By early 2025, Cruise operations ceased.

GM is now focused on integrating ADAS in its retail vehicle lineup.

Select models of Cadillac, Chevrolet, and GMC will feature “Super Cruise”, which enables hands-free, level 2+ driver-assist driving on mapped highways.

Select models of Cadillac will soon have Ultra Cruise, which can perform door-to-door hands-free driving on up to 95% of public roads.

Making consumer vehicles auto-drive with driver supervision is a more manageable endeavor than providing fully autonomous robotaxi services.

Both Super Cruise and Ultra Cruise will require driver supervision.

Aurora

Aurora (AUR) produces “The Aurora Driver,” which is a self-driving system designed to operate multiple vehicle types.

This “Driver” can be integrated into a Toyota Sienna minivan for robo-taxi service, or it can be integrated into Volvo long-distance freight-hauling trucks.

Aurora technology is already enabling driverless customer deliveries between Dallas and Houston in Texas, making it the first company to operate self-driving heavy-duty trucks on public roads.

Components For Autonomous Vehicles

Companies that manufacture components for autonomous vehicles are indirectly related to the robotaxi space, as these components are essential for autonomous vehicles.

NVIDIA (NVDA) provides the AI chips used by automakers and robotaxi companies.

Mobileye (MBLY), a company spin-off from Intel, is a leader in vision systems, mapping, and Advanced Driver-Assistance Systems (ADAS) software.

Using cameras, radar, and LiDAR, it detects vehicles, pedestrians, objects, lanes, and signs in real-time to understand the environment.

Luminar (LAZR) is generally considered the leader in the LiDAR space today.

Think of LiDAR as radar but using lasers instead of radio waves to detect speed and distance of objects.

Unfortunately, LAZR stock chart does not look good from a technical analysis point of view.

Furthermore, founder and former CEO Austin Russell abruptly resigned on May 14, 2025, following an internal investigation into conduct and ethics.

Its competitor, Innoviz Technologies (INVZ), remains in the early phase of its valuation cycle, with its stock still trading at relatively low levels.

However, it looks much more constructive:

Ouster (OUST) is another contender that had merged with fellow LiDAR pioneer Velodyne in 2023.

Car Sharing Services

Ridesharing services will definitely be taking advantage of self-driving vehicles if they can eliminate the cost of putting a human behind the wheel.

Uber (UBER) has partnerships to integrate autonomous vehicles, including Waymo, into its ridesharing platform.

Soon, passengers in certain cities will be able to summon a Waymo directly from their Uber app.

Lyft’s (LYFT) ridesharing platform is following a similar approach with its partnerships with Mobileye and Marubeni.

ETFs

If you want ETFs related to robotaxi stocks, here are some to consider:

The ARK Autonomous Technology and Robotics ETF (ARKQ) holds investments in TSLA, NVDA, AMZN, BIDU, GOOG, and other companies.

The Global X Autonomous & Electric Vehicles ETF (DRIV) holds investments in NVDA, GOOGL, TSLA, GM, BIDU, and other companies.

The Self-Driving EV and Tech ETF (IDRV) holds a global mix of car manufacturers, including XPeng, BYD, Volkswagen, Li Auto, Renault, Rivian, and Tesla.

Conclusion

We have listed some examples of stocks related to the robotaxi industry.

Since these are not necessarily recommendations and are not listed in any particular order, you need to do your due diligence in exploring them further to see whether any of them might be a good fit for your particular portfolio and circumstance.

We hope you enjoyed this article on Robo taxistocks.

If you have any questions, send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.