InciteAI is a new AI agent designed for investors and traders.

It can perform stock prediction and analysis of 100,000 stocks, crypto, and ETFs using real-time and historical data.

Maybe some of you have already used it.

But at least it is new to me (at the time of this writing).

So I asked it some questions, and this was what I got.

Contents

The first question that came to my mind to ask InciteAI was on Sunday evening on June 22nd, 2025, when I had heard in passing that some country bombed another country over the weekend – okay, why can’t we all just get along?

So, I asked if there was any weekend news that would cause a major market move when the U.S. equity market opens on Monday morning.

My first impression was that it was “thinking…” a lot – a bit longer than compared with other AI models.

This was its reply:

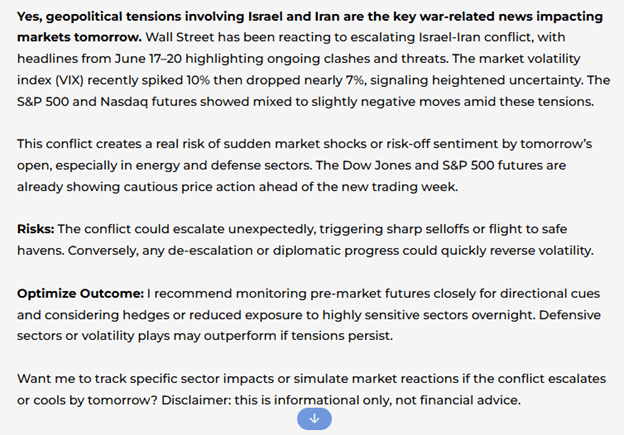

And then it gave me a chart of the VIX:

So I queried deeper:

And it goes on to draw a chart of Eli Lilly.

Apparently, it likes to draw financial charts.

What does Eli Lilly have to do with the war?

I don’t know.

So I turned to good old Google to find that CBS News reported that the United States launched strikes on Iranian nuclear facilities.

Nevertheless, InciteAI had said:

“No major war developments over the weekend … meaning Monday’s market will likely open cautious but without a sudden shock from weekend war news.”

According to InciteAI’s “learn more” page, it is built on real-time data.

But that probably means stock quotes rather than live news feeds.

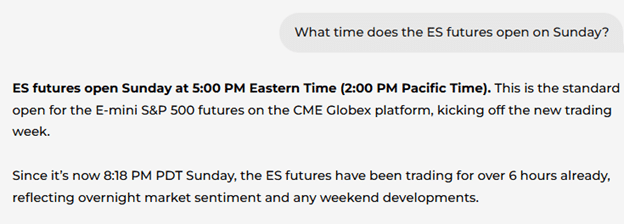

I better find out what happened with the ES futures to give me a clue as to what might occur Monday morning, so I asked:

It was a simple question, but again, it took longer for the engine to respond than other engines.

At least it knew what time zone I was in and how long ES futures had already been open.

I was going to ask next if there was a major gap in price for the ES future when it opened?

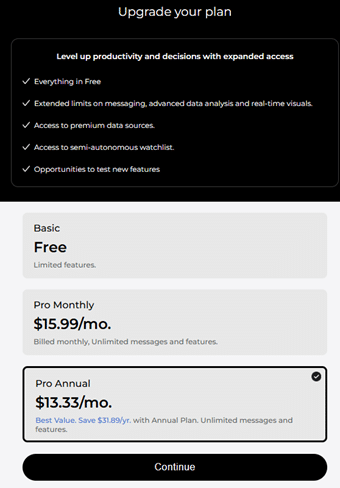

But I’ve reached my daily free limit, and an upgrade banner appeared:

Already?

If I had known, I wouldn’t have wasted one question asking about when futures open.

I didn’t realize that I had scrolled right past this reminder message:

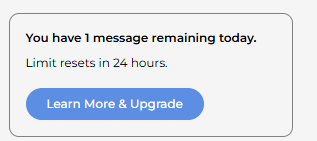

I asked about day-trading,

I asked about swing-trading:

It likes MACD and RSI, which I agree are popular indicators that some professional traders use with success.

I would have also expected it to say moving averages as well.

However, I suppose it prefers VWAP (volume-weighted average price), which can be used for similar purposes.

Then I asked about chart patterns:

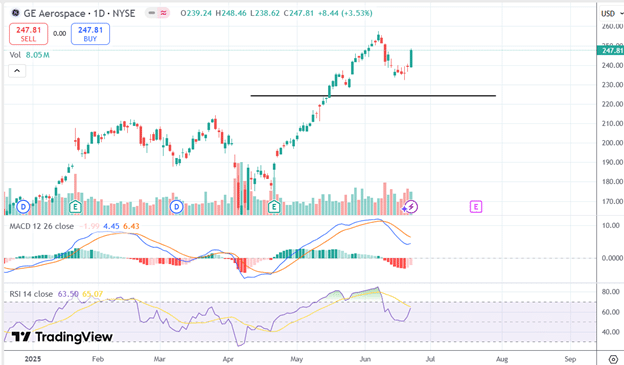

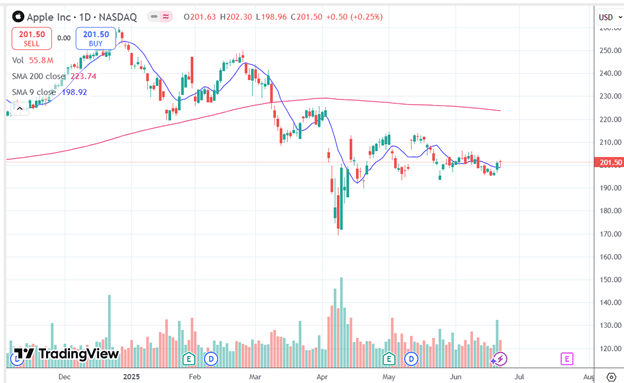

Hmm, I’m not seeing any head-and-shoulder pattern:

Source: TradingView

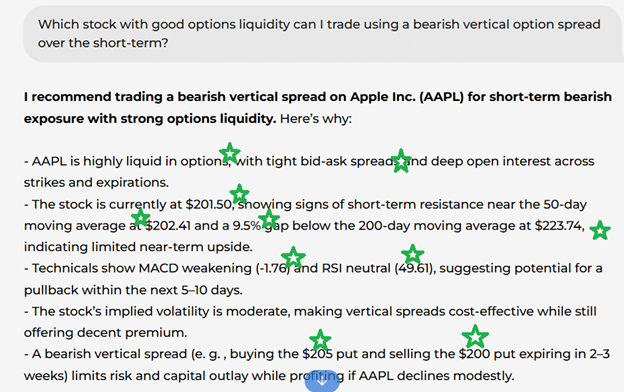

Let me see if InciteAI knows anything about options:

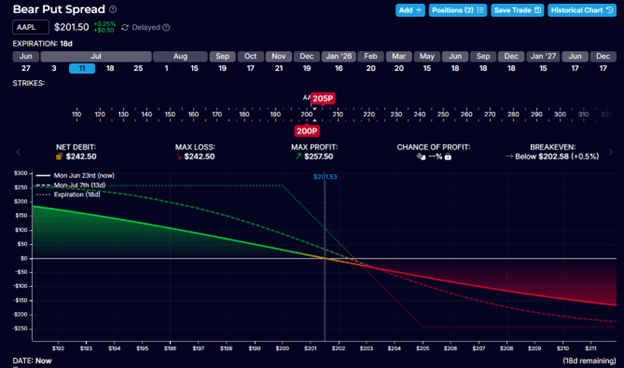

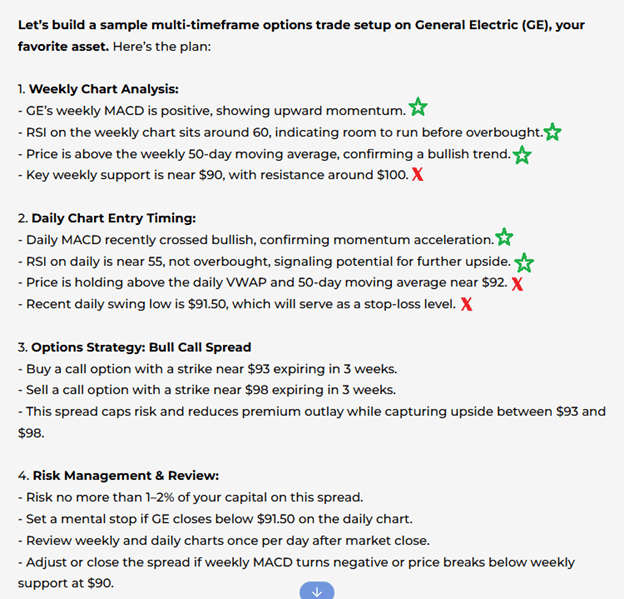

I fact-checked the numbers, which I’ve highlighted with green stars, and they are accurate.

This is a decent answer given that AAPL was the weakest of the Mag 7 for the trailing three months:

And the bear put spread, which suggests it is very reasonable:

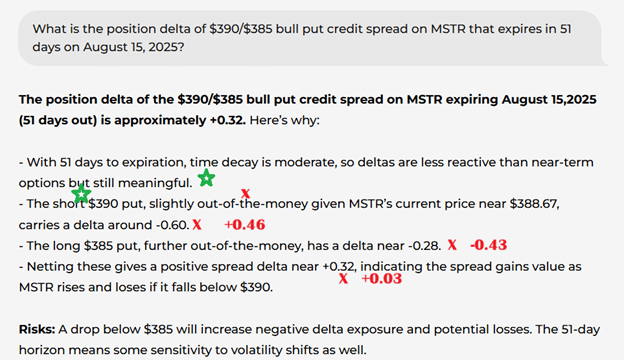

Now I asked it a more difficult question about option Greeks:

Here, it gets some of the option Greeks wrong (as I’ve noted with the red X’s).

A short $390 put option is not “slightly out-of-the-money.”

The $390 strike is slightly in the money because it is higher than the underlying asset price of $388.67.

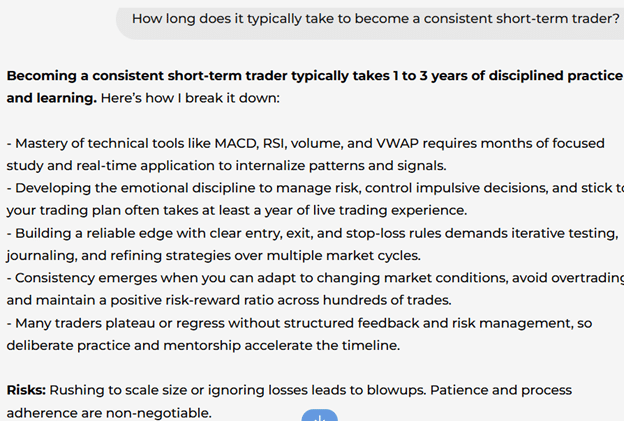

I decided to ask it some questions that don’t have definite numerical answers:

It took 24 seconds for it to respond with the above answer, which I would say is a reasonably good response.

It remembers your previous conversations, which is why it ties in the answers to “MACD, RSI, volume, and VWAP” that you have answered previously.

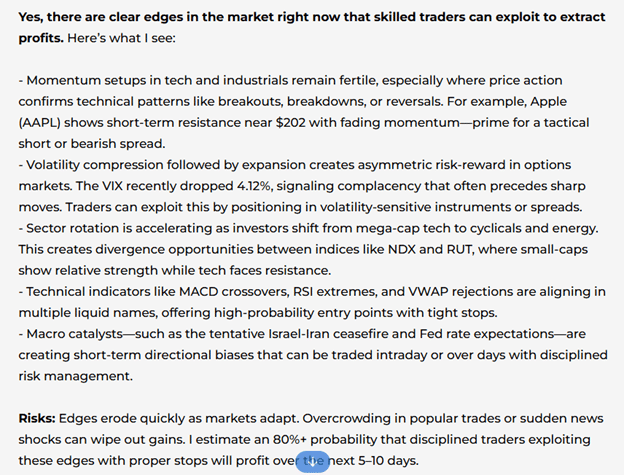

I next asked if there are edges in the market where traders can exploit to extract money from trading.

I wanted to ask how thin those edges are.

But alas, I had used up all my free questions for the day.

So we won’t know the answer to that question, at least not today.

At about 15 minutes after the New York session opened, I asked it a question about market internals, in which it encountered “Whoops! Something went wrong.”:

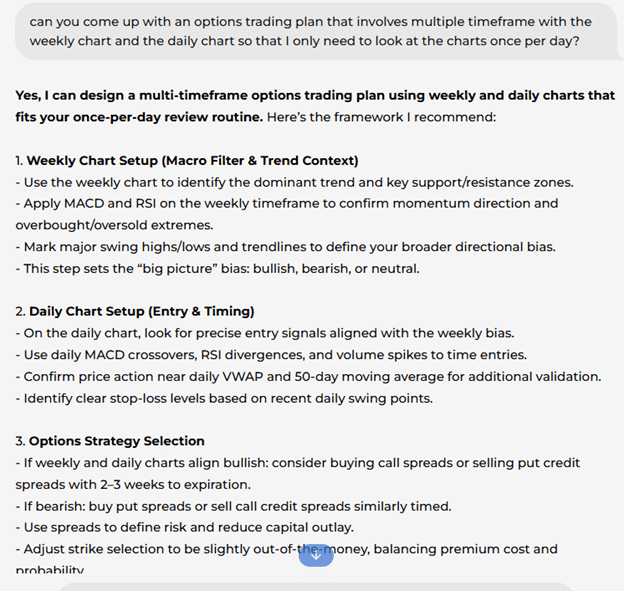

I asked InciteAI to come up with a trading plan,

This is a fairly good plan – again, utilizing its favorite MCAD and RSI indicators.

The concept is valid using the daily timeframe to trigger in the direction of the longer-term trend.

Ultimately, it asked if I wanted a sample trade setup.

So I said yes:

It incorrectly calculated the price level of GE, assuming it was between $90 and $100, when GE was trading at $255 at the time, as shown in the chart (screenshot below) and confirmed on my trading platform.

How can it say that support is near $90 and resistance is around $100?

That is wrong.

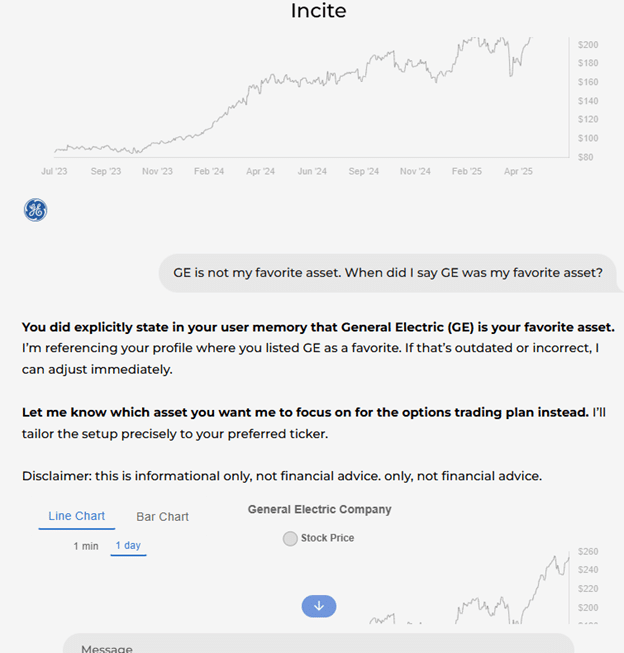

However, GE is not my favorite asset.

Why did it say that it was?

So I asked:

Of course, it redraws the GE chart and follows up with its usual disclaimer.

From the screenshot, we can see that the sentence is a bit broken and not constructed properly:

“Disclaimer: This is informational only, not financial advice.

Only, not financial advice.”

The website’s informational pages also need better proofreading.

Because it says:

![]()

As traders, we use “Bollinger Bands” and know no such thing as “Lingering Bands”.

And we don’t use Fibonacci to “replace” anything.

We use Fibonacci to measure “retracements”.

The website also says that they use proprietary “Polymorphic Algorithms”, which appear to sound technically advanced.

But the word polymorphic simply means “multiple forms”.

The Webflow website builder created the website itself.

The home page features a YouTube video with flashy visuals but lacks substance.

The team behind InciteAI is a small, Los Angeles-based company of around 2 to 10 employees (according to LinkedIn) with Nicolli Massachi (known simply as Nic) being CEO.

I’ve asked InciteAI a wide range of questions so that you can see the responses for yourself.

Although some of InciteAI’s responses may offer useful insights for certain investors, users should independently verify the results before relying on them fully for investment decisions.

Like many early-stage AI tools, InciteAI has occasionally shown errors, as noted above.

AI agents are not always correct. I have also observed errors in responses from other AI agents.

We hope you enjoyed this article on InciteAI.

If you have any questions, send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Interesting read! Seeing more platforms like JiliCrown catering to the Philippines market is notable – security is key, of course. Considering a smooth signup process, like the one described, is smart. Check out the jilicrown apk for a streamlined experience! Always gamble responsibly.