Table of Contents

1. Introduction

2. EA Overview

3. Installation

4. Input Parameters

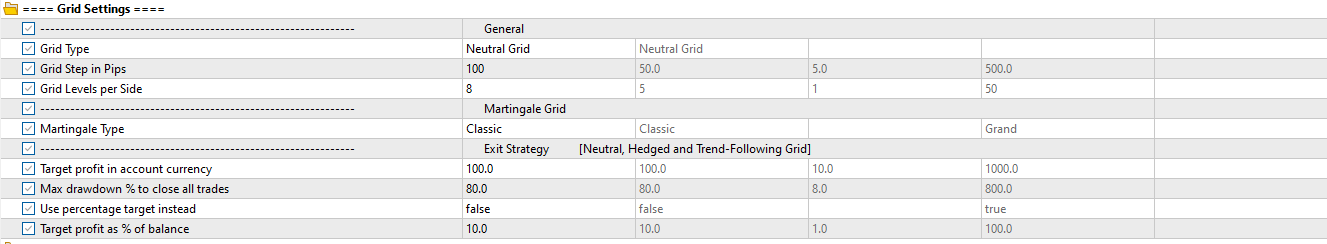

- Grid Settings

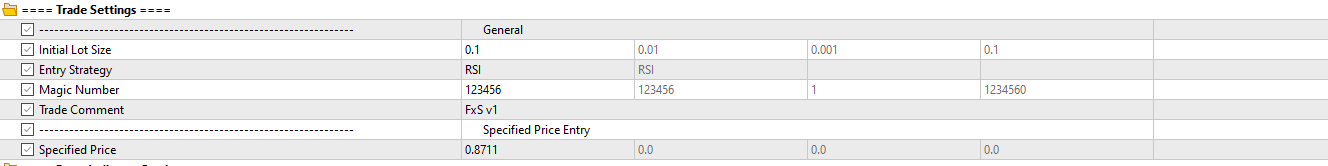

- Trade Settings

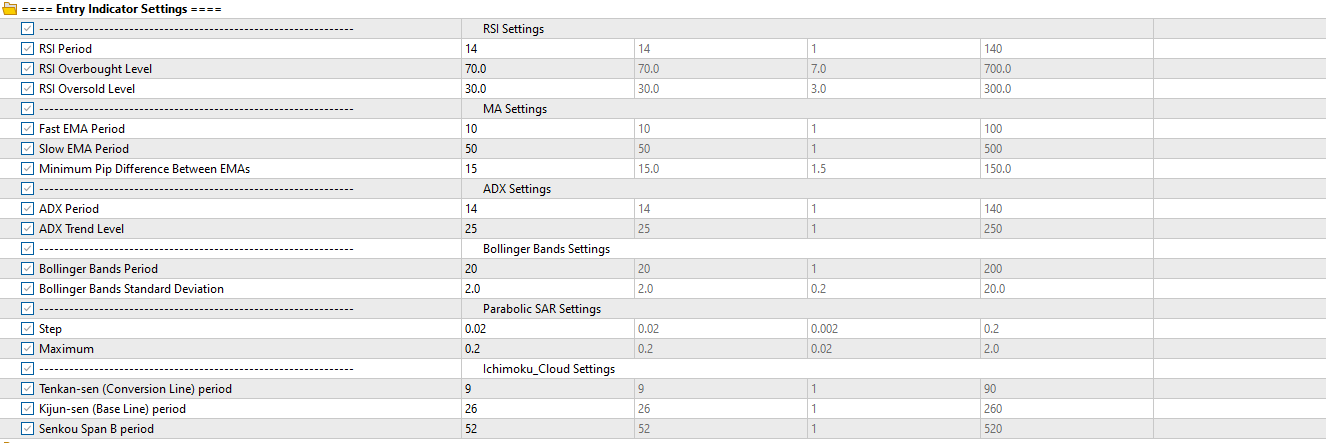

- Entry Indicator Settings

- Time Filters

- Dashboard Settings

4. Optimizing the EA

5. Troubleshooting

1. Introduction

Welcome to the Grid EA, your all-in-one solution for grid-based trading on MetaTrader 5. This guide provides a step-by-step breakdown of how to install, configure, and operate your EA effectively.

2. EA Overview

Core Features:

- 4 Grid Trading Modes: Neutral, Hedged, Trend-Following, and Martingale

- 11 Entry Strategies: RSI, Moving Averages, ADX, Bollinger Bands, Ichimoku Cloud, Parabolic SAR, and more

- Session-based Time Filters

- Built-in Dashboard Interface

- Manual and price-level entries supported

- Risk Management via Target Profit and Max Drawdown

3. Installation

For a detailed guide of how to install the EA, refer to this guide installation manual.

4. Input Parameters

Parameter Explanation:

✅ Grid Type: Options (Classic Grid, Hedged Grid, Trend Following Grid, Martingale Grid)

Defines the structure and behavior of the recovery grid.

✅ Grid Step in Pips: Distance between grid levels in pips.

✅ Grid Levels per Side: Number of grid positions on each side (buy/sell).

✅ Martingale Type: Options (Classic, Grand)

Controls lot sizing for Martingale Grid.

✅ Target Profit in account currency: Profit goal in account currency to close all trades.

✅ Max Drawdown % to close all trades: Closes all trades if drawdown exceeds this limit.

✅ Use percentage target instead: Enable profit closure based on balance percentage.

✅ Target profit as % of balance: Profit percentage (e.g. 10% of balance).

✅ Initial lot size: Base lot size of initial trade.

✅ Entry Strategy: Options (RSI, Moving Averages, Average Directional Index, Bollinger Bands, Ichimoku Cloud, Parabolic SAR, Specified Price Buy/Sell, Current Price Buy/Sell, Manual)

Select one of 11 entry methods.

✅ Magic number: Unique number for trade separation.

✅ Trade comment: Label for trade identification.

✅ Specified Price: Used in ‘Specified Price Buy/Sell’ modes.

- Parameters of Entry Indicator Settings

Parameter Explanation:

a. RSI Settings

✅ RSI Period: Sets the period of the RSI.

✅ RSI Overbought Level: Sets overbought level for the RSI.

✅ RSI Oversold Level: Sets oversold level for the RSI.

b. MA Settings

✅ Fast EMA period: Sets the period of the fast EMA. A lower value makes the EMA more sensitive to price changes (default: 50).

✅ Slow EMA period: Sets the period of the slow EMA. Used in conjunction with the fast EMA to identify trend direction (default: 200).

✅ Minimum pip difference between EMAs: Minimum pip difference between the fast and slow EMA to confirm a valid crossover signal. Helps filter out weak or false signals (default: 15).

c. ADX Settings

✅ ADX period: The lookback period for calculating the ADX indicator (default: 14).

✅ ADX Trend Level: The threshold value above which the trend is considered strong. Entries are filtered based on whether the ADX value exceeds this level (default: 25).

d. Bollinger Bands Settings

✅ Bollinger Bands Period: Number of periods used in the Bollinger Bands calculation (default: 20).

✅ Bollinger Bands Standard Deviation: The number of standard deviations from the moving average used to form the upper and lower bands (default: 2.0).

e. Parabolic SAR Settings

✅ Step: The step increment of the SAR. Smaller steps make the indicator more sensitive to price changes (default: 0.02).

✅ Maximum: The maximum value that the step can reach, influencing how quickly the SAR accelerates toward price (default: 0.2).

f. Ichimoku_Cloud Settings

✅ Tenkan-sen (Conversion Line) period: The period used for the conversion line (Tenkan-sen), which reacts quickly to price movement.

✅ Kijun-sen (Base Line) period: The period for the base line (Kijun-sen), used as a trend confirmation.

✅ Senkou Span B period: The period used to calculate one of the cloud boundaries (Senkou Span B), representing longer-term sentiment.

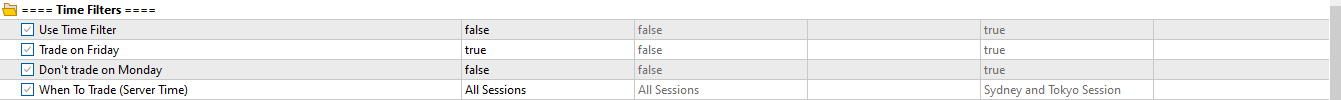

- Parameters of Time Filters

Parameter Explanation:

✅ Use time filters: Toggle to enable/disable using time filters.

✅ Trade on Friday: Toggle to enable/disable trading on Friday.

✅ Don’t trade on Monday: Toggle to enable/disable trading on Monday.

✅ When To Trade (Server Time): Select which session should trading be allowed.

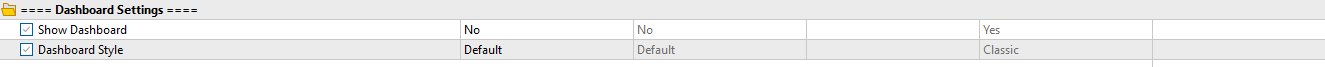

- Parameters of Dashboard Setting

Parameter Explanation:

✅ Show Dashboard: Show dashboard can be either Yes or No.

✅ Dashboard Style: Dashboard Style options are Default, Dark or Classic.

4. Optimizing the EA

Issue Solution / Fix EA not trading Ensure Algo Trading is enabled and market is open. Dashboard Not Showing Verify that ‘Show Interface = Yes’ “No Entry” Recheck entry conditions (RSI/MA filters, session time). Too Many Trades Reduce `Grid Levels` or increase `Grid Interval Pips`. Slippage or Requotes Use ECN/low-spread broker; avoid high news periods. Not Closing Trades Verify `Target Profit` or `%Target` is being reached.

Tip: Check the Experts and Journal tabs for detailed error logs.

- Frequently Asked Questions (FAQ)

- Frequently Asked Questions (FAQ)

Q1: Can I run multiple instances on different symbols?

A: Yes. Attach one FxS Grid EA per chart/symbol; ensure each uses a unique Magic Number to avoid trade interference.

Q2: How do I load my optimized settings?

A: Save your optimized `.set` file in `\MQL5\Presets`. In the EA’s Inputs tab, click Load and select your file.

Q3: Does the EA support hedging accounts?

A: Yes. FxS Grid EA is compatible with both hedging and netting account types.

Q4: What timeframes work best?

A: Default strategies perform well on H1–H4. Use optimization to test other timeframes for your symbol.

Q5: My broker uses 5-digit pricing—do I need to adjust inputs?

A: The EA auto-detects digit format and adjusts pips accordingly. No manual changes needed.

Q6: What should I do if backtests look different from live results?

A: Ensure backtest spread, slippage, and execution model mirror your broker’s live conditions. Consider tick data import for accuracy.

Q7: How often will I receive updates?

A: Updates are released quarterly or as needed for bug fixes and new features. Check the MQL5 Market page under Updates.