Covered call ETFs continue to gain traction with income investors—and for good reason.

They provide a structured way to convert volatility into consistent distributions, often on a monthly or even weekly basis.

Instead of managing options positions yourself, these ETFs do the heavy lifting.

You simply hold the fund and collect the income.

No spreadsheets.

No Greeks.

No margin calls.

Here are eight covered call ETFs worth considering for monthly (or weekly) income, along with how they fit into a well-structured portfolio.

Contents

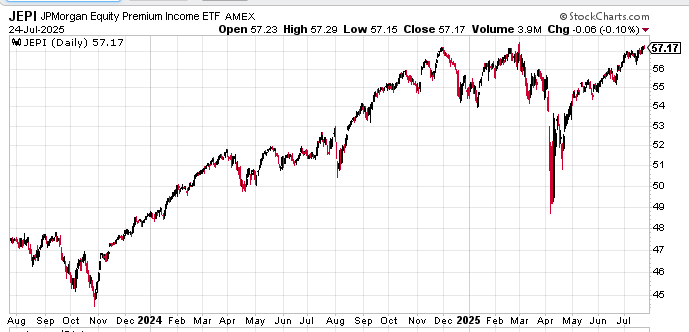

Yield: 8.3% | Expense Ratio: 0.35%

JEPI is the flagship in this space.

It’s designed for equity exposure with reduced volatility and strong monthly income.

The fund holds a portfolio of defensive U.S. large-cap stocks and layers on out-of-the-money S&P500 covered calls using structured notes.

JEPI appeals to conservative investors who seek income without sacrificing all the upside.

With $37B in assets, it’s liquid, diversified, and relatively stable compared to other yield-oriented ETFs.

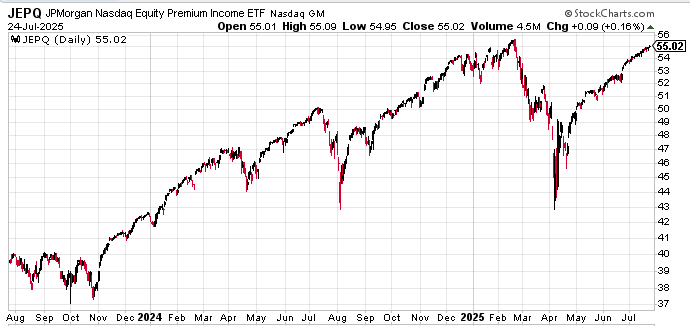

Yield: 11.23% | Expense Ratio: 0.35%

Think of JEPQ as JEPI’s tech-heavy cousin.

It’s based on Nasdaq-100 names, with a significant allocation to companies such as Apple, Microsoft, and Nvidia.

Volatility is higher than JEPI, but so is the income potential.

If you want to stay exposed to growth but monetize that volatility, JEPQ makes sense.

The higher yield is a direct result of more expensive call premiums driven by elevated implied volatility.

This ETF is ideal for investors comfortable with a bit more price movement in exchange for higher income.

Yield: 28.3% | Expense Ratio: 0.95%

RDTE takes things a step further by selling zero-day-to-expiration (0DTE) index options on small caps.

It’s a pure volatility harvest play.

The ETF targets daily income by writing same-day calls on the Russell 2000.

That translates into a monster yield—but it’s not without risk.

This isn’t a buy-and-forget fund.

RDTE can be used tactically to enhance income in sideways markets or as a satellite position within an income sleeve.

Please note that the high yield reflects high turnover, and the underlying market can be choppy.

Yield: 43.1% | Expense Ratio: 0.95%

For those seeking to capitalize on crypto volatility, YBTC offers a unique solution.

It implements a synthetic covered call on spot Bitcoin ETFs, such as IBIT, using options to generate yield while capping the upside.

The current yield is eye-popping, but that reflects Bitcoin’s inherent volatility.

This is not a core income position.

It’s a highly speculative tool that may work in a flat or range-bound Bitcoin market.

Use YBTC sparingly, and size it accordingly.

Yield: Varies | Expense Ratio: ~0.99%

APLY focuses on Apple stock. It holds synthetic long exposure to AAPL and sells call options on it to generate income.

If you’re bullish on AAPL long-term but want to collect income in the short term, APLY lets you do both—with capped upside.

The ETF is one of several single-stock covered call funds under the YieldMax umbrella.

Yields fluctuate depending on AAPL’s volatility and recent price action.

Best used in moderation or as an income-focused AAPL proxy.

Yield: Very High | Expense Ratio: ~0.99%

TSLY follows the same model as APLY but with Tesla.

As you’d expect, the higher volatility of TSLA translates into much higher option premiums—and, thus, a much higher yield.

But that also means TSLY carries significant drawdown risk.

Like YBTC, it should be viewed as a tactical position, not a core income asset.

Traders may use TSLY to express a neutral-to-bearish view of Tesla while still generating cash flow.

Yield: Variable | Expense Ratio: TBD

NDVY is a newer entrant with a unique twist: it combines dividend stock exposure with interest rate volatility.

The goal is to offer dividend income while potentially benefiting from changes in the yield curve or macro uncertainty.

This ETF can serve as a diversifier within an income portfolio, especially if you’re concerned about interest rate volatility continuing through 2025.

Yield: 13.4% | Expense Ratio: 0.35%

TLTW is the bond market’s answer to covered calls.

It holds long-duration Treasuries via TLT and sells monthly 2% out-of-the-money calls to generate premium.

The result: a double-digit yield from a government-backed asset base.

However, long-duration Treasuries are extremely sensitive to interest rate movements.

In a rising rate environment, TLT can fall fast—and your capital is at risk.

Still, TLTW offers an interesting way to earn equity-like income with Treasury exposure.

It’s best suited for rate-stable or downward-rate environments.

Covered call ETFs are powerful tools for income-focused investors, especially in volatile or sideways markets.

They give you access to sophisticated option strategies—without the complexity or margin requirements.

If you’re building a portfolio focused on income and capital preservation, a mix of these ETFs can deliver monthly or even weekly cash flow.

Just make sure you understand the trade-offs: capped upside, potential NAV drawdowns, and fluctuating yields.

Don’t chase yield blindly.

Use these ETFs as part of a broader, risk-aware allocation.

We hope you enjoyed this article on eight covered call ETFs for income-focused investors.

If you have any questions, send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.